The SEC Says XRP Is NOT A Security

We Are So Back

GM DOers!

The SEC finally made a decision in the Ripple case that’s been going on for YEARS!

Their verdict?

POP YOUR CHAMPAGNE BECAUSE WE ARE SOOO BACK!! 🍾

The crypto markets are seeing some upside, led by Ripple’s mental 70%+ increase since the news broke (at the time of writing).

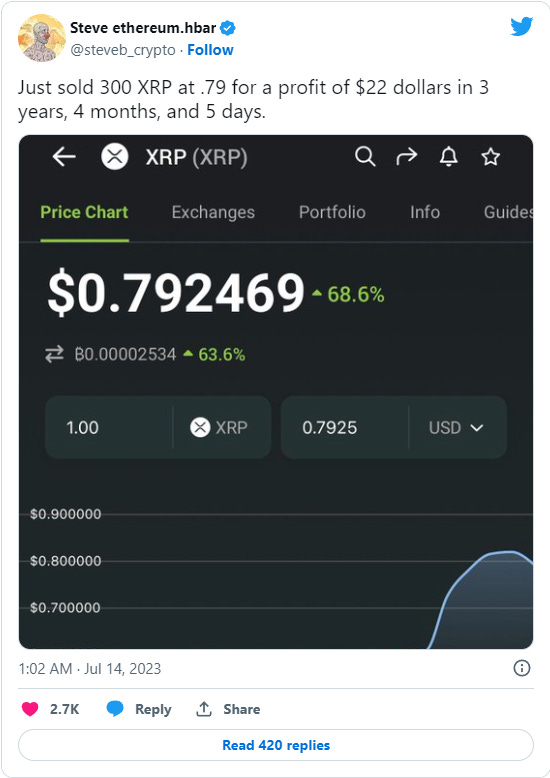

Now, people are already started to book some profits after years of waiting. 😂

So, is this the start of the bull market we’ve been telling you about all this time? 🤔

If you read Web3 Academy on a regular basis, you’d already know the answer to that. 😏

Reminder: We’re soon launching an investment course — which we believe is going to be the greatest investment course in web3 and crypto.

Our PRO members will get a hefty discount but as an active reader of Web3 Academy, we wanted to give you a discount too!

👉 All you need to do is reply to this email with a GM. We’ll then contact you once the course is live.

P.S- This is your last chance to lock in that discount if you’re not a PRO!

Now, let’s talk about how Ripple ended up fighting the SEC, why they won (partially) the lawsuit, who’ll benefit the most from this verdict, what this means for the entire industry, and of course, should you invest in XRP? 💸

Let’s get it. 👇

👉 Lens Protocol: The Future of Social Media

Decentralized social media finally allows creators to own their content, data and followers. That’s why we choose to build part of our media platform on Lens Protocol.

Why Did The SEC Go After Ripple In The First Place?

The SEC filed the lawsuit against Ripple in December 2020. Why?

Because Ripple allegedly conducted an unregistered securities offering by selling $XRP.

The SEC argues that Ripple's sale of $XRP tokens, which raised more than $1 billion in 2013, is essentially the sale of a security and, therefore, according to law, should have been registered.

This was concerning because if Ripple was classified as a security, then they’d face stricter regulation & additional legal burdens.

This, most likely, would’ve made Ripple even more centralized than it already was, limiting the growth of the project and discouraging investors. 😕

However, the most concerning thing was that in the case of an SEC win, it’d open the floodgates for the SEC to come after every cryptocurrency out there. 😨

I mean, they already tried by coming after Coinbase, Binance, and a dozen other altcoins. We wrote about that here. But it looks like that’ll stop. Let me tell you why. ⏬

Catch Up On Web3 News

This Ripple news is just one of the abundance of news we’ve had this week. In our Rollup, we broke down Coinbase integration with XMTP, Polygon’s new $POL token, Google Play allowing NFTs in their app store, and so much more…

Probably the biggest week for news in at least 6 months. 🚀

🎧 Listen to today’s Weekly Rollup podcast on your fav podcast platform:

