$RPL Tokenomics: Rocket Pool To The Moon? 🚀

Securing Blockchains and Capitalizing on the Future of Crypto

GM DOers!

SaaS Tokens > NFT Marketplace Tokens

For once, let’s talk about a token with some real and innovative utility.

Rocket Pool's token has some very interesting tokenomics that I’m excited to share.

In contrast, a few weeks ago I broke down the tokenomics of $BLUR, $LOOKS and $X2Y2 in PRO.

If you listened and understood the tokenomics, rather than blindly following the hype, you would have saved yourself from this disaster…

$BLUR is down 30% since that PRO report went out.

Now, I’m not a trader or short-term investor by any means - that takes a whole different type of skill to master.

However, I do understand supply and demand dynamics, and how tokenomics can play a role in that.

When you combine that with understanding the long-term trends of certain technologies and sectors within a technology, generally, you can do quite well.

More than anything though, you save yourself from FOMOing in on the “next hot thing”.

That said, I’m not teaching tokenomics for investment advice, but instead to understand how to incorporate tokens in your own business, as well as uncover what’s sustainable and what’s not in this industry.

A side-effect of that is staying clear of the garbage and capitalizing on opportunities 🤷♂️

Today we’re talking about $RPL, the native token of Rocket Pool. A token that has interesting tokenomics, facilitates a strong product, and is within an industry that I believe is part of an “up only” secular trend for years to come.

Not to mention that it’s at a critical point in the industry, which you should understand if you read last week's PRO report on the Staking-as-a-Service Industry. (If you haven’t read it yet, I recommend you do it before continuing this report).

Ok, let’s start by explaining how Rocket Pool’s product works and then we’ll dive into $RPL tokenomics and how the token is bootstrapping their ecosystem.

Enjoy!

Rocket Pool’s Killer Product

Rocket Pool has by far one of the best Staking-as-a-Service products on the market today, as it’s truly a win/win for everyone. In terms of SaaS products, there are 2 user groups involved:

Protocol Users (aka those who are looking to stake their $ETH to earn a reward)

Validators (aka those who are looking to run a validator on the Ethereum blockchain).

As a quick summary of what I’m going to explain::

Rocket Pool has the lowest risk for $ETH stakers.

Rocket Pool provides the highest earning potential for validators.

Rocket Pool is subsidizing these 2 features via inflation to capitalize on a trend and gain market share.

Rocket Pool Protocol Users

If I want to stake my $ETH in a SaaS product, there are a few things I might want to consider: risk, earning potential, and liquidity.

Here’s a breakdown of these for Rocket Pool Users:

Rocket Pool is a decentralized and permissionless Staking-as-a-Service protocol. At the time of this writing, it is the farthest along the decentralization spectrum compared to any other SaaS product right now.

Users can stake as little as .01 $ETH in Rocket Pool and earn $ETH staking rewards. Rocket Pool currently takes a flat commission of 15% of rewards (Coinbase, for example, takes 25% and Lido takes 10%).

When using SaaS products you rely on someone else to run your validator, which means there is potential that the validators' rewards could get slashed if they don’t follow the rules properly, which in turn would impact your rewards. Rocket Pool, however, requires operators to use $RPL as collateral to cover any damages, acting as “insurance” on your stake, and ensuring that you always receive sufficient rewards.

When staking $ETH in Rocket Pool, in return you receive $rETH, a liquid staking derivative. $rETH can be used as collateral or to earn yield in DeFi to make additional use of your capital. It also creates a very easy means to move your capital in and out of Rocket Pool.

As a user, Rocket Pool checks off all the boxes for me.

Rocket Pool Node Operator (Validator):

Rocket Pool’s greatest strength for operators is that it allows you to earn a greater ROI staking inside the Rocket Pool protocol vs outside of it.

Here’s how it works.

If I want to run a validator on my own, I need 32 $ETH and the technical “know-how”. This would give me the sovereignty to run my own validator and earn 100% of the validator’s rewards from Ethereum (around 5-8% APY).

However, with Rocket Pool, an operator needs to provide only 16 $ETH (soon to be 8) and then the rest of the $ETH to equal 32 is pooled together from the protocol users.

