GM PRO Doers!

I don’t know about you but “Is Solana Dead?” seems to be the question I’m seeing all over Twitter and in my inbox.

A few of you PRO members also asked that I answer this question with on-chain analysis. So here we are. 🤷♂️

On that note, I (and the Web3 Academy team) would again like to share our gratitude for the overwhelmingly positive response from the 100+ DOers who have already gone PRO and secured themselves a 50% lifetime discount. 🙏

Although we’ve reached our 100 DOer cap, there’s been so much demand and positive feedback from the community that we wanted to show our gratitude with actions, not words.

So in case you missed Wednesday’s DOer Spotlight, we’ve decided to extend the lifetime discount until Saturday! 🎉

Now, we value our work and know that our reports are worth way more than just $7.50 per month. But we value our community more and want you to have the best opportunities to succeed in web3.

We won’t be doing discounts like this often—if at all… 😬

So please take advantage of this hefty 50% lifetime discount while you still can and level up with the #1 web3 resource for understanding what businesses, business models, and tactics are winning in web3.

Note: Substack may ask for your email before you can sign up!

Now, let’s get down to business.

There’s no doubt that Solana is down bad…

Just look at the price chart below. In the last 14 months, the price of SOL (Solana’s native token) went from around $260 down to <$10 and is now sitting at just above $16 at the time of writing.

At its lowest, SOL dropped a cute +97% from all-time highs. 👀

To make matters worse, one of the top NFT projects on Solana, DeGods, recently announced it’s moving to Ethereum and the team's second project, Y00ts, is moving to Polygon as well.

Of course, all of this is happening on the back of one of SOL's biggest holders (>10% of total supply) and the broadest Solana ecosystem investors, FTX, falling bankrupt.

There is no doubt that things look bad for Solana.

However, those who were around back in 2018 know that we experienced a somewhat similar scenario with Ethereum.

In 2018, the price of ETH fell from its (then) all-time high of $1,428 down to around $85, resulting in a 94% drop in the price of ETH. 🤷♀️

The crypto and web3 space were very different back then, but many projects and businesses ran out of money, people were fleeing the space, and it left many, even the most committed to Ethereum, wondering if it was going to make it.

Thankfully, the Ethereum community pushed through the depths of a long crypto winter, and the vibrant and flourishing Ethereum ecosystem we know today exists.

Now, you may be wondering why I’m talking about Solana’s price on Web3 Academy since it’s an area we don’t tend to cover.

Well, the reason is this…

If there is one thing I’ve learned following Ethereum for all of these years, it’s that there is a big difference between Ethereum the blockchain, and ETH the currency.

This is also true of Solana the blockchain and SOL the currency. So while the price of SOL looks unbelievably terrible, it may not reflect what is happening to Solana the blockchain, and its community.

In fact, take a look at this logarithmic price chart of the Amazon stock below.

In 2000, the price of AMZN dropped 94.79% down to $4. For some context, Amazon's most recent all-time high was $165 and over its 26 years of trading on the stock market there have been:

Seven times when the price dropped more than 30%

Four times when the price dropped more than 50%

And three times where the price dropped more than 60%

What a ride! Yet, Amazon is one of the largest companies in the world (it’s currently down more than 50% from its ATH though lol). 📉

The point is this, the price is irrelevant to the underlying technology. Prices of technologies will always fluctuate and can sometimes significantly “de-peg” from their fundamental value.

And this doesn’t matter because network effects are the true driver of technological adoption.

Network effects are a phenomenon whereby an increased number of participants who use or interact with a particular technology increases the “value” of said technology.

A more valuable technology then increases the number of participants who use or interact with the technology which, again, increases its “value”, thus increasing the number of participants… You get the point. ♻️

The internet for example became better and better as more people started using it. Facebook, Amazon, etc. had the same benefit of network effects.

Once a technology reaches a certain level of network effect it’s very tough for it to die. Bitcoin and Ethereum have likely both reached this point.

That’s not to say it can’t die, it’s just to say it’s more difficult than people think—especially if that network is continuing to grow over time.

So, when we ask the question “is Solana going to die?”, what we need to do is look at its network effects. We must look into what’s happening with the participants of the Solana blockchain, i.e., its users and developers.

The wonderful thing about blockchain technology is that we can do just that!

We can look into the trend of new users on the Solana blockchain.

