W3A PRO | Where Value Flows Onchain: Uniswap Edition

Everyone Profits Besides Uniswap?

GM PRO DOers! 😎

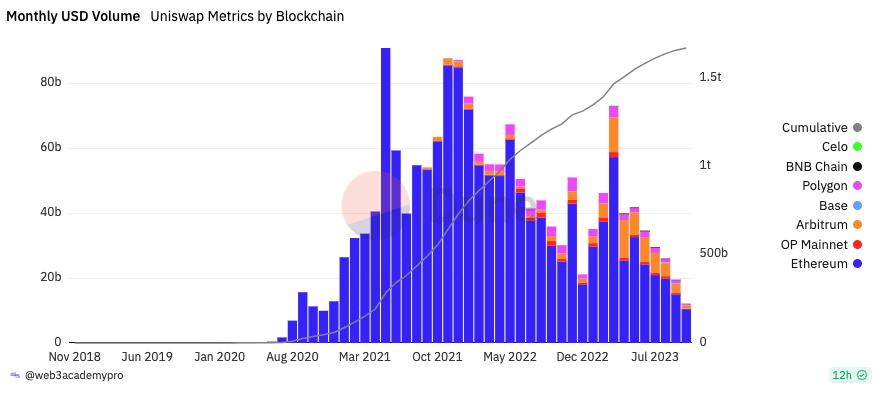

🚀 $1.67 trillion in trading volume.

🚀 242 million transactions.

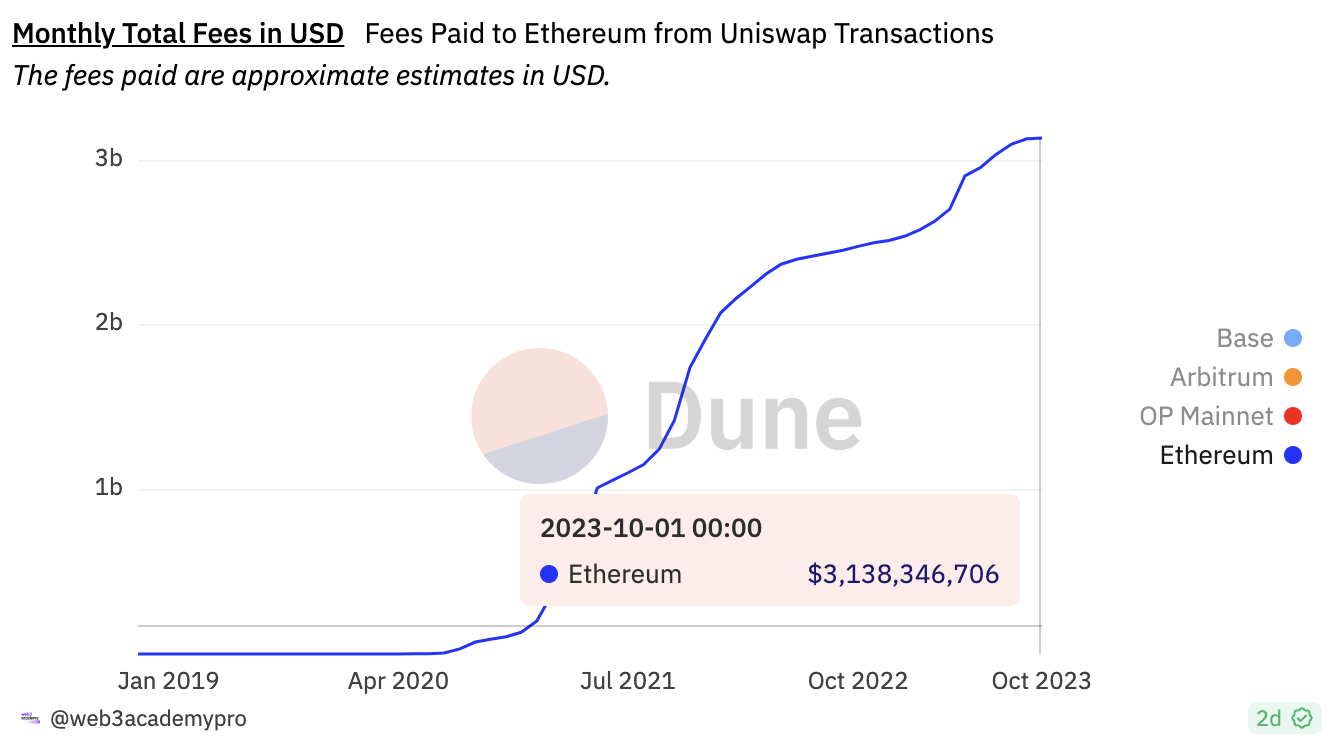

🚀 $3.2 billion in revenue generated.

🚀 $1.5 billion in $ETH burned.

🚀 And $1.6 billion paid to Ethereum validators.

Since November 1st, 2018, these are the outstanding numbers generated from Uniswap, the most successful application in crypto.

Guess how much revenue Uniswap has generated from it all?

