🟣 W3A PRO | AI x Crypto: The Biggest Narrative of 2024?

Is This Real or A Bubble?

GM PRO DOers!

We’re currently witnessing potentially the biggest bubble in the history of bubbles. 🫧

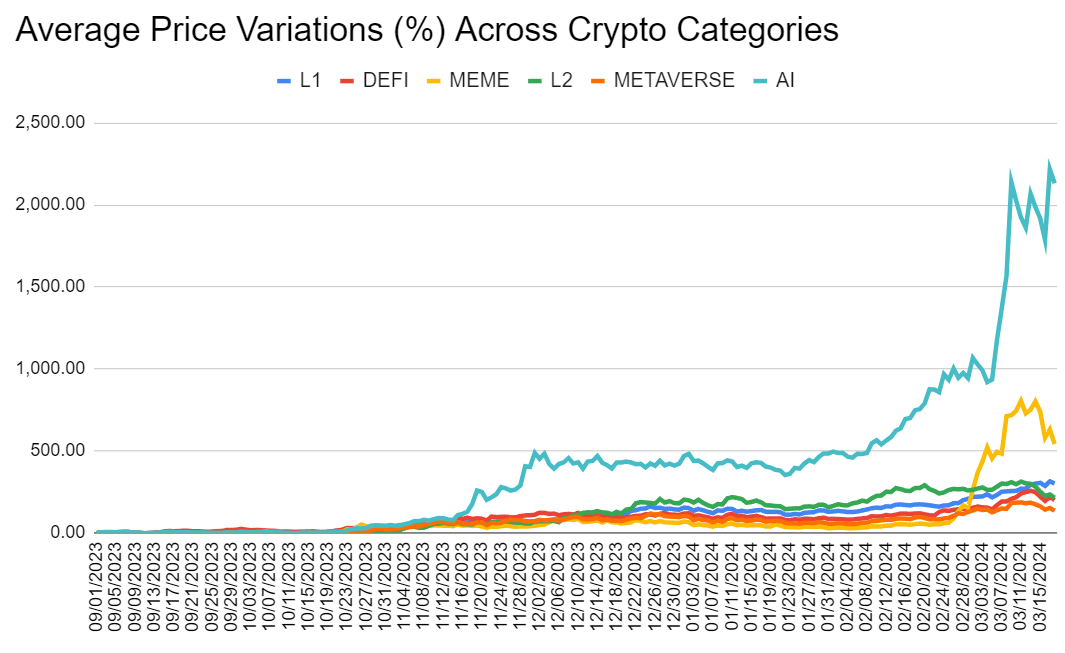

The convergence of AI and crypto has become the hottest narrative of the past 6 months, with Crypto AI tokens seeing massive returns and outperforming every other crypto sector.

This narrative was kickstarted by OpenAI’s launch of ChatGPT in late 2022, and then amplified by the rise of Nvidia, a leading tech company that develops powerful graphics processing units (GPUs), pivotal in driving advancements in AI and data center operations.

Nvidia’s stock is up a whopping 250% in the last year, and earlier this month, Nvidia added the entire market cap of Tesla AND Starbucks to its own market cap in just 15 days. 🤯

So it’s clear that the AI sector is in a massive hype cycle.

At the same time, crypto is currently witnessing the beginning of its next bull cycle.

So what happens when you combine both of these hype cycles into one? Potentially, the biggest bubble ever.

We’re in a period during which new AI crypto tokens are launching, promising the world to investors.

Just like the Kardashians, these are highly marketable, with lots of hype, but you never know what’s real and what’s just for show.

Today, I wanted to share a report that will help you navigate this Crypto AI sector with more confidence, so you can capitalize on the opportunity and not get rekt.

Throughout this report, you’ll see that I separate this sector into 4 main categories:

Blockchain businesses that use AI

AI businesses that use blockchain

Blockchain businesses that benefit from the AI revolution

Businesses leveraging blockchain and AI for net new innovations

Within each category, I share clear examples that will help you differentiate fundamentally strong projects from vaporware.