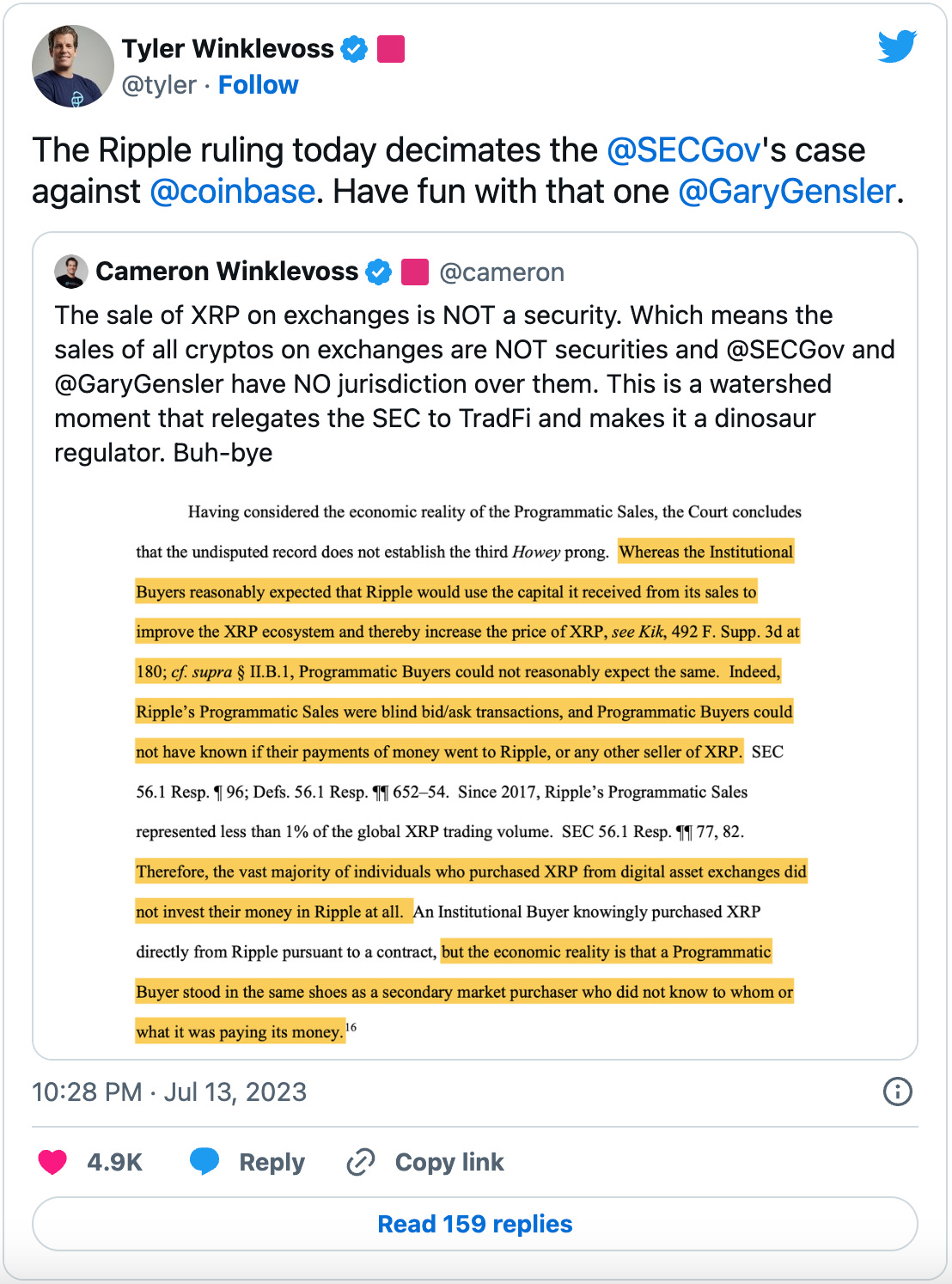

The Verdict 🔨

Firstly, the court ruled that a segment of Ripple's fundraising activities (specifically the sale of $XRP to institutions) was indeed an act that classified $XRP as a security. 🚫

However, the issuance of tokens through exchanges (the public listing of their tokens for retail investors) did not fall under the purview of securities law.

In simple terms:

TL;DR:

Sales to users via exchanges are fine 👌

Sales via an ICO/IEO/Launchpad are NOT okay

Offering $XRP as bounties is okay 👍

Using $XRP to invest in other tokens is okay 👍

Providing grants with $XRP is okay 👍

$XRP transfers are okay 👍

Long story short, this calls for a celebration. Why exactly?