$0

ZERO Doll Hairs! 🤯

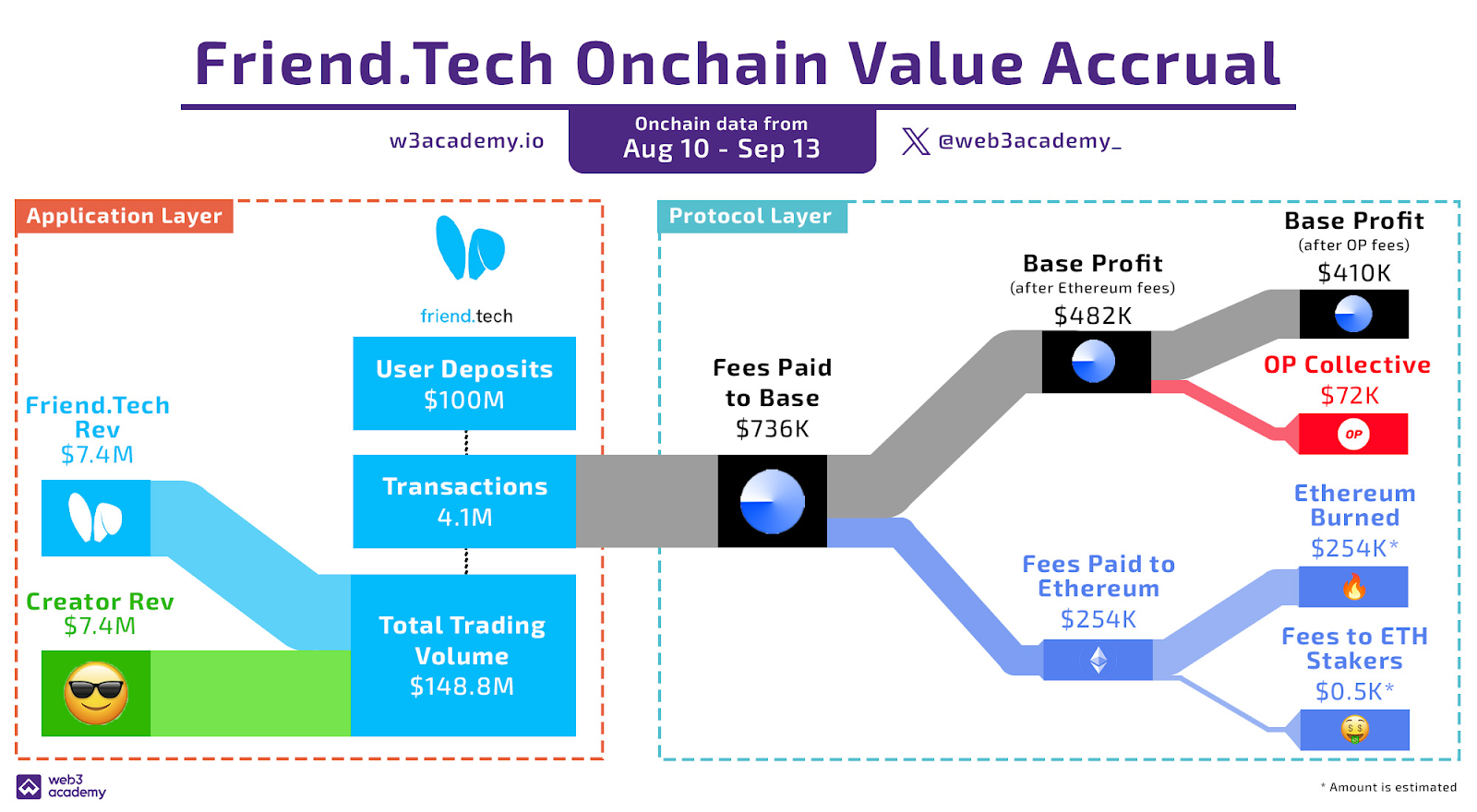

Seriously, you can double-check my math with another kick-ass value accrual visual here…

I know this is a lot to digest, so today we’re diving deep into the value accrual mechanisms of Uniswap, an application that I believe many of us take for granted in crypto.

Uniswap might be one of the greatest inventions that our industry has ever produced.

When TradFi people hear about what Uniswap is, their faces generally light up and their minds are blown.

Keep reading to understand what makes Uniswap so unique, as well as how you can capitalize on the opportunity of billions of dollars of value creation from the application.

Let’s dive in. ⏬

The Incredible Innovation That Is Uniswap 🦄

On the surface, we understand Uniswap simply as a way to swap tokens, similar to how we buy and sell shares of stocks from our bank accounts or Robinhood.

However, under the hood, Uniswap functions very differently.

Most exchanges, crypto, and equities use something called an order book, which matches bids and asks from buyers and sellers of particular stocks.

However, Uniswap invented the Automated Market Maker model (AMM).

AMMs use liquidity pools, whereby anyone in the world can provide liquidity for a pair of assets (i.e., ETH & USDC), allowing anyone to trade between those pairs of assets without requiring a buyer or seller on the other side of the trade.

But why would people provide liquidity? Why would they lock up their assets in the Uniswap protocol to be traded?

Because Uniswap takes .03% of every trade and distributes it to the liquidity providers for that particular trade.

So what makes the Automated Market Maker model so innovative? A few things…

1️⃣ Trades become extremely efficient and fast since you don’t need to hope that there is a match for your bid on the other side.