We can review the trends of user transactions and value on the Solana Blockchain

And most importantly (especially early on in a technology), we can look into developer activity trends and new projects being deployed on the blockchain.

Now, before I dive into the charts, it’s important to remember that we are now 14 months into a bear market, so naturally, these numbers aren’t going to look great. 🤧

So what we’re going to do is compare Solana's numbers to Ethereum during the same timeframe, as well as Ethereum's first cycle in 2017-2018 to see what we can uncover about the health of Solana.

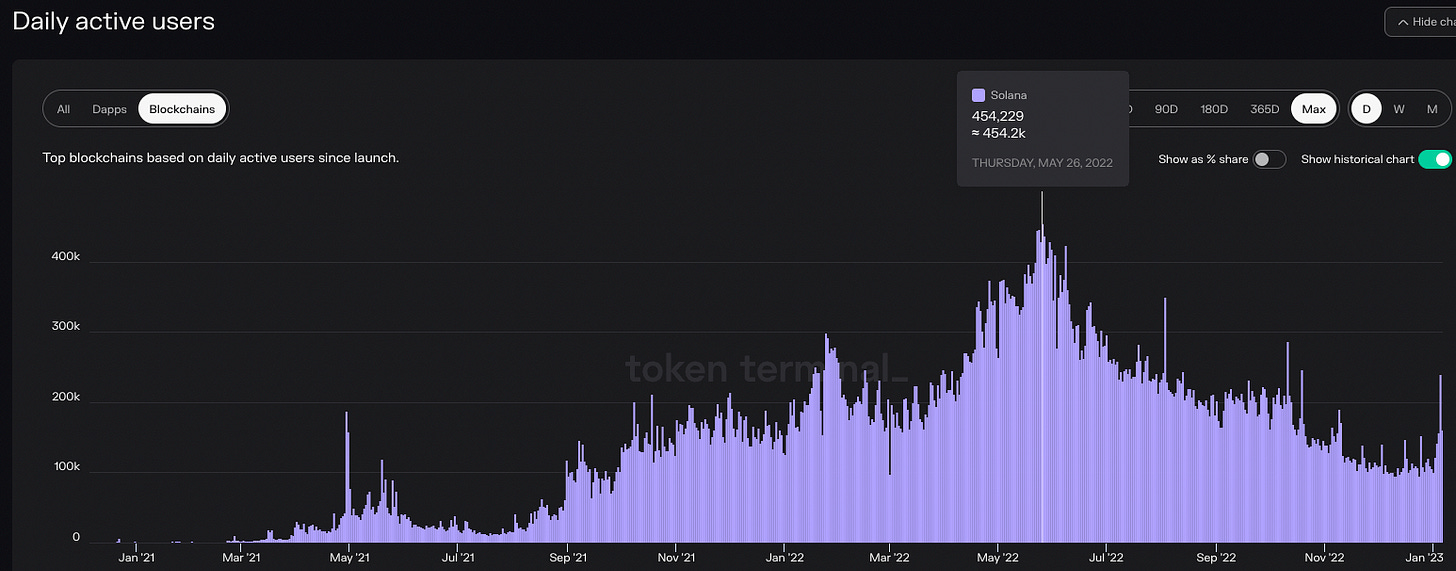

If we look at the daily active users (DAUs) on the Solana blockchain we see a drop from its all-time high of 454,229 down to a low of 95,958 directly after the FTX situation, a 78.8% drop in DAUs.

To start the new year we’ve begun to see a retrace, however, it’s still too early to tell if that will continue.

In comparison, Ethereum has seen a much lower decrease in DAUs despite the mess across the industry. Excluding the random spikes, Ethereum has dropped from 528,671 DAUs to a low of 295,500 DAUs, a modest 44% decrease in the same time frame as Solana.

We also need to keep in mind that the focus of the Ethereum community right now is to move users from its layer 1 over to its newly flourishing layer 2s like Arbitrum and Optimism.

We can see below that these L2s have actually gained users throughout the ongoing bear market.

A more fair comparison, however, might be to look at the drop in DAUs of Ethereum in its first cycle, since this is Solana’s first cycle as well. Interestingly, in the 2018 bear market, Ethereum DAUs went from 459,969 down to 128,265, a 72% drop in DAUs.