As mentioned above, Rocket Pool takes 15% commission from the rewards of the protocol users and gives 100% of it to the validators.

What this means is that on your 16 $ETH you earn your 5-8% APY like if you were to run your own validator, but then you also receive 15% of the 5-8% APY from the rewards of the other 16 $ETH.

Even if you had 32 $ETH and could run your own validator, you would be better off running 2 in Rocket Pool as you would earn that extra 15%!

Now there is a bit more to the story here…

I mentioned above about the “insurance” for protocol users. What this means is that Rocket Pool Operators must stake a minimum of 10% of the value of their $ETH stake in $RPL tokens up to a maximum of 150% to act as collateral.

You might be wondering, why would anyone buy and stake more than the 10% $RPL required if they don’t have to? Well, that’s the beauty of this product and the $RPL tokenomics.

Validators earn rewards on their staked $RPL in the form of more $RPL. The amount you earn is proportionate to your share of the effective stake. (More on where these $RPL rewards come from in just a second).

Effectively, as a validators in Rocket Pool, you can earn an extra 15% of the $ETH APY on your capital, while also earning rewards in $RPL versus running your own validator. That’s a pretty nice incentive!

The only downside here is that you would need to add a minimum of 10% more on your $ETH staking capital to use Rocket Pool.

So you can say that as a Rocket Pool Operator, it is at least 10% more expensive than other protocols, though, of course, you are earning extra rewards on this capital.

Overall, I think it's easy to understand how this is a clear win for both the protocol users and the validators.