2️⃣ No intermediaries are required to facilitate a trade, as this all happens through automation via smart contracts.

This means that trading assets can be global, available 24/7, and completely permissionless.

3️⃣ In traditional exchanges, all trades end up back in FIAT currency. There’s no trading of a stock for another stock (i.e., sell Tesla shares for Apple shares). It’s generally Tesla to USD, then USD to Apple.

With AMMs, you can swap an asset to any other asset seamlessly (so long as there is liquidity for that pair).

4️⃣ AMMs like Uniswap are decentralized and permissionless protocols, which means that any asset can be listed on the exchange at any time, permissionlessly.

This means that any liquid and fungible asset can be traded without necessitating any approvals.

5️⃣ Finally, it means that anyone in the world can earn a profit off their assets by providing liquidity to the AMM, rather than in the traditional world, where only professional market makers can participate (i.e., large TradFi companies).

Pretty fascinating stuff for the finance world, and nobody has done it better than Uniswap. 💪

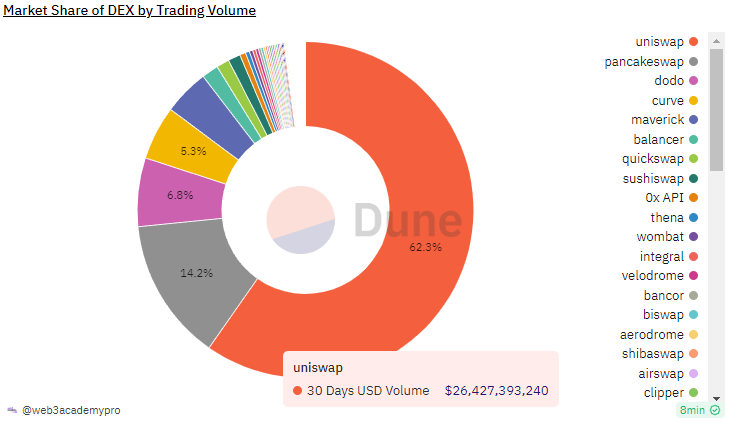

Since the invention of Uniswap in 2018, there have been 100s of forks and iterations of decentralized exchanges (DEXs), yet Uniswap’s dominance in trading volume continues, with a 62.3% market share in the past 30 days of volume.

It’s all about which DEX can accumulate the most liquidity, as this makes it more efficient for traders to exchange assets, as well as having more assets available to trade.

Uniswap, currently on version 3 of its protocol, has led the industry in innovating and improving its features, making it not only the most successful DEX in crypto but also the most successful application onchain.

Uniswap’s numbers in the last 5 years are pretty incredible, functioning across 8 EVM chains.