Because Ripple is one of the more centralized foundations, having a key figurehead, who had standard sales via exchanges, and formal distribution programs – sounds a lot like a stock, doesn’t it?

If these don't count as securities, it implies that most cryptocurrencies traded on exchanges are 'safe'. 👍

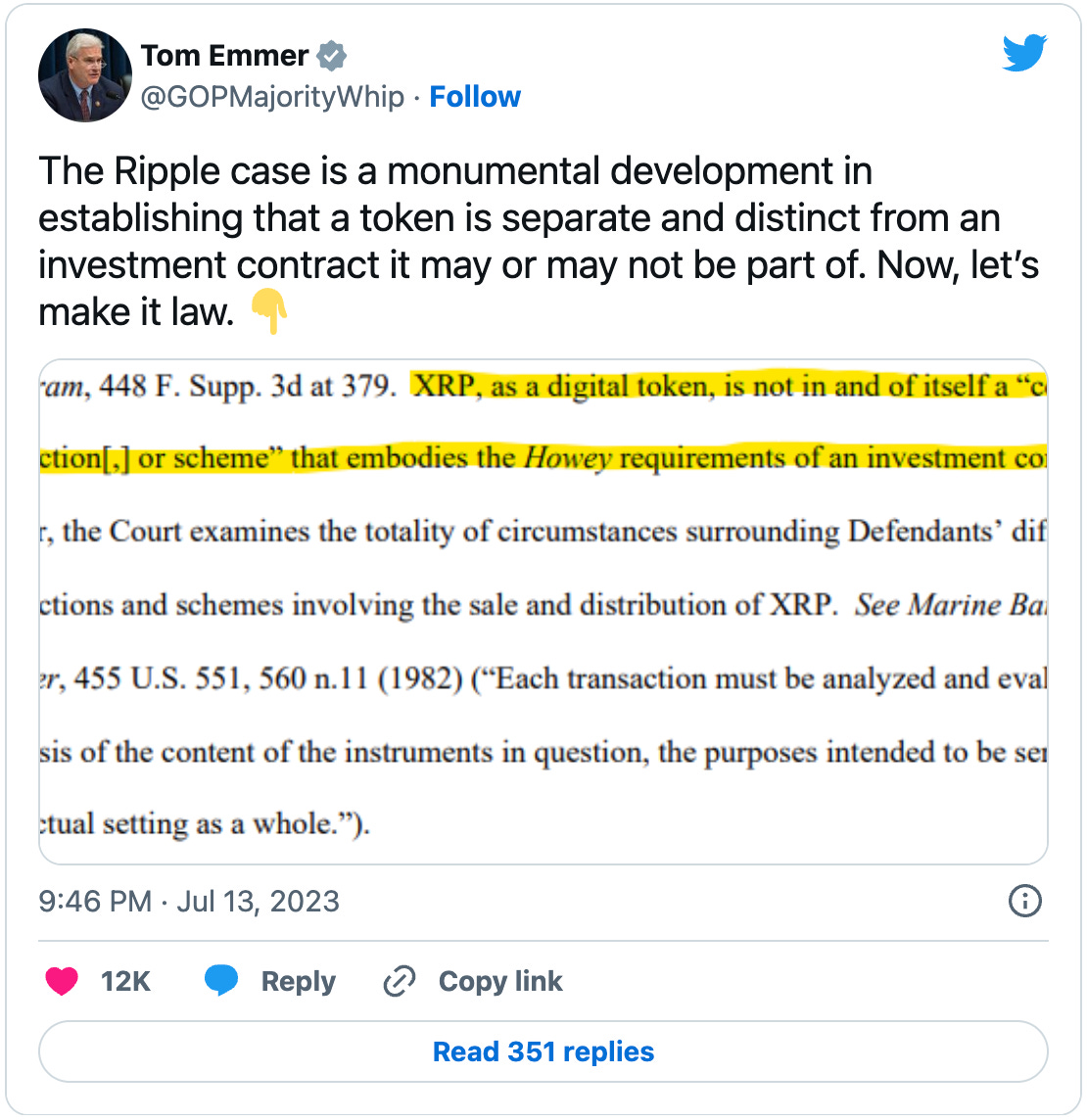

Now, keep in mind this is a summary judgement, so there is potential for further trials and appeals.

It doesn't signify the end of the case, but it's indeed a MASSIVE victory and well justified - even applauded by pro-crypto politicians.