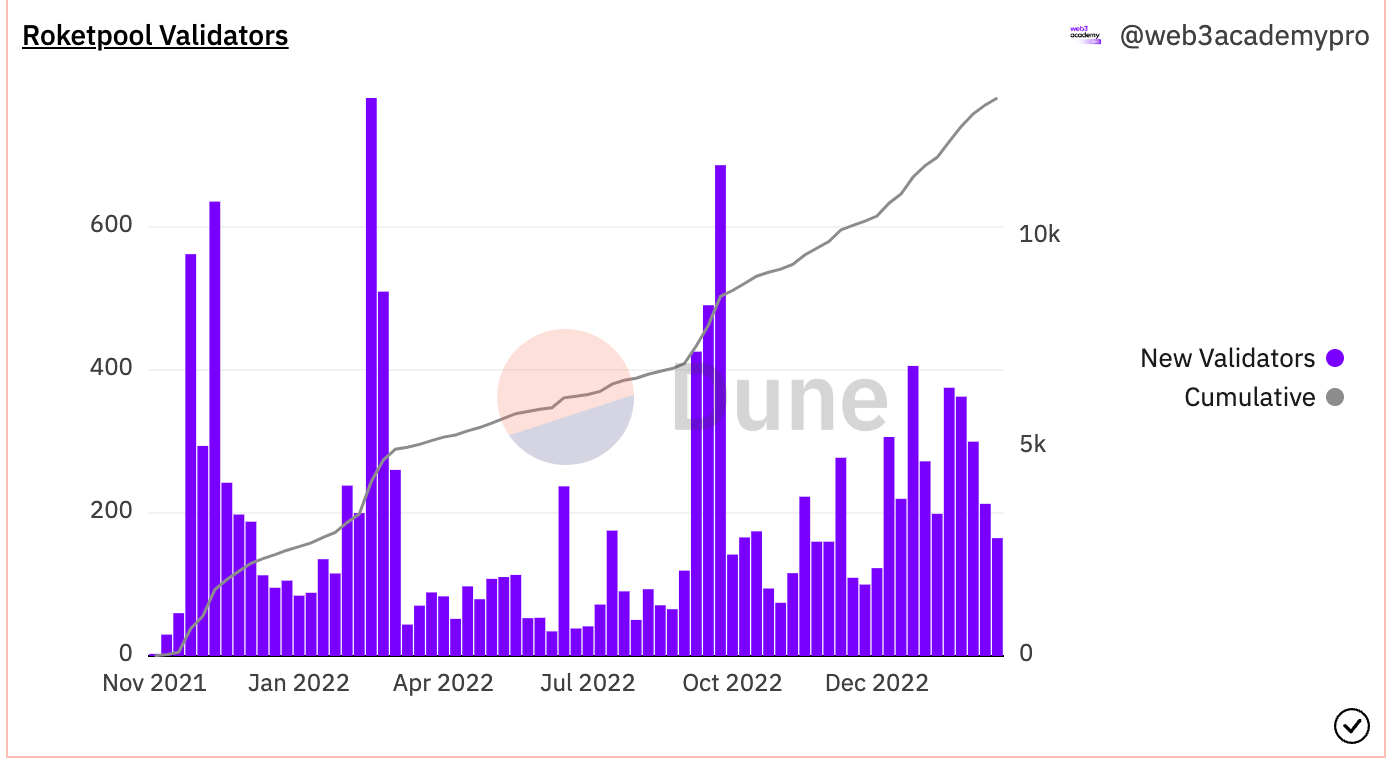

As we can see below, Rocket Pool’s growth of new validators is growing significantly.

But hopefully, as a knowledgeable PRO member, you’re thinking “Kyle, this seems too good to be true, where are those extra rewards coming from?

Seems like someone is subsidizing these rewards from somewhere?”

You PRO members are so smart!

Those extra $RPL rewards are coming from $RPL inflation. But let’s remember, not all inflation is bad.

$ETH, for example, has inflation, yet its tokenomics are the most sustainable in the industry.

Let’s explore $RPL tokenomics and see what we can uncover.

$RPL Tokenomics

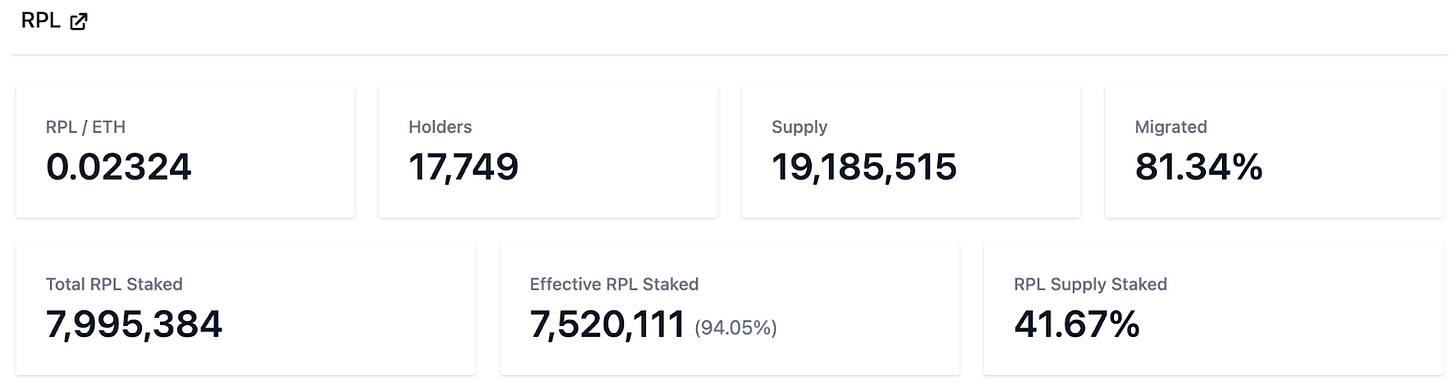

$RPL is a governance token for The Rocket Pool Protocol DAO. Currently, there is a total supply of 19,185,084 $RPL and an inflation rate of 5% per year.

From the 5% inflation, 70% is distributed to the validators who stake their $RPL, 15% goes to the DAO treasury to fund development, and the final 15% goes to the Oracle DAO, a small group of individuals and entities who manage Rocket Pool oracles across the ecosystem.

For operators to earn their share of the 70% they must stake 10-150% of their $ETH value in $RPL. Currently, 41.67% of the total supply of $RPL is staked and 94% of the potential $RPL that can be staked by validators is staked.

That said, ultimately what we have is an inflating governance token with no burn mechanism to balance it. It sounds very similar to the NFT marketplace tokens I mentioned a few weeks ago, doesn’t it?

You might wonder why couldn’t The Rocket Pool Protocol and Oracle DAOs simply take a cut from the 15% $ETH reward fee rather than give 100% of that to validators?