Hopefully, this will serve you as a solid foundation that helps you understand how Crypto and AI work together, and where the opportunity lies.

But first, let’s talk about the fake stuff – AI tokens that aren’t AI tokens. Let’s dive in. ⏬

0. AI Tokens That Aren’t AI Tokens

You probably know that it’s common practice for new crypto projects to seek different ways to distinguish themselves from the crowd.

The meta right now is various projects throwing around the term 'Crypto AI,' making it sound like they’re on the cutting edge of tech.

But if you peek behind the curtain, you'll see that for many of them, the AI part is just a tiny slice of the pie or mainly just a catchy phrase they're using to grab your attention.

Example: Near Protocol

At its core, Near is a layer 1 blockchain designed to be fast, cheap and scalable.

Despite that, Near ranks as the top Crypto AI project on CoinGecko and CoinMarketCap, even though Near has little to do with AI itself.

This narrative is largely driven by its strategic marketing efforts, including participation in AI-focused events, such as Nvidia’s AI conference.

Now, to be fair, Near Protocol is working on ‘Near Tasks’ – a platform where people help train AI by doing tasks and get paid for it.

But while Near Protocol is dipping its toes into the 'Crypto AI' pool with NEAR Tasks, it's just one piece of their larger puzzle, which remains deeply rooted in blockchain technology, not AI.

Despite this, Near Protocol has seen its $NEAR token go up 6x since October, thanks to the buzz created around being involved in AI.

Unfortunately, Near Protocol's story isn't unique. Many platforms hype up their AI angle to draw in investment, often focusing more on marketing than on actual AI integration or innovation.

While Near is a legit project making real efforts with AI and more, beware of 'vaporware' – projects that aren’t building anything innovative or of value and don't deliver on their AI promises. These are always going to get investors rekt.

We saw this happen in the ICO bubble in 2017 and once again in the NFT bubble of 2021. I think that the current Crypto AI narrative will end the same.

95%+ projects will go to 0 and a few projects are here for the long term, ready to completely change the game.

While just about every Crypto AI token will do well in the bull market, once that ends, most of this industry will get flushed out. This is why it’s so crucial to do your homework before diving into 'Crypto AI' investments.

To help you wrap your head around this space, let’s start by outlining the key categories within the Crypto AI sector.

1. Blockchain Businesses that Use AI

This is perhaps the most misunderstood category at the intersection of AI and crypto.

In this category, we’re talking about blockchain companies that use AI within their products/services to improve operations, enhance user experience or fix certain problems.

Even though some folks might call them 'Crypto AI' companies because of this, they're not really about AI.

They're mainly blockchain businesses that smartly use AI to stay up-to-date, kind of like how every physical business needs to use the internet for their business, even though they are not an “internet business”.

It's pretty much expected that any modern company, especially in blockchain, should be using AI in some way to keep up. This shouldn’t be considered “bullish”, it should just be required of any company that exists in 2024…

Yet, this category benefits immensely from the narrative of AI to pump their tokens, when in reality, they probably shouldn’t.

Here’s a few examples of popular “AI tokens” that fit into this category.

Example 1: AIOZ Network

AIOZ is a modern platform designed for web3 video sharing, relying on blockchain to decentralize the process.

By utilizing AI, AIOZ improves the efficiency and performance of its streaming services.

This setup ensures viewers enjoy smoother playback with fewer interruptions, leveraging a network of distributed nodes to handle storage and delivery.

TL;DR: AIOZ is a web3 streaming platform, similar to YouTube or Twitch, that uses AI features to improve their product.

Even though the use of AI is minimal in the grand scheme of things and its platform doesn’t have any meaningful adoption whatsoever, $AIOZ has gone up 2,400% in the last year, reaching almost $1 billion in market cap, all thanks to the AI hype.

Example 2: LimeWire

LimeWire, once a peer-to-peer file-sharing service, has reinvented itself as an AI-powered content publishing platform focused on blockchain technology.