Now… Who are the CLEAR winners from this ruling?

🤝 Thanks to our trusted partner, Whag.

Web3 users lose billions of dollars every year due to phishing attacks. Luckily, Whag uses verifiable links so you can rest easy, knowing that every link you click on is safe.

Just click below to see for yourself. The first 1000 users that sign up and use the code “free1000” get free access FOR LIFE.

Who Really Won? 🏆

First up, Ripple. No doubts there. Their token's value skyrocketed, but what's more crucial is they're (hopefully) free from the SEC's relentless pursuit.

It's like they've graduated high school and won't have to deal with Billy, the lunch money bandit, ever again.

Next, exchanges. If institutional sales, OTC deals, and direct token sales are deemed securities, then all trading would pivot back to public order books.

This puts an end to billions of $$$ from VCs in early convertible funding rounds. This will also prevent them from dumping tokens on retail investors once the token hits exchanges.

Then there's Coinbase! And to an extent, Binance. They're not just winners because they are exchanges, but because they've been under the SEC's scrutiny for alleged securities sales.

Now that Ripple's not a security, most other tokens probably aren't either. This means Coinbase can breathe easy.

Binance, however, still has to address their commingling allegations, which is unrelated to this judgement.

Finally, the web3 and crypto industry are winners.

We finally get some clarity as to what’s wrong and what’s right.

It's evident that the SEC can no longer and should no longer be the regulator of crypto.

Does this mean they'll back off? Probably not. But it's crystal clear that they can't intimidate us anymore.

Now… The elephant in the room 🐘

Should You Invest in XRP? PRO Advice For Builders And Investors

This verdict isn’t solely about $XRP. We believe that this ruling will have a ripple effect on many other crypto projects, who can finally build without having to think about breaking the law. 😌