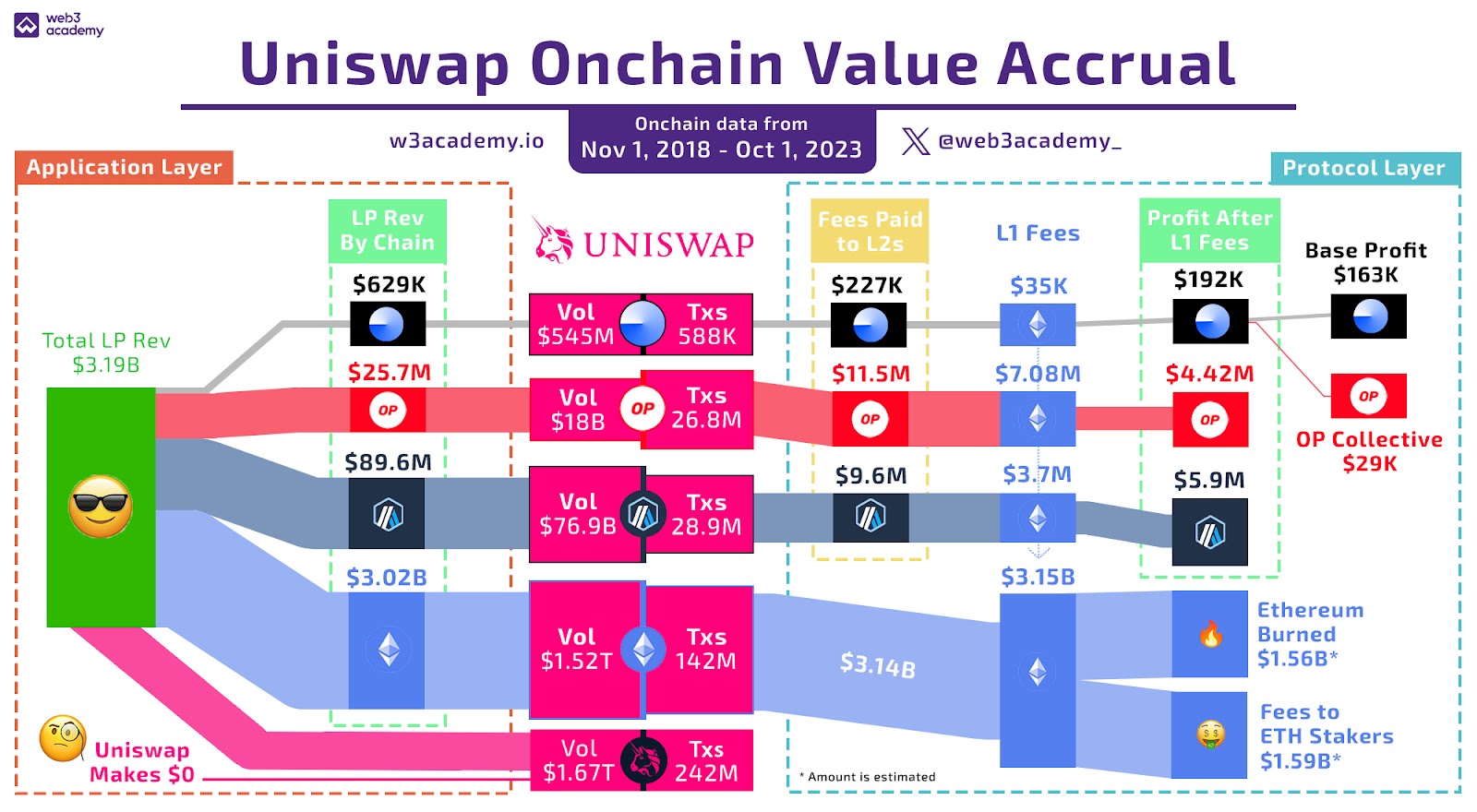

I mentioned the highlights at the top of this report, however, let’s take a look at the charts and then break down where all the value accruals are.

Uniswap's Top Metrics 🔝

Uniswap is one of the first and only applications onchain to find product market fit.

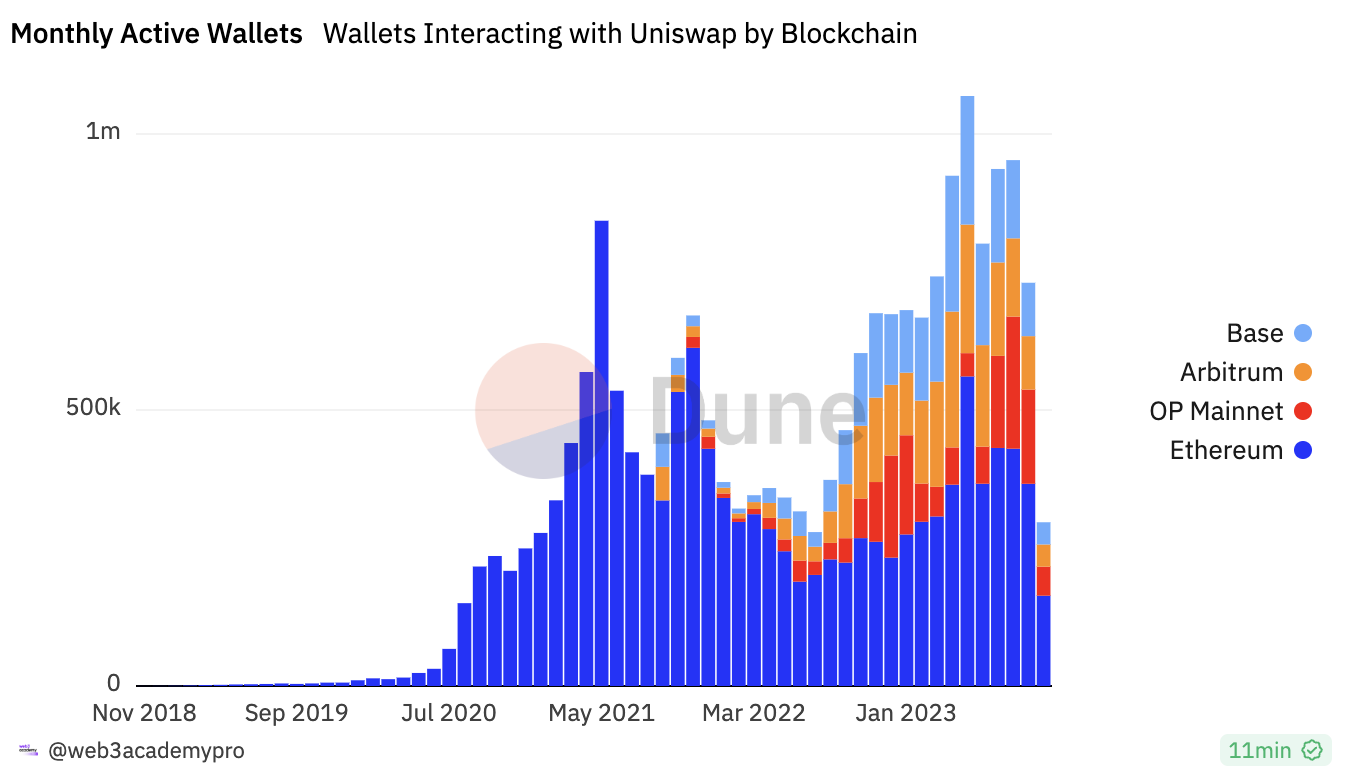

While the numbers are still not massive, the total unique wallet addresses to ever interact with Uniswap is just over 8 million.