Now under new ownership, LimeWire aims to empower creators with tools to generate, own, and monetize their music.

TL;DR: LimeWire provides creators with AI tools for creating music and visuals, while at the same time using blockchain (the $LMWR token) to share up to 90% of ad revenue with creators.

Thanks to the AI hype, $LMWR has doubled in price since the beginning of the year.

A glitch on CoinMarketCap made the chart turn red instead of green, even though the value actually went up.

Like AIOZ, LimeWire leverages AI to improve efficiency and user experience.

But here’s the thing: Every company in the world needs to leverage AI to stay competitive and relevant – and many already do!

Canva has AI features

Zoom uses AI for note-taking

Adobe implemented AI features in Photoshop

While all of these companies use AI, it would be unfair to categorize them as ‘AI companies’.

Yet, that’s what we’re doing in crypto, which is misleading, and we need to make that distinction clear.

P.S. By no means are we saying that AIOZ or LimeWire are bad investments. We just want you to be aware of how they work in reality and how they should be categorized.

P.S.S. Within this category, there’s an exciting opportunity to explore businesses which have the potential to leverage AI so much that they completely change their business model.

What do I mean by that?

Think about Tesla: An electric Tesla car is cool. But throwing AI into the mix and making Tesla cars drive themselves is flipping the whole car industry on its head, bringing in a new era of safer, hands-off driving—that's something that deserves an AI repricing!

This could make Tesla one of the most important companies in the world.

The point here is that you should be thinking about how AI can help certain blockchain-based businesses evolve into something bigger in the future.

This idea isn't just for Tesla; Bing Search, Photoshop, LimeWire, AIOZ or even Near Protocol could also evolve to be more AI-driven, opening up new possibilities and attracting different users.

If you’re spotting these opportunities early on, you could set yourself up for massive success.

2. AI Businesses that Use Blockchain

This part is about AI companies that are starting to use blockchain.

By doing so, these AI companies can make their systems more secure, use crypto for payments and come up with new ways to offer what they do.

Or… These AI companies are simply looking to capitalize on the hype around crypto, by targeting a new user base (crypto degens) for their product/service.

Example 1: Worldcoin

Led by Sam Altman (founder of OpenAI), Worldcoin tackles one of the biggest issues caused by AI: identity verification.

By scanning people’s eye-balls using a device called ‘the Orb’, Worldcoin wants to create a decentralized identity system that can assess who’s human and who’s a robot on the internet.

The Worldcoin ecosystem is powered and sustained by blockchain via their $WLD token, used for rewarding people for scanning their irises and protocol governance.

TL;DR: Worldcoin is a business trying to create an identity system that’s relevant in an AI world, by using blockchain technology.

Because of this setup, Worldcoin’s $WLD has managed to go up 8x since September, reaching a market cap of $1.5 billion, and a fully diluted market cap of $100 billion.

Fully diluted market cap is the total value of a company if all its available tokens were issued and at current prices.

Context: OpenAI is worth $86 billion and has 100 million+ users, whereas Worldcoin has a few million…

Example 2: PAAL AI

PAAL AI is a platform that creates customizable AI-driven chatbots, which can be embedded into various social media platforms like Whatsapp, Telegram or Discord to act as customer service on the behalf of any brand.

PAAL AI created $PAAL in order to monetize their chatbots and create a revenue-sharing model for the holders of this token.

TL;DR: PAAL AI is an AI business using crypto to monetize their product.

But here’s the deal: In the current state of crypto, it’s generally a bad idea to use crypto as a means of payment, like PAAL is doing with $PAAL, because you essentially exclude all non-crypto businesses and people that could find use in your product, so you’re limiting yourself as a business.

However, by doing this, PAAL AI focuses on attracting a crypto-native customer base, which has become their niche – this has pumped their token 6,000% in the last year, helping $PAAL reach up to almost $1 billion fully diluted market cap.

