🟣 Saylor Found an Infinite Money Glitch

PLUS: Elon Pumps Dogecoin Again

GM DOers!

Michael Saylor’s MicroStrategy used to be worth $1.1 billion in 2020 when they started to acquire Bitcoin.

Today, the market cap of $MSTR is almost $30 billion. 🤯

Just look at the insane growth of this company.

So how did they get to this point? Did Michael Saylor discover an infinite money glitch?

Today, I’m going to explain how MicroStrategy is able to acquire hundreds of millions of dollars worth of Bitcoin every month…

And how Coinbase might follow its footsteps soon. 👀

We’re also going to talk about how memecoins are getting out of hand:

Elon is pumping Dogecoin again

WIF is going on the Sphere 🤯

Solana memecoins can’t be stopped 🚀

At the end, we’re going to highlight the Onchain App Of The Month.

Let’s go. ⏬

Saylor’s Infinite Money Glitch Explained 🤑

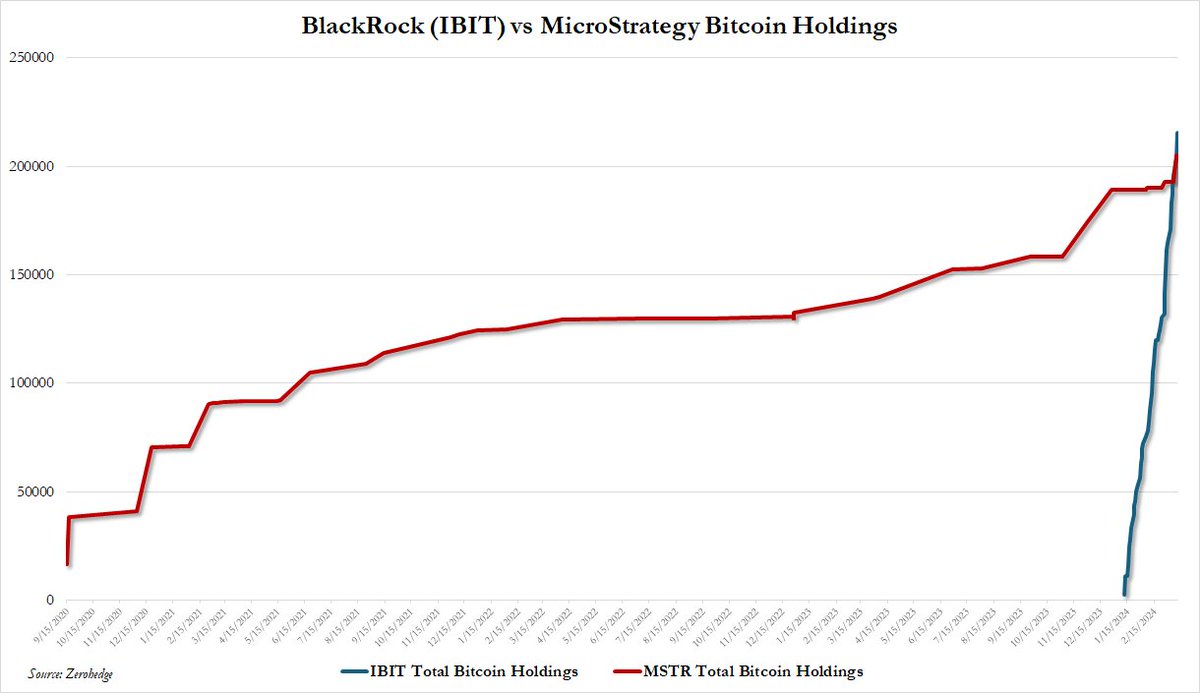

Michael Saylor’s MicroStrategy owns a whopping 205,000 $BTC, which they bought for ~$6.91 billion at average price of $33,706 per Bitcoin.

But how have they been able to spend almost $7 billion if their company was only worth $1 billion 4 years ago?

Here’s Michael Saylor’s playbook:

Issue Convertible Notes: MicroStrategy starts by issuing convertible notes, which is a way to borrow money from investors.

These notes can later be turned into MicroStrategy's own stock instead of being paid back in cash.

Buy Bitcoin: With the money raised from these notes, MicroStrategy purchases Bitcoin. They're betting that Bitcoin's price will go up over time.

Bitcoin's Value Increases: As the value of Bitcoin increases, so does the value of MicroStrategy's holdings.

The increased value of MicroStrategy's Bitcoin holdings usually contributes to a rise in its stock price – $MSTR is basically a proxy for $BTC, i.e. it follows the Bitcoin price.