However, a more useful metric would be to look at Monthly Active Wallets, which is sitting at just under 1 million. Interestingly, above the all-time highs from the previous bull run.

These numbers really put into perspective how small our industry is, considering Uniswap is the most used app in web3.

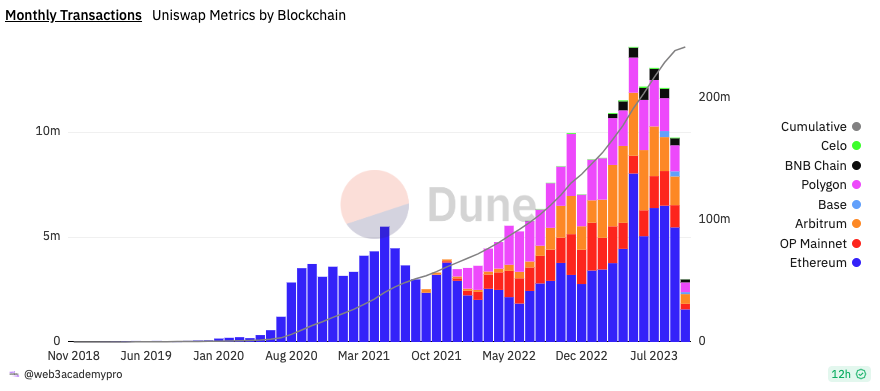

Of those 8 million+ total users, we’ve seen more than 242 million transactions all time.

More importantly, the amount of transactions we are seeing is “up only”, which is a result of Uniswap deploying on chains providing cheaper transactions like L2s and alternative L1s.

Though we have more transactions, volumes continue to move downwards, but overall Uniswap has facilitated $1.67 trillion in volume. 🤯

As I mentioned above, from that volume, Uniswap takes a .03% fee, generating $3.18 billion in total revenue.

However, here's the interesting part about that revenue.

100% of that revenue goes towards paying liquidity providers, and 0% has gone to Uniswap.

Surprisingly, as big as Uniswap is and the amount of value it has created, Uniswap has yet to generate any revenue from its protocol.

This is one of the interesting dynamics of decentralized protocols like Uniswap.

Technically, Uniswap also doesn’t have any expenses or employees. Uniswap is a DAO, governed by the $UNI token, which was used as one of the first-ever airdrops in our industry; it went to more than 250,000 early users back in 2020.

There is a centralized company called Uniswap Labs which developed the protocol and still works on it today, however, it doesn’t technically own the protocol.

Uniswap Labs received $176 million in funding since launching. Plus, they have a solid share of $UNI tokens, which is how they pay the bills to continue improving the Uniswap protocol.

One day, it’s assumed that the DAO ($UNI holders) will turn on the “fee switch” and begin generating revenue from fees to grow the Uniswap treasury and/or distribute fees to token holders, but to date, that has not been the case.

When (if) that ever happens, Uniswap could become the largest “Public Good” for this industry outside of Ethereum itself. 😲