Will this turn out to be a good business move or simply a way to attract more short-term capital via a token? I guess time will tell.

More importantly, in terms of an investment, is the incredible growth of its token coming from significant adoption of its product? No.

It’s coming because it’s an AI business that has a token! What do you think happens to a token like this in the bear market?

3. Blockchain Businesses that Benefit from the AI Revolution

This section is perhaps the most palpable and where the biggest opportunity lies right now.

This category includes businesses that have an existing product, which is or could gain popularity because of the AI rush we’re seeing.

Think the crypto-versions of NVIDIA – a company that blew up because the rise in AI increased demand for GPUs.

In this context, we're seeing blockchain businesses that could play a pivotal role in the AI landscape, not by creating AI, but by providing essential services that AI technologies need to thrive.

Example 1: Ocean Protocol

Ocean Protocol is a data exchange that enables the sharing, buying, and selling of data in a secure and transparent manner.

What’s the #1 thing that AI needs in order to function? Data.

AI developers and researchers can utilize Ocean Protocol to access a vast pool of data resources essential for training AI models.

The Ocean platform will ensure data privacy, traceability, and secure transactions, thus providing a foundational infrastructure for AI developers and data scientists.

TL;DR: Thanks to the rise in AI, Ocean Protocol has found a completely new customer base that’s able to amplify its business model.

As a result, $OCEAN has already managed to surpass its all-time high in market cap that it reached last cycle, when AI wasn’t really a thing yet.

Example 2: Akash Network

Akash is a decentralized marketplace for cloud and compute.

It lets people with extra cloud storage and compute power offer it to others who need it for their projects, like a shared workspace but for computers. It uses blockchain and token incentives to function and has been around since 2020.

Akash has done extremely well over the last year since finding product market fit (or at least a narrative) with AI, as of course, AI projects require a lot of computing resources to function.

As the development of AI continues to rise, so too would the demand for more computing power. This puts Akash in an excellent position to capitalize on the AI boom.

Its token ($AKT) is already up 1,500% in the last year, and has completely smashed through its past ATH in market cap.

Now, just because Ocean and Akash are both well-positioned to capitalize on the AI narrative, it doesn’t necessarily mean that their tokens will do well this cycle.

Both of these projects are currently worth astronomical amounts, while their core business model is lagging behind.

For example, while Akash is worth over $2 billion in market cap right now, its revenues are struggling to even surpass $60k/month, as you can see below.

That’s absurd. $60k/month in revenue is a threshold that should be surpassed easily by any company valued at $2+ billion, like Akash is.

This shows that although some crypto projects have found market fit thanks to AI, they’re still insanely overvalued.

So, from a fundamental standpoint, these are clearly not great investments, and as an investor, you should pay attention to this.

However, because the Crypto AI narrative is still strong as f*ck, these tokens will probably go on to reach even more mental valuations during this cycle.

One thing is for sure though: You don’t want to be holding onto these tokens when the music stops. But more on that at the end of this report.

4. Businesses Leveraging Blockchain and AI for New Innovations

This section is where we let our fantasies loose. This is where we imagine where the future is going.

Below, I will share 4 new innovations that will probably play a significant role in the future of the world and internet, which are only possible because of the synergy of AI and crypto.

Keep in mind however that the things highlighted below will probably take many years to be developed, and there’s no certainty that they’ll find market fit (although it’s very likely).

Decentralizing Governance of AI via Tokens (DAOs)

Decentralizing control of Large Language Models (LLMs) ensures no single entity dominates AI, promoting fairness by spreading governance and data access widely.

It's like having a community work together to build and manage a public garden rather than one person owning it all. This way, AI can grow in a way that's fair and benefits everyone.

Right now, the AI world isn't as open and shared as we'd hope. Elon Musk recently sued OpenAI, claiming they've shifted towards a more closed, profit-driven approach with their AI tech, rather than open-sourcing the tech for wider human benefits.

Blockchain fixes that.