If they did this, they could then have their $RPL token for governance with no inflation, which generates fees from the protocol. Wouldn’t that simply make this entire ecosystem sustainable?

The answer is yes it would, however, I think the Rocket Pool team sees an opportunity here...

The Rocket Pool Opportunity

With the Shanghai update to Ethereum coming in April which will unlock withdrawals and the likely massive wave of capital that will follow in terms of staking and running validators, Rocket Pool wants to be positioned well to take market share during this opportune time.

The more Rocket Pool Operators and the more $ETH staked using Rocket Pool means the more revenues that Rocket Pool will generate long term.

If Rocket Pool can provide the greatest incentive to both user groups to use their product, it’s likely they will grow market share now and create long-term customers.

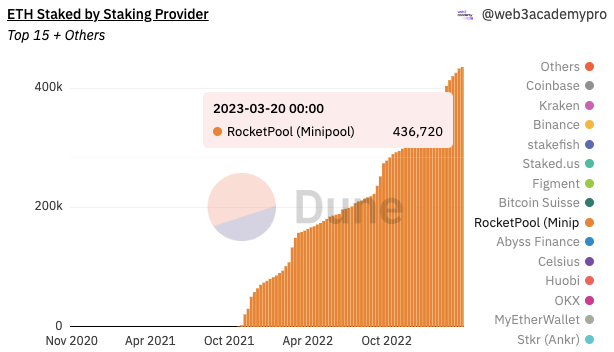

Rocket Pool's market share is still small, however, it’s growing and now sits at about 2.4% of the entire staking market, after launching almost 1 year behind many of its competitors.

Because of the 5% $RPL inflation, Rocket Pool is able to provide the best incentives to validators by giving 100% of the $ETH rewards and the additional $RPL rewards. They are making a timely bet on the secular trend of their industry.

I say timely because the Rocket Pool Protocol DAO can vote to lower or turn off the inflation rate at any time.

They could also add a burn mechanism just like Etherum did or turn the revenue share switch on. However, at the moment they don’t need to.

They have momentum on their side.

You see, every time a new operator spins up a validator on Rocket Pool, they must buy $RPL tokens and stake them.

So long as enough validators are joining Rocket Pool, then they have enough “buy and hold pressure” on the token to make up for the 5% inflation rate.