Protocol Layer Value Accrual ♻️

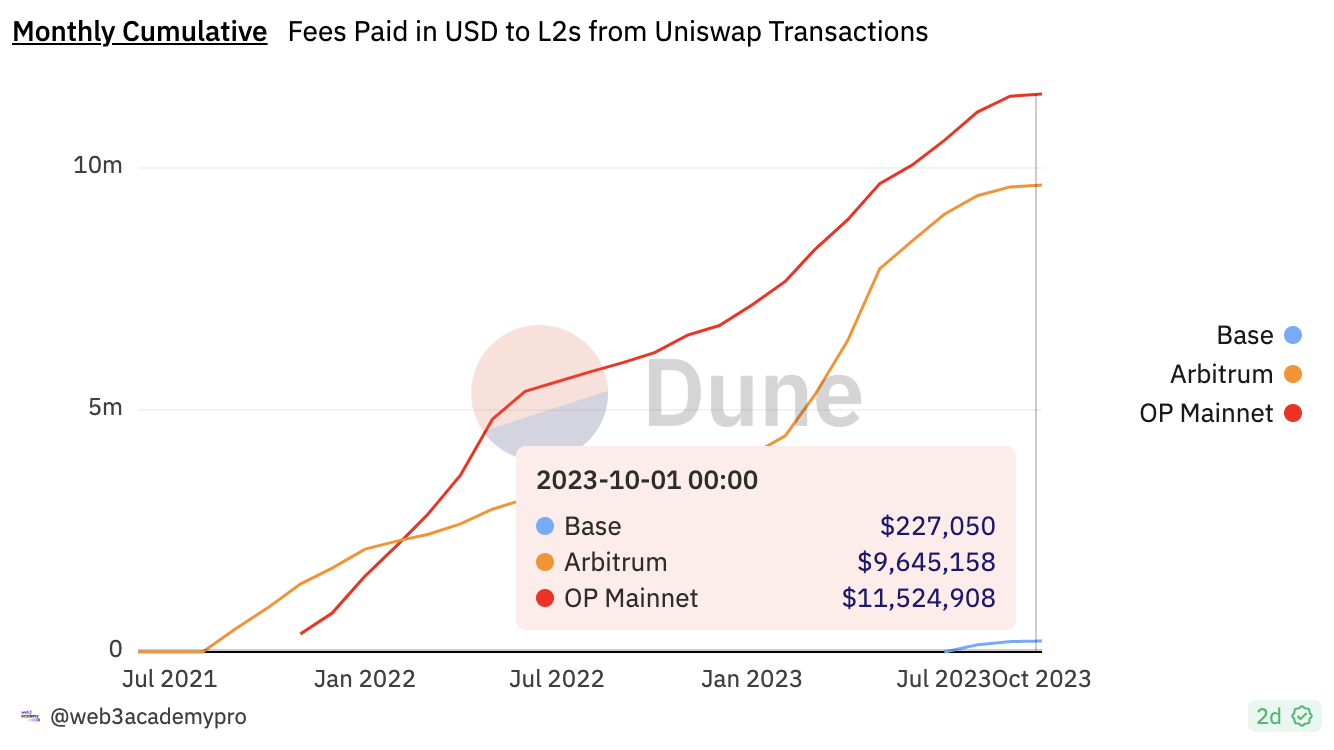

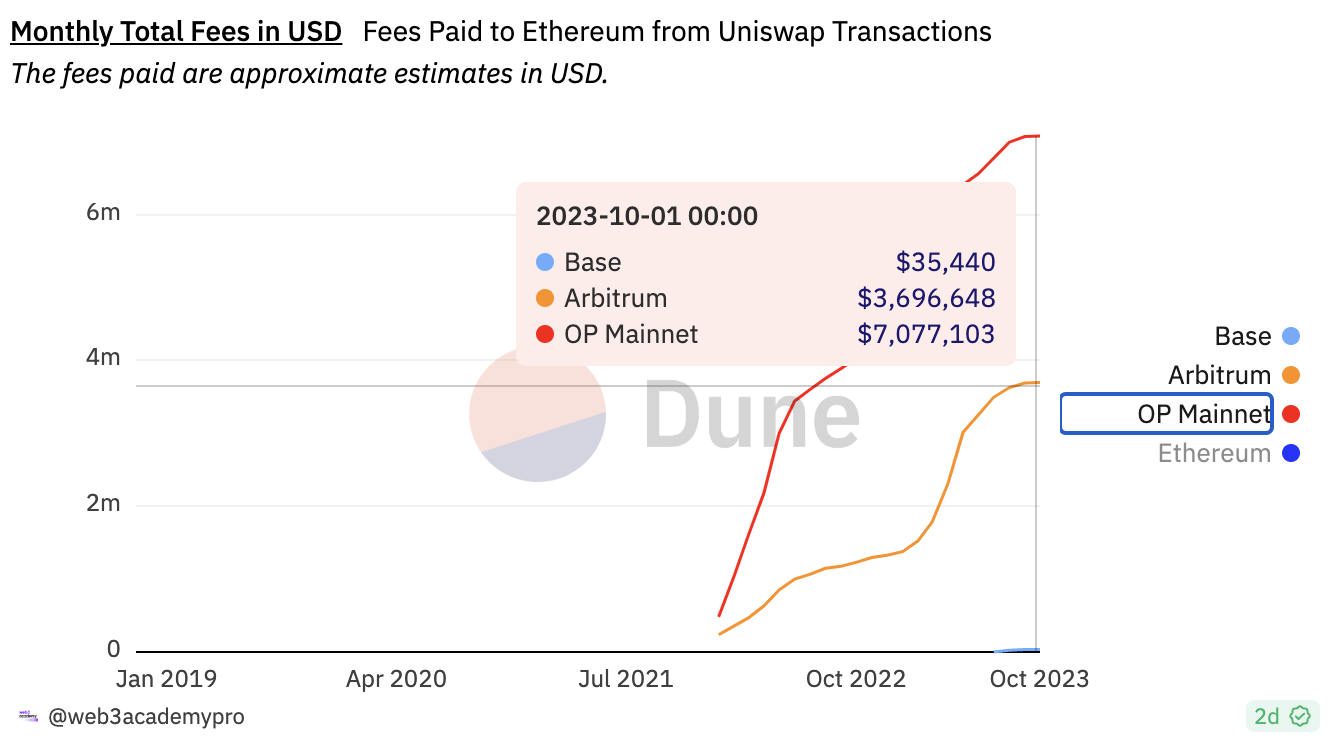

For the purpose of this report, we will only cover the protocol value accrual for profitable chains, which include Ethereum and its L2s: Optimism, Arbiturm, and Base.

From the 200 million transactions across these 4 chains, we can see that Optimism generated $11.5 million in revenue, Arbitrium $9.6 million, and Base $227k.

The biggest of them all, however, is Ethereum, generating $3.138 Billion in revenue from Uniswap transactions.

Moreover, L2s have to pay their dues to Ethereum to settle their transactions, so Ethereum has made an additional $7 million from Optimism, $3.7 million from Arbitrum, and $35k from Base.