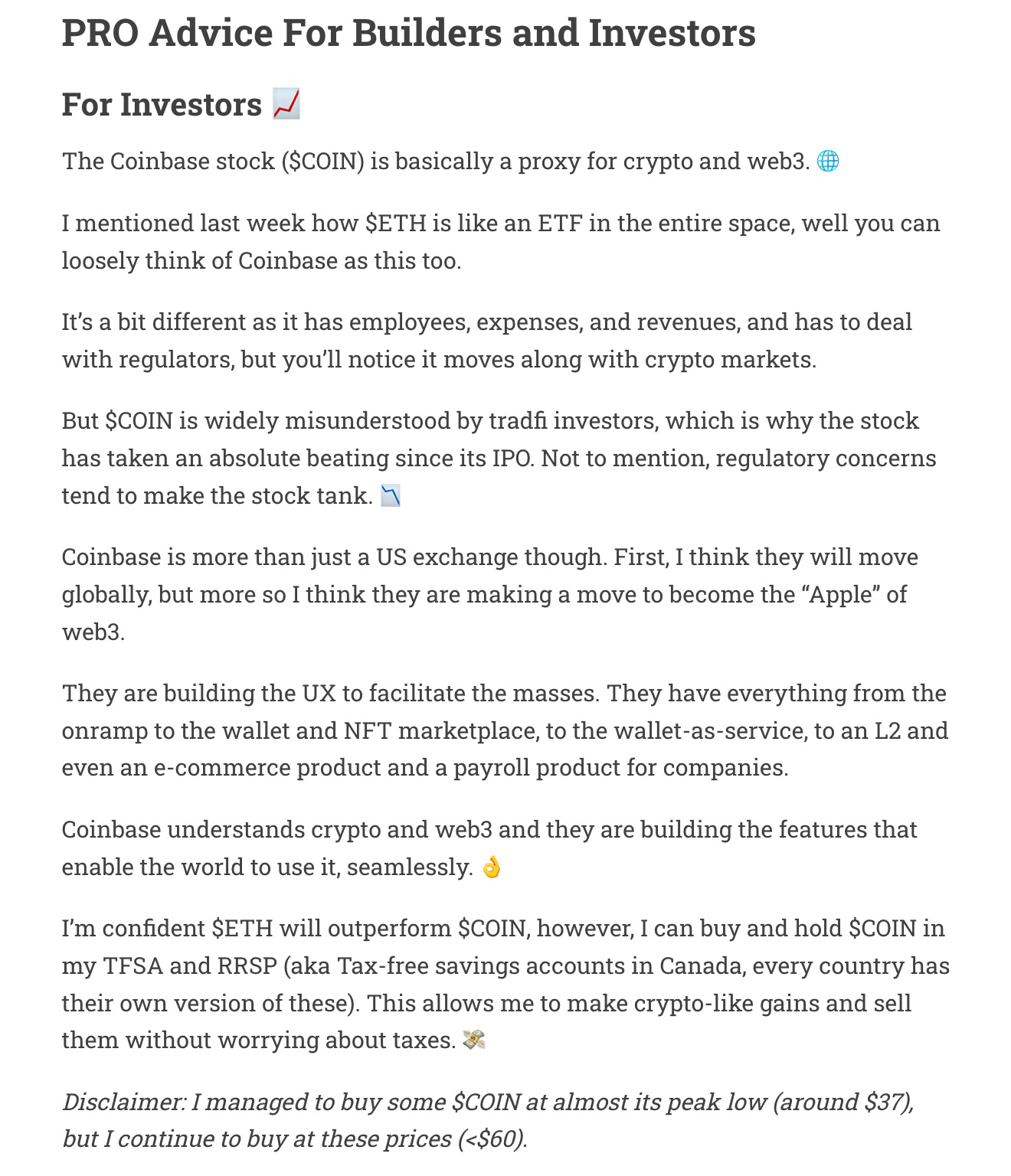

The following section is for PRO members only. But before we get into it, I wanted to remind our PROs of the Advice we wrote back on May 15th in our Coinbase newsletter here.

We told you that $COIN was a good investment at under $60. It’s now at $107 (time of writing) – in only 2 months.

That should put the importance of our weekly PRO Advice in perspective. 😉

First of all, we will not be investing in XRP and we do not recommend you do either. Despite this victory for XRP it’s still a shitcoin.

So the question is. Where are the opportunities to invest?

I strongly believe that Coinbase is the real winner that’s come out of this ruling. Simply because they’re now off the SEC’s hook and they can keep building without a chip on their shoulders.

If you’ve missed our call to buy at sub $60, that’s okay. We still believe that DCAing into $COIN will be a good strategy for the long-term.

This stock will grow to resemble an ETF for the crypto market. And long-term, that’s very bullish.

Furthermore, we still firmly believe that we’re at the early stage of a bull market. The stage where FIAT flows into big cap coins like $ETH and $BTC. Even though this court ruling is very bullish for Altcoins, we still think it’s not the right time to start allocating a big proportion of your capital into Altcoins.

If you want to DCA slowly, that’s fine. But if you’re investing, stick with $ETH and $BTC for now. We’ll tell you when we enter the next phase of the bull run. 😏

Now… What about the Altcoin market?

I think that a lot of good projects – like Coinbase and MetaMask – have been hesitant in launching a token because of regulatory concerns. (I’m not saying they’ll launch a token now).

But because we have some clarity, I think more valuable tokens will launch in the next few years. Keep your eyes opened for that. 👀

Secondly, I think that some projects have given up on certain initiatives to stay clear off the SEC’s radar.

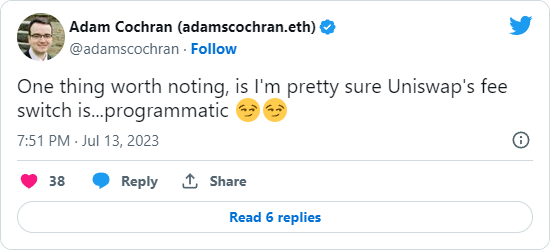

For example, Uniswap was considering charging liquidity providers a fee of one fifth of the pool fees across all Uniswap pools.

The fees collected would then be distributed to the $UNI token holders.

This proposal was put on hold due to concerns that the SEC would deem $UNI a security if this happened.

However, for the business model of Uniswap and for the benefits of $UNI holders, this would be super bullish. And I see no reason why they wouldn’t turn the fee switch on now.

If they do, $UNI should 100% be on your radar as an investment for when we transition into the next phase of the bull market.

With all of that said, we’ll be watching closely when Gary Gensler goes in front of the Senate next week.

And don’t worry if you’re not able to tune in. We’ll be watching and we’ll share everything you need to know.

Thanks for reading. And remember, you're strong, you’re powerful, you’re alpha! ❤️

See you soon. ✌

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.