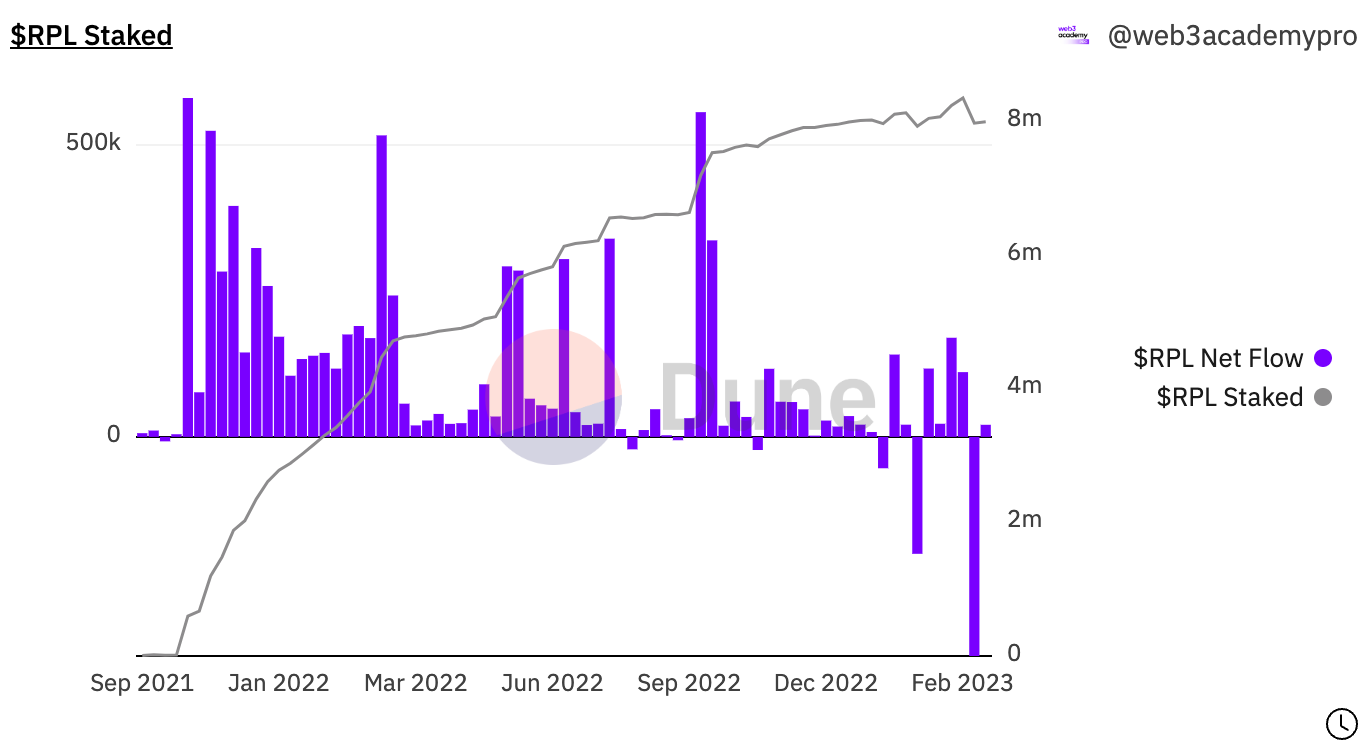

You can watch the cumulative stake and the net flows of staked $RPL on-chain with the chart below.

If $RPL didn’t have that buy pressure, the token would likely quickly inflate away as we saw with the $LOOKS and $X2Y2 tokens. Instead, the $RPL token has managed to do quite well over time.

I find that this tokenomic design and strategy is a fascinating way to use your token to accelerate growth during opportune moments while understanding market pressures to ensure that you don’t inflate your token away and hurt existing token holders.

This strategy not only provides a better product for each user group in Rocket Pool but also bootstraps the Rocket Pool DAO and ecosystem development.

Now, of course, when the growth of new operators and capital into the space begins to slow down they will need to adjust their inflation rate or create additional utility/burn mechanisms to ensure the sustainability of the $RPL token.

Programmable money is a pretty cool thing!