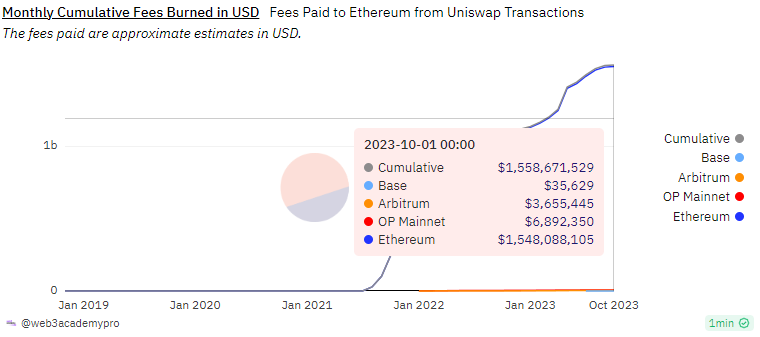

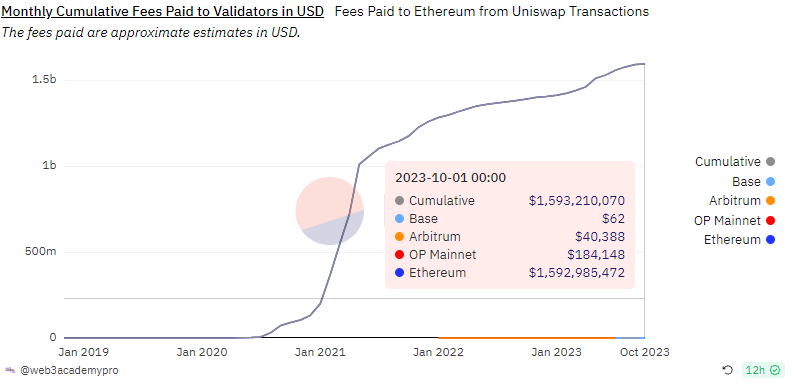

Of the cumulative $3.14 billion of Ethereum's revenue, we can split it up to see that $1.56 billion worth of ETH was burned.

And $1.6 billion of ETH was paid to validators (a combination of Miners and Stakers as Uniswap predates Ethereum's merge from Proof-of-Work to Proof-of-Stake).

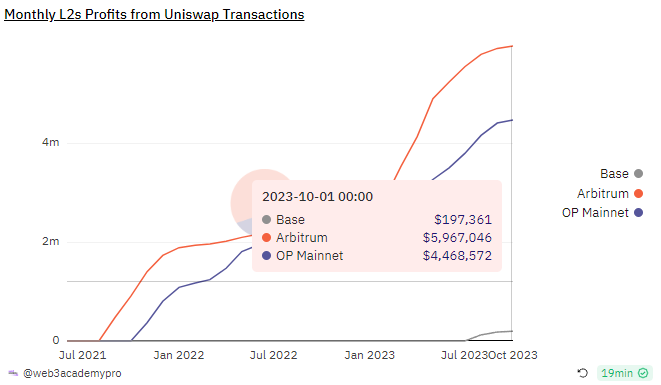

Ethereum holders have done very well off the back of Uniswap, but so have L2s.

As we can see from the chart below, Base has profited $197k, Optimism $4.4 million, and Arbitrum $5.9 million.

