🟣 TradFi is Bullish on Ethereum

$1.5T Asset Manager Starts Bull Posting

GM DOers!

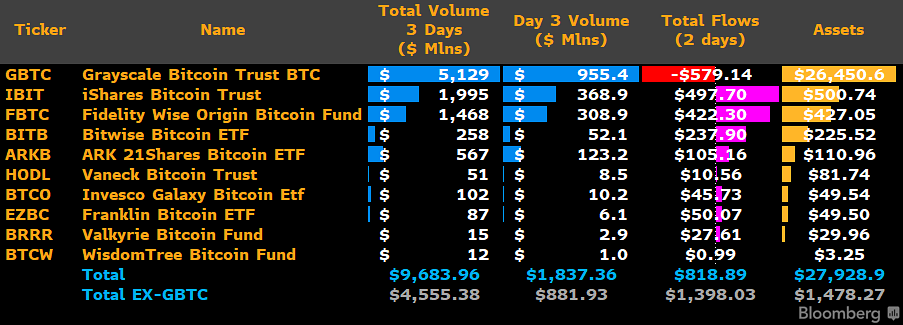

The Spot Bitcoin ETF has already settled more than $11 billion in its first 4 days.

BlackRock’s ETF, in particular, has done more volume than all 500 ETFs (COMBINED) that were launched over the course of 2023.

The market response for this ETF has been phenomenal so far, and that has certainly attracted a lot of eyeballs from TradFi.

But today’s piece isn’t about the Spot Bitcoin ETF.

It’s about how the biggest figures in TradFi are bullish on Ethereum and the crypto industry as a whole.

Larry Fink is shilling $ETH and calling for an ETF approval

Jamie Dimon describes $ETH in what he says could be a big blockchain

Franklin Templeton, a $1.5 trillion asset manager, starts bull posting about crypto

Soon, there’ll be many more suits than hoodies in this space. Soon, every TradFi investor will want a piece of crypto.

Right now, you’re still early! Make sure you don’t fuck this up.

Let’s get into it. ⏬

TradFi is Bullish on Ethereum 🐂

First up, we have Larry Fink – the CEO of BlackRock, the largest asset management firm in the world, with almost $10 trillion in AUM.

Larry went on CNBC and said this:

He sees value in a Spot ETH ETF

Everyone will have a tokenized identity

Tokenization of all real-world assets is coming

Tokenization will eliminate all corruption

He said all of this in the context of a Spot Ethereum ETF. Larry and BlackRock will do everything in their power to get this ETF live ASAP.

Not because they’re fans of crypto necessarily. But because they can make a shit ton of money from ETF fees. 💸

Okay, let’s move further to Jamie Dimon… He also went on CNBC and said that there are 2 types of cryptocurrencies.

One, the type that does nothing – referring to Bitcoin, calling it a pet rock.

Second, the type that has an embedded smart contract in its blockchain which we can use to buy and sell real estate and move data.

With the second type, he essentially described Ethereum (or smart contract platforms in general).

Now, we cannot take what Jamie Dimon said for granted. I’m certain that he knows absolutely nothing about crypto.

He literally said (in this same interview) that Bitcoin doesn’t have a limited supply and that Satoshi would come back to change the 21 million supply cap and erase all Bitcoin forever.

He’s delusional and looks like he hasn’t spent a second in his life learning about crypto.

However, I’m seeing a trend. And that’s tokenization.

Both Larry Fink and Jamie Dimon get the idea of putting real world assets onchain.

If you’re a PRO member, you’re already aware of this trend from our recent PRO report called “The Inflection Point For Real World Assets Onchain”.

If you haven’t already, I recommend you go back and read it.

Tokenization of real-world assets (RWAs) is one of the main onchain use cases that has potential to find a killer product market fit.

$1.5T Asset Manager Franklin Templeton Starts Bull Posting 🚀

For an hour on Wednesday, a few crypto degens on the Franklin Templeton team took over the X account.

These posts need absolutely no introduction so I’ll just leave some of them below. They’re absolutely hilarious.

Reference to the DogWifHat memecoin…

Bull post about Ordinals on Bitcoin…

Bull post on Ethereum…

Bull post on Solana…

This shows us 2 things.

Crypto culture is going to revolutionize finance

TradFi will adapt to crypto, not the other way around

If you’re still not bullish, I don’t know what to tell ya, except that an Ethereum ETF is coming 🔜. Let’s talk about that. ⏬

TradFi is Capitalizing on Crypto, Are You?

We're entering a bull market that will change lives & make many millionaires.

That's why you should capitalize on this once-in-a-lifetime opportunity by investing early to make insane gains in the coming years.

The Web3 Investing Masterclass can help you do that.

P.S. PRO Members get a 50% discount.

Wrapping Up 🧵 A New Deadline Obsession: Ethereum ETF

Crypto isn’t going mainstream. It already is.

We have a Bitcoin ETF

Larry Fink is shilling Bitcoin and praising Ethereum

Jamie Dimon sees value in tokenization of assets

Franklin Templeton is adapting their marketing strategy after crypto trends

On top of everything else, a Spot Ethereum ETF is coming this year (hopefully).

On the 23rd of May, the SEC needs to make a final decision on VanEck’s ETH ETF application.

Hashdex and ARK also have their respective deadlines at the end of May.

Will we get approval by May?

JP Morgan says there’s a 50% chance while Bloomberg ETF analyst Eric Balchunas says he expects a 70% chance.

These odds are lower than what Bitcoin got – 90% chance of approval.

The reason for that is clear: Ethereum hasn’t yet been officially recognized as a non-security.

To be clear… Ethereum is not a security. The fact that it has a Futures ETF shows that.

However, the SEC hasn’t officially said that yet. Until they do, it’s unlikely that they’ll approve a Spot ETF for ETH.

So the approval might not occur in May. But regardless, I’m certain that it’s just a matter of time until the approval happens.

I’ll stick to my 2024 prediction that this ETH ETF comes this year. Let’s see. 👀

Thanks for reading. And remember, you're strong, you’re powerful, you’re alpha! ❤️

How'd you feel about our read today?

Are You Fairly New to Crypto & Web3?

Let us help you wrap your head around this industry that’s constantly transforming.

Take our Free 1-hour Web3 Rabbit Hole Course to learn the foundational components you need to start building and investing successfully.

Recommended Tools 🛠

Secure Your Crypto w/ a Hardware Wallet – Get a Ledger Today

Join us on Discord | Follow us on Twitter

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.

7,821

7,821