🟣 The Bitcoin ETF is HERE. What Now?

Celebrate with 33% PRO Discount

GM DOers!

THE SPOT BITCOIN ETF HAS BEEN APPROVED.

As of yesterday, we have 11 Spot Bitcoin ETFs trading LIVE, allowing anyone in the U.S. to buy Bitcoin the same way they’d buy a stock.

The gates have been opened for institutional money to flood in, and on the first day, the ETFs have collectively settled over $4.5 billion in volume.

The hype around Bitcoin is huge and crypto just became mainstream. This is a monumental moment in the history of cryptocurrency.

We've been waiting for this moment for 10 years – ever since the Winklevoss twins planted the seed.

What the hell happens now? In today’s newsletter, I will go over what everyone should expect to happen next.

But first, let’s take a moment to freaking celebrate, because we certainly deserve it.

If you’re reading this, chances are you’ve been here through the bear market… You’ve stuck around through the thick and thin of this industry.

For that, you deserve a pat on the back.

At Web3 Academy, we decided to celebrate with a nice 33% discount for our PRO membership.

Why? Because we believe we’re entering a period of at least 2 years of ‘up only’ in crypto and we want everyone in this community to have the best chance of fully capitalizing on this once in a lifetime opportunity.

The coming period will bring generational wealth to many of us, and I’d hate for any community member to get left behind.

At Web3 Academy PRO, we’ll ensure that you’re well equipped with the most valuable and relevant insights that will help you navigate this bull market and make the most of what this crypto bull market will have to offer.

Simply follow the button below to learn what you can expect from PRO & to grab your 33% discount.

P.S. - This offer expires on January 16th. Don’t stall. ⏳

Now, let’s talk about how this ETF was approved and what’s coming next for this industry…

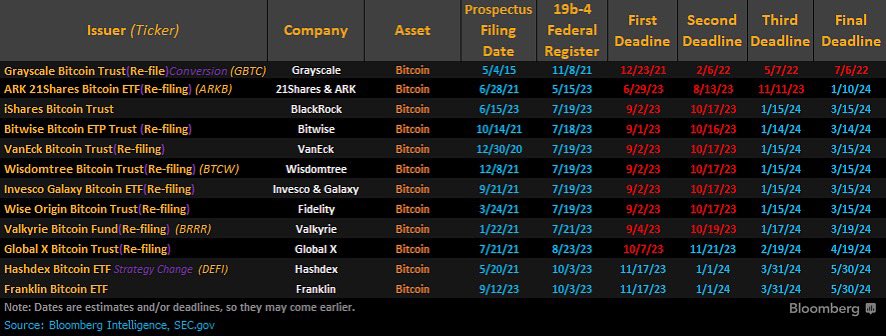

The Timeline of the Bitcoin ETF Approval

The odds of getting this ETF approved by January 10th 2024 was at 90% for a very long time, according to ETF analysts.

But we didn’t get here without hiccups. 🎢

1 day before the official approval, the SEC X account was hacked because they didn’t use 2FA and someone posted a fake Spot Bitcoin ETF approval announcement.