Example: Bittensor

Bittensor is essentially a decentralized database used for developing customized AIs. How it works:

Marketplace: Bittensor acts as a marketplace where developers, data scientists, and contributors can offer their computing resources, data, or AI models.

This way, Bittensor expands their database, while contributors are rewarded with $TAO – Bittensor’s native cryptocurrency.

Subnets: Bittensor subnets are like small networks within the main network. Each one focuses on a specific type of AI work, such as writing text or analyzing data. This setup lets Bittensor work on different AI projects all at once, making what it can do more varied.

Example: If someone wants to build their own version of ChatGPT on Bittensor, they would create a subnet for that specific purpose.

This subnet (ChatGPT) would then take all of the necessary data from Bittensor’s main database, in a decentralized way, in order to function.

TL;DR: You can think of Bittensor as the decentralized counterpart of OpenAI, where data is public and governed by a community, instead of a handful of people.

Now, keep in mind that this isn’t comparing apples to apples, as OpenAI has a much bigger pool of data to use than Bittensor. They’re also much, much far along in development.

But despite that, $TAO has reached a fully diluted valuation of over $14 billion, with the token being up over 700% in the past year.

For reference, OpenAI is worth 6 times more than Bittensor ($86 billion). However, OpenAI has working products like ChatGPT and DALL-E, while Bittensor is still trying to grow their database right now.

So it’s clear that Bittensor is overvalued today, but, this is a powerful concept that will be developed for years to come and you should pay attention to it.

AI Governing Decentralized Protocols (DAO’s Treasuries Run by AI)

Imagine if AI could run the investment strategy for treasuries of crypto protocols like MakerDAO or Uniswap, with the goal of making as much money as possible with their billion-dollar treasuries.

AI can crunch a ton of data, so it should come up with some genius moves that humans can’t even think of, helping these protocols grow and rake in more cash.

It's a cool peek into what could be a reality if AI took over certain crypto protocols. But since nobody's really done this yet at scale, we're all just guessing what could happen.

H/t to Vance Spencer for introducing this idea.

AI Agents

AI Agents are basically programs that can surf the web, suggest the best flights for you, provide you with a complete budget with travel expenses, create a 21 day hour by hour itinerary and plan you a trip that would have taken you months to plan yourself. 🌴

These programs can also create games, YouTube videos, code websites, predict hay fever, automate your social media posting, manage your finances and so much more.

But here’s the deal: For these AI Agents to be truly useful, they need to be able to conduct payments. They’re useless unless they can pay for your food, flights and hotels. For this to work, they need to use some sort of currency.

Because AI doesn't stick to one country, it needs a currency that’s cross-border, digital, and not controlled by any single country, aka cryptocurrency.

Joe Lonsdale, who helped start Palantir, mentioned that as AI grows in our economy, they'll probably start using crypto to handle buying, selling, and trading, making AI a big player in the crypto world.

Just like countries provide services like money and banking to people, crypto can offer similar services to AI Agents, making it a kind of universal system for managing property and transactions.

While still nascent, the concept of AI Agents is beginning to gain traction, and they’re slowly but surely starting to play a big role in the world economy.

Example: Fetch.AI

Fetch.AI is one of the companies on the forefront of this category, creating a unique digital world where AI agents can do tasks on their own while using crypto for payments.

We’re working on a report on Fetch.AI coming your way soon, so we won’t expand on this business in this report.

Stay tuned.

AI Crypto Gaming

I didn’t think AI and Crypto could revolutionize a category like gaming. That’s until I met Kalos, the co-founder of Parallel, the game development company behind Parallel Colony.

Parallel Colony

This is a game that thrusts you into a world of survival simulation, uniquely driven by generative AI.

In this game, you start by shaping the personalities of your own AI agents through questions.

As the game progresses, these agents, following their own unique logic and choices, may act in unexpected ways. You can suggest what they should do, but they decide their own actions, engaging in tasks like gathering and trading resources.