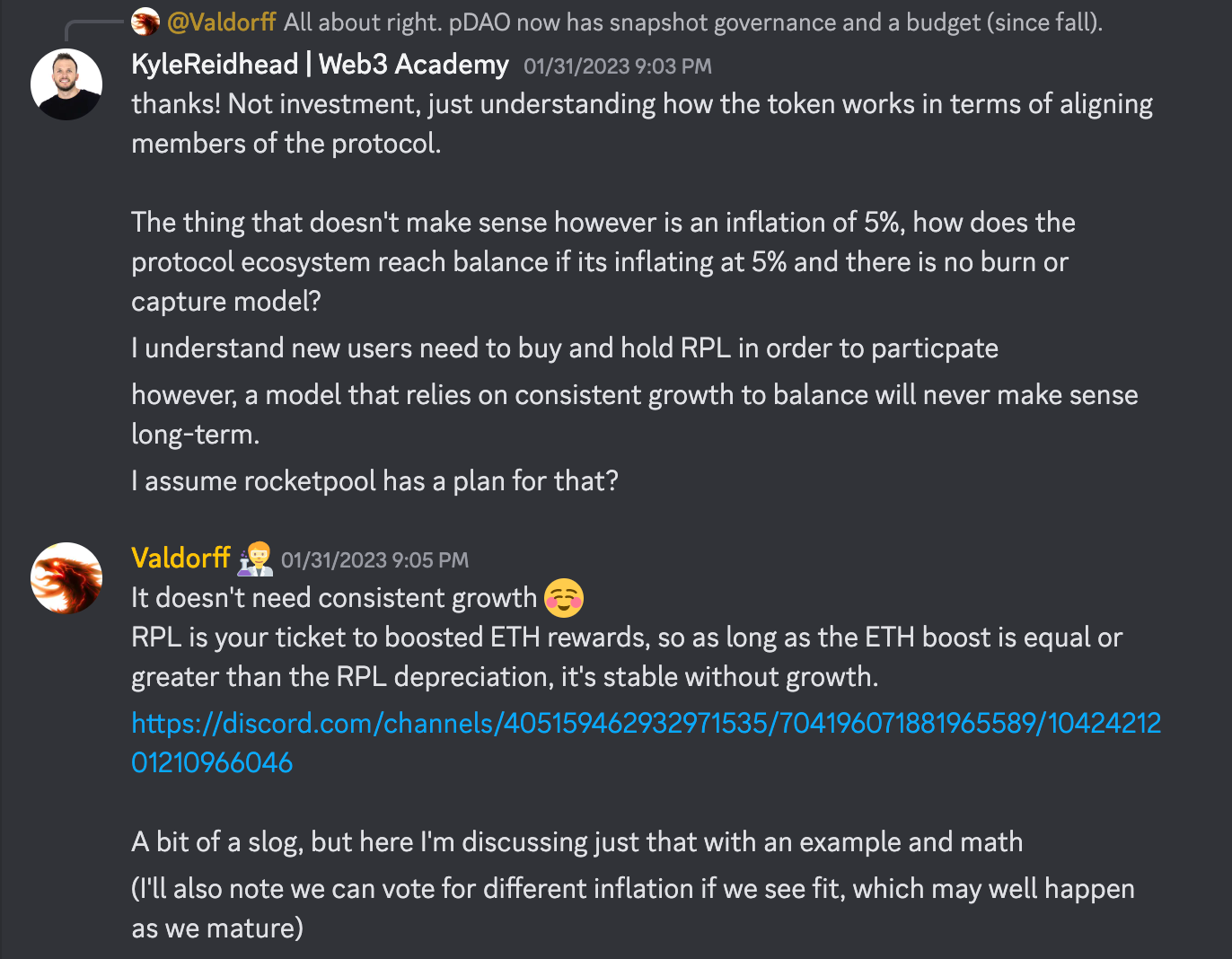

If you want to go deeper down this rabbit hole I have a really great discussion with the Rocket Pool Community in their Discord. You can join and follow this link to read the discussion.

Why Kyle Is Bullish On $RPL

In full transparency, I am invested in $RPL. That said, just because I am does not mean that you should be. I have no idea what the price of this token will be tomorrow or a few weeks/months from now.

I do believe, however, in the next 6-18 months that Rocket Pool is going to do very well and thus $RPL will be a beneficiary of that.

Here are my reasons why I believe this:

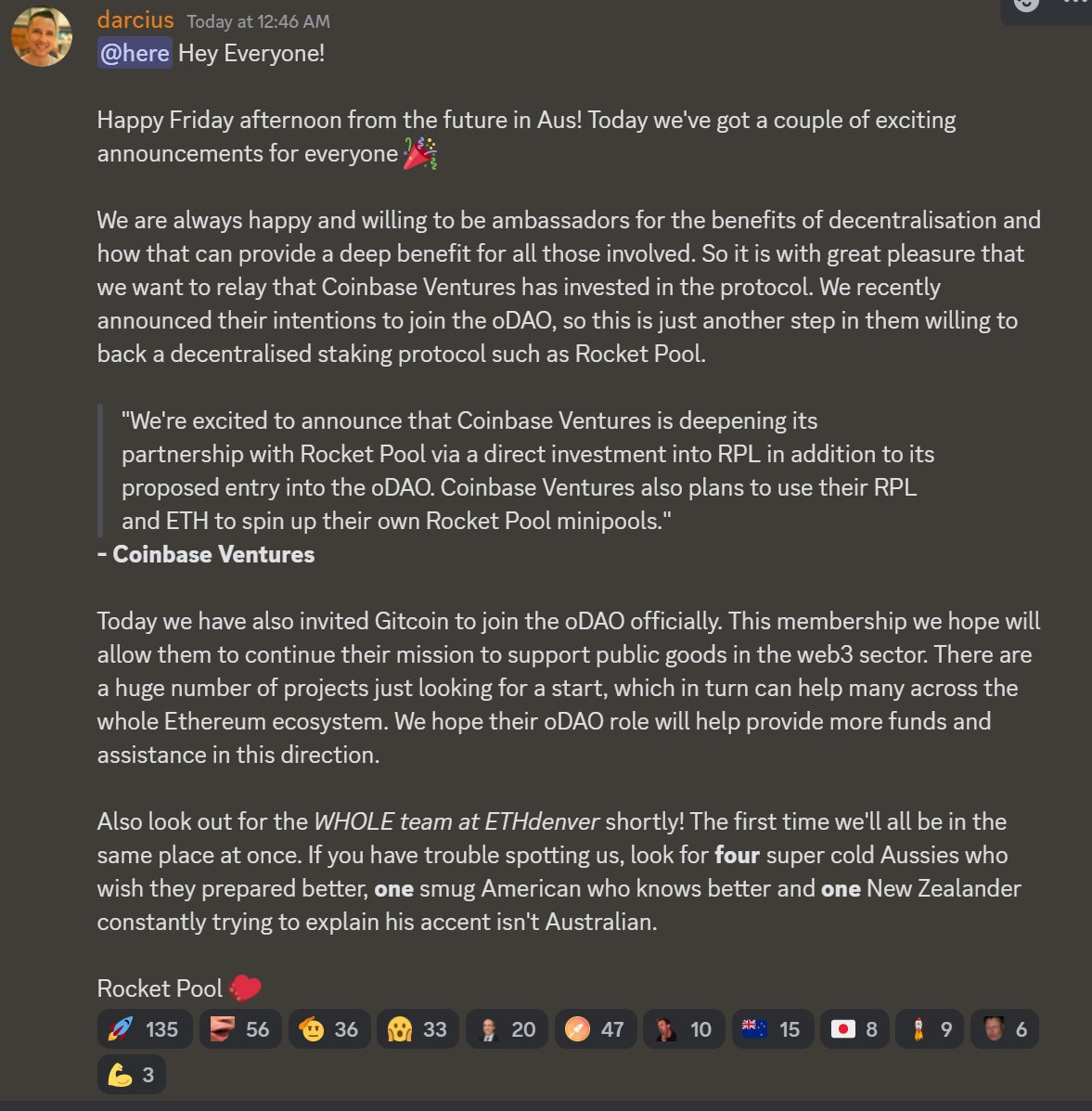

Rocket Pool has an incredible team that has been building in this space for many years, well before most other SaaS companies and I appreciate their focus on decentralization and providing a great product.

I believe that the SaaS industry is going to grow 20x+ in the coming years and Rocket Pool is one of, if not the top product in the industry.

While I don’t know what happens with capital flows into or out of this industry immediately after the Shanghai update, I believe that plenty of capital will flow in, in the medium to long term. I also believe that a large % of existing capital being staked will move from competitors into the Rocket Pool ecosystem (better incentives).

Finally, if this design works and does in fact help Rocket Pool gain market share, then Rocket Pool will have a path to generate significant revenues. In turn, this will provide the Rocket Pool community with a path to make future adjustments to the $RPL tokenomic design making it significantly more sustainable while sharing in the Rocket Pool revenues.

My hope is that this report gives you some more insight into the world of token design and how it can impact a business.

It’s important to recognize that not ALL inflation is bad and it can be used as a tool during opportune times.

The programmability of equity/money/governance is still very new but something that is so exciting for both the business and the investment world.

I'll keep doing my best to share new and innovative designs of tokens in future PRO reports.

By staying up-to-date with the latest developments in tokenomics, I hope to offer valuable insights and analysis to help you navigate this rapidly evolving landscape.

And as always, if you have any questions, ask them here or jump on our Discord to discuss it with our community!

Take care and I’ll see you next week 😉

ABOUT THE AUTHOR

Kyle Reidhead

Founder of Web3 Academy and Impact3

Find him on Twitter

🟣 PRO ACTION STEPS

CLAIM PRO NFT

As a PRO, you’re entitled to your PRO/FOUNDERS Pass, which unlocks different perks & benefits across the web3 ecosystem.

We airdrop these passes each Monday & Thursday. To get yours, make sure to fill out the Kazm Form by clicking this link or the button below.

JOIN DISCORD

Speaking of special perks and benefits, check out our Web3 Academy Discord community by clicking the button below (you’ll be asked to complete a form).

As a PRO member, you’ll have access to exclusive channels and perks, such as PRO meetups (we had one yesterday!). See ya there! 😉

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.