Issue More Convertible Notes: With the company's stock higher, MicroStrategy can issue more convertible notes under possibly even better terms and repeat the cycle, buying more Bitcoin with the raised funds.

Context: It makes sense for investors to buy these convertible notes because they offer a low-risk investment with a fixed interest rate, plus the potential to convert into MicroStrategy's stock, which could go higher in the future.

In short: Borrow Money -> Buy Bitcoin -> Bitcoin Goes Up -> Stock Looks Good -> Repeat

For all of this borrowing, MicroStrategy issued convertible notes with a low 0.625% annual interest rate.

To pay this interest rate, MicroStrategy can raise even more money in the future, or simply sell some Bitcoin to cover the rate.

After raising $800 million last week, Saylor is looking to raise another $500 million.

What’s interesting is that despite Saylor’s aggressive Bitcoin buys, BlackRock’s $IBIT has still overtaken MicroStrategy’s Bitcoin holdings.

There’s a big difference though: Microstrategy owns the Bitcoin. Blackrock’s customers own the Bitcoin in $IBIT.

Funny Story: A few days ago, Saylor went live on TV to say: "People who use fiat currency as a store of value - there's a name for them - we call them poor" 😂

Coinbase Following in MicroStrategy’s Footsteps 👣

Coinbase plans to raise $1 billion, not by asking its current stockholders for more money, but by issuing "convertible bonds” – same as to what MicroStrategy is doing.

By borrowing a page from MicroStrategy's playbook, which successfully funded its Bitcoin investments this way, Coinbase aims to grow its company without upsetting its shareholders.

Investors who buy these convertible bonds will get a fixed interest rate on their investment plus the possibility to convert their investments into $COIN stock at a later date.

Infinite Money Glitch or Nah? 🤔

MicroStrategy’s playbook is using borrowed money to buy Bitcoin, hoping its value will keep going up.

Right now, as Bitcoin's heading into a massive bull market, their plan seems to be working.

But, this strategy is risky. If Bitcoin's price falls or people lose interest, there could be problems.

In 2022 for example, MicroStrategy risked liquidation on a $205 million loan due to falling Bitcoin prices. The loan required double its value in collateral.

By using Bitcoin as collateral and planning to add more if needed, MicroStrategy managed the risk.

Regardless, this isn't a surefire way to make endless money. It’s rather a massive bet placed by Saylor, which will probably turn out to be extremely profitable.

Memecoins Getting Out of Hand 😳

Elon Musk Pumps Dogecoin… Again

Elon spoke at the ‘We Are Giga’ event in Texas and said a few things:

Tesla will enable Dogecoin payments at some point.

Dogecoin is the people’s crypto.

Dogecoin to the moon

Are we surprised? Not at all. 😂

Dog wif hat is Going on the Sphere

The WIF community has successfully raised over $700k out of the $650k intended to put the dog in a pink hat on the Sphere in Vegas.

This raise was catapulted by Phantom, the leading Solana wallet that added the fundraising campaign on its Phantom Explore page.

Can’t make this up…

Solana Memecoins Can’t Be Stopped

Book of Meme ($BOME) is the latest sensation in the Solana memecoin sector, reaching a $400 million market cap after it was launched only yesterday. 🤯

Some have made millions in this memecoin overnight.

Because of all of this memecoin mania on Solana, $SOL is the only token that’s holding up during this wide market correction.

The Onchain App Of The Month is... EigenLayer

EigenLayer is a restaking protocol built on Ethereum.

Restaking is a new primitive that enables previously staked assets to be staked again to extend cryptoeconomic security and earn additional rewards.

Next week, we're doing NFT Of The Month, where we'll feature 4 NFT collections suggested by our community. Reply to this email with your suggestion on which collections we should pick.

Thanks for reading. And remember, you're strong, you’re powerful, you’re alpha! ❤️

How'd you feel about our read today?

Are You Fairly New to Crypto & Web3?

Let us help you wrap your head around this industry that’s constantly transforming.

Take our Free 1-hour Web3 Rabbit Hole Course to learn the foundational components you need to start building and investing successfully.

Recommended Tools 🛠

Secure Your Crypto w/ a Hardware Wallet – Get a Ledger Today

Join us on Discord | Follow us on Twitter

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.

11.5K

11.5K

JUST IN: MicroStrategy to raise another $500m through convertible notes.

JUST IN: MicroStrategy to raise another $500m through convertible notes.