These avatars have digital wallets, which you, the human player, manage the private key for, ensuring a blend of autonomy and control. But ultimately, they make their own decisions.

Parallel Colony is still in development but we should see a first version in the beginning of 2025.

This game is part of the wider Echelon Prime ecosystem that’s powered by $PRIME, a token that’s up 1,000% in the last year thanks to the AI hype it generated.

Wrapping Up – Beware of a Massive Bubble 🫧

We’re in a bubble where many tokens have already reached insane valuations.

1/ Worldcoin, with a current fully diluted valuation of almost $80 billion, and a total $240 million raised, would rank in the top 200 publicly listed companies.

Their main achievement? Scanning the irises of ~4 million people (0.05% of the world population).

Is this achievement justifying Worlcoin’s insane valuation? Of course not.

While the concept they’re trying to pull off is cool and I think has great potential, in its current state, Worldcoin is crazy overvalued.

2/ Bittensor is worth $14 billion and it doesn’t even have a working subnet (application) using its database at somewhat of a scale.

3/ Akash is worth $2 billion and can’t even make $60k/month in revenue.

4/ Fetch.AI raised $100 million and their token is worth $3 billion, yet only a few people use their AI agents for things like scanning the weather.

Are Bittensor, Akash & Fetch.AI building cool stuff? Definitely, and I think their products could eventually be used by millions of people and thousands of businesses.

But the chances of any of them succeeding is <1%. Remember, these are all start ups and 99% of startups fail… especially in a new industry like AI and like crypto. A good reference is the dot com bubble. How many companies survived that period? Under 1% for sure.

The AI world is still very new and even ChatGPT isn’t THAT great of a product. It’s going to take years for AI and these businesses to really crack the code and take over the world like many of us have been told.

This isn’t going to happen overnight and it’s likely not even going to happen this cycle.

This means that whenever this bull market ends, most of these AI crypto projects will have minimal adoption, user base and revenues, if they even have a working product by then!

Yet, most of these will be valued in the multi-billions because that’s just what we do in crypto.

There’s no doubt that the synergy of crypto and AI is going to create some of the greatest new innovations and use cases we’ve ever seen in tech, so it's important to stay in-the-know and do your research within this sector.

It also doesn’t hurt to play around with these projects and invest in their tokens, so long as you understand what you’re doing and realize that most of this is already overvalued in comparison to the fundamentals.

AI and crypto are here to stay, but currently the token prices are driven by narrative and many will be wiped out when the cycle ends, so invest with caution my friends!

Good luck out there.

Thanks for reading. And remember, you're strong, you’re powerful, you’re alpha! ❤️

How'd you feel about our read today?

ABOUT THE AUTHOR

Kyle Reidhead

Founder of Web3 Academy and Impact3

Find him on Twitter

PRO ACTION STEPS

CLAIM PRO NFT

As a PRO, you’re entitled to a PRO or FOUNDERS Pass (NFT), depending on your subscription.

This Pass will grant you access to our token-gated Discord and to other perks such as early access to various protocols and discounts to IRL and online events.

To grab your Pass, simply click the button below, connect your wallet to your Paragraph account and grab your Pass.

TAKE WEB3 INVESTING MASTERCLASS

Learn the best practices to allocate capital and successfully invest in crypto and web3 with our Web3 Investing Masterclass.

This invaluable resource costs $249. But as a PRO, you get it at a 50% discount.

And as a Founding member, you get it for FREE! 🤯

All you need to do is grab your PRO/Founders Pass (see above ☝) and connect your Pass using the link below. 👇

JOIN OUR DISCORD

As a PRO or FOUNDERS Pass holder, you have exclusive access to our token-gated Discord channels dedicated to PRO members!

Upon claiming your Pass, head to Discord and connect your Pass in the #start-here channel (WEB3 ACADEMY PRO category) to unlock access to PRO-only channels!

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.

5,136

5,136

I signed up for pro (yearly), but you charged me 180$ instead of 120$. How can I contact you?