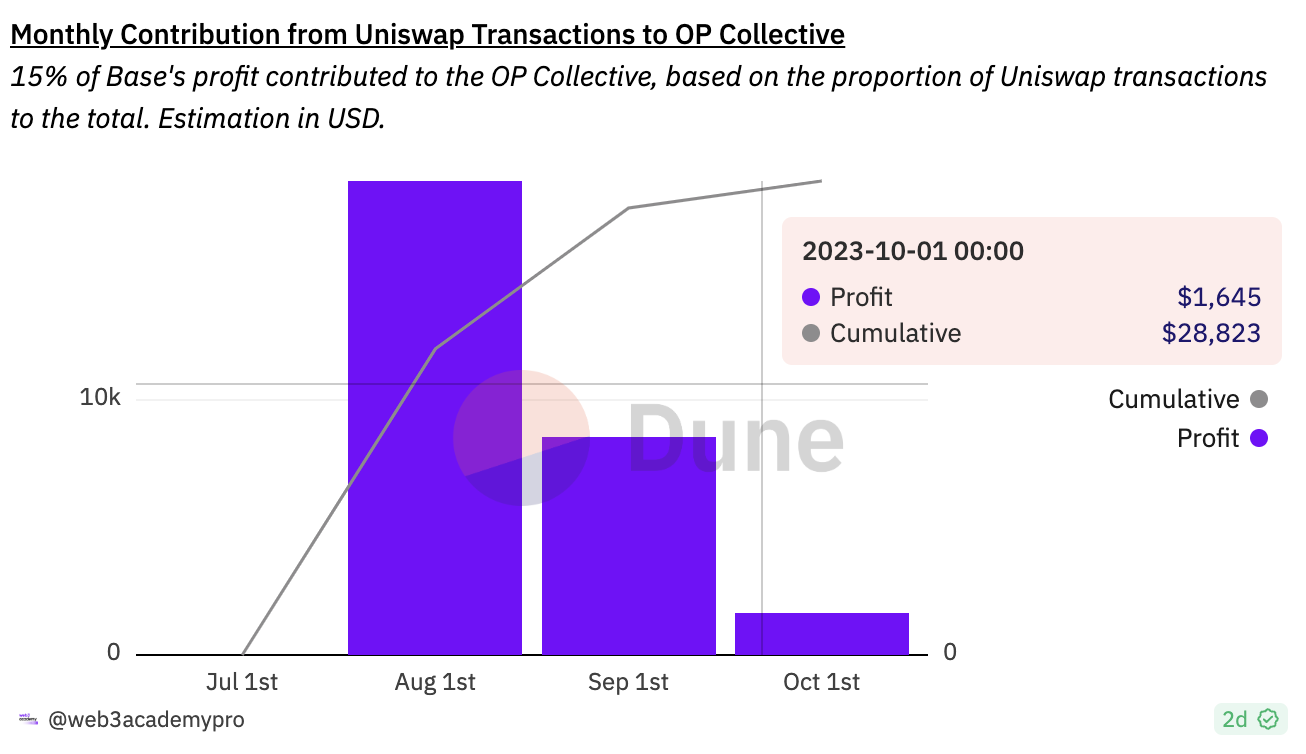

And if we take it one step further, it's important to note that because Base is built on the OP Stack, they pay 15% of their profit over to the OP Collective for public goods funding, driving an extra $28,823 in revenue to the Optimism Ecosystem.

It’s always so interesting to see how the protocol layer generates value from the application layer.

This fee revenue drives Web3 Academy’s main investment thesis around investing in protocols rather than applications.

And now that we've laid it out for you, this onchain value accrual chart hopefully makes more sense than it did at the start of the report.

Looking Into The Future 🔮

Uniswap is an incredible innovation that is only just getting started.

At the moment, Uniswap only facilitates trades between crypto assets, still a fairly niche asset class in comparison to traditional assets.

In the coming years, not only will we have more crypto assets to trade, but we will also have more real-world assets like equities and bonds moving onchain.

It’s very likely that Uniswap will become the go-to place to exchange all fungible assets in the future.

Imagine having the ability to trade Tesla stock for ETH in a permissionless, global, and 24/7 manner.

Or trading some Amazon stock for your favorite musician's social token. This is what is coming and it’s likely that Uniswap will remain at the forefront of all of this.

While the trading volume and transactions seem like pretty high numbers today, I believe in the coming years, these will be minuscule for what’s ahead.

Remember, there are only just over 8 million wallets (not people) that have ever interacted with Uniswap in its entirety.

Imagine what sort of numbers Uniswap can generate when there are 100 million people using it? Or what about 1 billion people?

That’s a 10-100x in users, which should bring at least a 10-100x in volumes and transactions, though with more assets and activity onchain, it's more likely that a 10-100x in users means something more like a 100-1000x in volumes and transactions.

This means that Uniswap could someday be facilitating $100’s of trillions in volume/year and settle billions of transactions.

If this is the case, not only would Uniswap’s liquidity providers be generating 100s of billions of dollars in revenue (and hopefully Uniswap is eventually taking a % of that too), but the protocols that enable Uniswap to function would be generating significantly more in fees as well.

To think that Uniswap could be burning $10s of billions in $ETH and paying $10s of billions to ETH stakers in the future is wild, especially when you consider that this is just one application being used on top of Ethereum and its L2s.

Surely if Uniswap reaches these levels it can’t be the only onchain application with product market fit and significant activity.

As this industry continues to grow, it’s going to be incredible to watch how and where value continues to accrue.

I think the numbers are going to become simply massive, creating an unbelievable opportunity for those in this space who understand where value flows onchain, perhaps the most important concept to grasp.

That is why, at Web3 Academy, we invest a lot of our time to create value flow charts like this one.

And like this one.

Our goal is to give our PRO members the inside scoop so that you know something the rest of the world doesn’t.

So we've got a lot more of these coming your way soon! 👀

In the meantime, take the Uniswap Onchain Value Accrual chart above and share it on Twitter (X) & tag @web3academy_!

We’ll repost!! ♻️

Thanks for reading. And remember, you're strong, you’re powerful, you’re alpha! ❤️

How'd you feel about our read today?

ABOUT THE AUTHOR

Kyle Reidhead

Founder of Web3 Academy and Impact3

Find him on Twitter

🟣 PRO ACTION STEPS

CLAIM PRO NFT

As a PRO, you’re entitled to a PRO or FOUNDERS Pass (NFT), depending on your subscription.

This Pass will grant you access to our token-gated Discord and to other perks such as early access to various protocols and discounts to IRL and online events.

To grab your Pass, simply click the button below, connect your wallet to your Paragraph account and grab your Pass.

TAKE WEB3 INVESTING MASTERCLASS

Learn the best practices to allocate capital and successfully invest in crypto and web3 with our Web3 Investing Masterclass.

This invaluable resource costs $249. But as a PRO, you get it at a 50% discount. 🥳

And as a Founding member, you get it for FREE! 🤯

All you need to do is grab your PRO/Founders Pass (see above 👆) and connect your Pass using the link below. 👇

JOIN OUR DISCORD

As a PRO or FOUNDERS Pass holder, you have exclusive access to our token-gated Discord channels dedicated to PRO members!

Upon claiming your Pass, head to Discord and connect your Pass in the #start-here channel (WEB3 ACADEMY PRO category) to unlock access to PRO-only channels!

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.