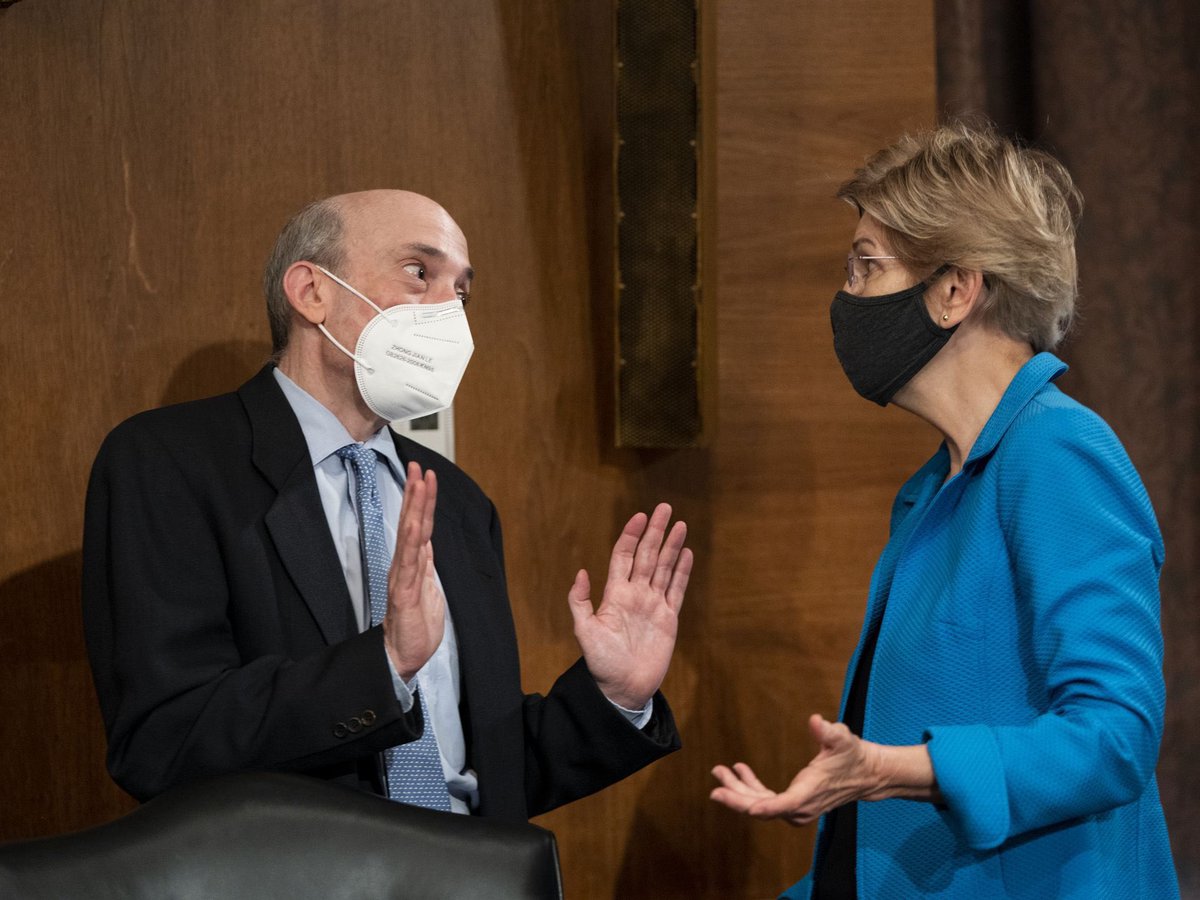

When the ETF was officially approved, Gary Gensler came out and said this:

Translation: “Sure, the courts are twisting my arm to go through with this, so dive in if you must. But personally, I find it to be a shitty investment."

Completely inappropriate, especially when you consider that he was 1 of the 3 commissioners that voted yes on the ETF approval.

But hey, Gary made it clear that he hates crypto a long time ago, yet nobody cares!

What everyone cares about is the fact that these ETFs have officially become the most effective instrument for institutions, pension funds, hedge funds, insurance companies and other big money players to get exposure to the best performing asset in the last 15 years.

Lesson: You can’t stop a permissionless technology so don’t even try.

4 Reasons Why This ETF Matters 🚀

Firstly, billions of dollars will flow into Bitcoin.

The Standard Chartered Bank estimates that up to $100 billion could be invested in ETFs this year alone.

Secondly, the ETF will become a backstop for pension funds and retirement accounts.

No financial advisor in this world will hesitate to recommend Bitcoin to its clients.

This is an asset that went up over 150% in 2023. Only a fool would tell its clients ‘don’t buy this crap’.

Thirdly, companies like BlackRock and Grayscale send out lots of financial advisors to encourage people to invest in Bitcoin.

They do this because they make money from the fees when people buy their Bitcoin ETFs.

The more people invest in these ETFs, the more money these companies make.

So, they really want their advisors to get as many people as possible to add Bitcoin to their investments.

Essentially, Bitcoin just received a massive marketing budget and marketing team working for it around the clock, all over the world.

This is exactly what happened to Gold…

Fourthly, “the Bitcoin ETF is the first ETF in history in which the underlying asset has a limited supply.”

Unlike most assets, where supply increases with rising prices, Bitcoin's supply remains fixed regardless of price changes.

Think of it like this: for other assets, higher demand and prices lead to more production.

But with Bitcoin, the supply stays the same even if demand and price soar.

So, if demand for Bitcoin grows (as explained in my three points above 👆), the price is likely to rise, given the unchanging supply.

TL;DR: We’re taking off in the next 2 years. 🚀

But Bitcoin isn’t the asset that will benefit the most from this ETF. Ethereum will.

Ethereum ETF is Up Next 👀

Did you think that we’d be done talking about ETFs? Think again…

There’s already a new deadline to obsess over.

In my predictions for 2024, I said that we’ll see a Spot Ethereum ETF this year.

But whether or not this will turn out to be true is irrelevant. All that matters is that starting today, the focus shifts from Bitcoin to Ethereum.

All of the hype that we’ve seen around Bitcoin over the last 6-9 months in anticipation of this ETF will now flock to Ethereum, in anticipation of its own ETF.

Now, don’t get me wrong. Bitcoin’s not going anywhere. A LOT of money will flow into $BTC this year and it’ll be very bullish.

However, I think that $ETH will outperform. This is typical during bull markets, and $ETH has been outperforming $BTC since the beginning.

At the moment, we’re still at the early stages of the bull market, and during these times, $BTC is typically the stronger investment.

But now that we have the Bitcoin ETF, I see no reasons why money shouldn’t start flowing into $ETH.

We’ll have to wait and see what happens. But if you’d like to receive my thoughts on the markets as we go, then you should join our PRO-only Discord.

Become a PRO w/ a 33% Discount Now

Here are some examples of what I’m sharing with PROs in Discord.

1. Market Analysis

Fun facts: since this call (made on Dec 22nd): $OP went from $2.5 to $4, $ARB went from $1 to $2.4, $MNT went from $0.58 to $0.85, while other L2s pumped as well.

Very proud of this one. 🙂

2. Technical Analysis

I actually called the perfect bounce on $ETH with this one.

3. Airdrop Farming Strategies

I think you get the point… There’s a lot of alpha being shared in our PRO-only Discord every week.

If you’re not a PRO already, then you’re missing out…

Thanks for reading. And remember, you're strong, you’re powerful, you’re alpha! ❤️

How'd you feel about our read today?

Are You Fairly New to Crypto & Web3?

Let us help you wrap your head around this industry that’s constantly transforming.

Take our Free 1-hour Web3 Rabbit Hole Course to learn the foundational components you need to start building and investing successfully.

Recommended Tools 🛠

Secure Your Crypto w/ a Hardware Wallet – Get a Ledger Today

Join us on Discord | Follow us on Twitter

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.

13.1K

13.1K