To recap so far…

Daily Active Users

Solana 2022 = 78.8% 📉

Ethereum 2022 = 44% 📉

Ethereum 2018 = 72% 📉

Price

Solana 2022 = 97% 📉

Ethereum 2022 = 79%📉

Ethereum 2018 = 94% 📉

It seems Solana’s numbers in terms of price action and DAUs so far in this bear market are tracking similarly to Ethereum in 2018.

The main difference is that this time around, Solana has direct competition, whereas in 2018 Ethereum essentially stood alone as the only viable smart contract platform.

In this bear market, there are blockchains that are still gaining users during this time. Seen above with Ethereum L2s and also below with Polygon.

It’s important to note that the Ethereum L1 and Solana blockchain should be seen less as competitors since they are aiming to be very different things. Ethereum L2s and Polygon, however, are direct competitors to Solana.

So it’s interesting to see that Ethereum L2s and Polygon are growing, whereas Solana is not.

Solana performs significantly more transactions (txns) than Ethereum on a weekly basis.

However, I should note that the legitimacy of these txns is questionable, as many txns on Solana are thought to be the result of bots. Regardless, let’s forget about the size and instead compare the % change in weekly transactions.

Solana dropped from 496,847,478 weekly transactions down to 127,963,178, a 74% decrease (FYI this chart excludes all voting txns on Solana).

Ethereum, on the other hand, went from 11,074,661 down to 6,705,093, a decrease of 40%.

Let’s jump back in history and look at what happened with Ethereum transactions during its first bear market as well. We can see that Ethereum went from 8,203,034 weekly transactions down to 2,959,182, a drop of 64%.

Weekly Transactions

Solana 2022 = 74% 📉

Ethereum 2022 = 40% 📉

Ethereum 2018 = 64% 📉

Again, the stats of Solana and 2018 Ethereum are similar.

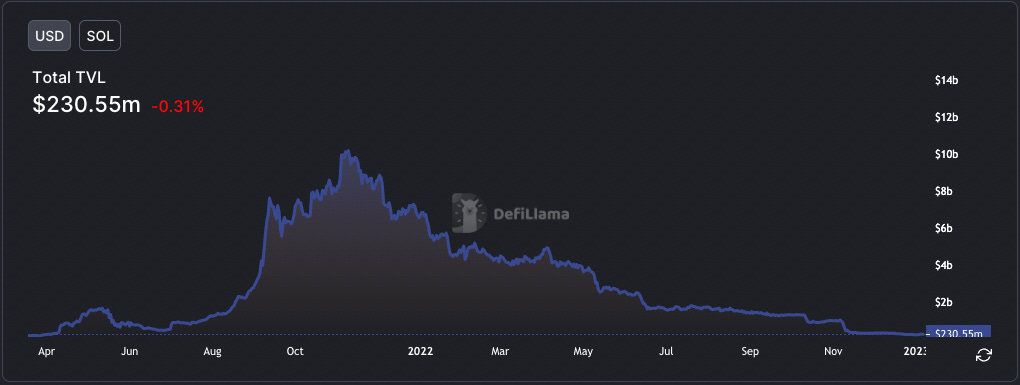

Outside of transactions, we can also take a look at the total value locked on either blockchain and how that has changed over time. Solana went from $10.17 Billion down to $230 Million, a ridiculous decrease of 98%.

Whereas Ethereum went from $109.49 Billion to $23.82 Billion in TVL, a drop of 78%.

There wasn’t a TVL metric back in 2018 as DeFi didn’t really exist back then, so we don’t have a historical comparison on this one.

Similar to transactions, we should take the developer activity numbers with a grain of salt.

This is a tough metric to track, especially in the Ethereum ecosystem where they have many different Ethereum clients. Plus, many teams are now building exclusively across the layer 2 ecosystems rather than Ethereum itself.

In the charts below we’re using Token Terminal’s tracking of Github commits for each blockchain and it’s clear they are not accurate in terms of numbers. So let’s focus less on the actual numbers and instead on the % change.

Solana saw a high of 156 daily active developers and hit a low of 61, a 61% decrease. Ethereum had a recent high of 296 and a low of 153, a drop of 48%.

But again, we should be taking into account the developer growth across the Ethereum ecosystem as a whole, as many Ethereum devs and teams are moving to faster and cheaper real estate across the various L2s on Ethereum.

That’s why the numbers and growth across Arbitrum, Optimism, Starknet, and Polygon shouldn’t go unnoticed.

But again, let’s take a look at the historical data of Ethereum in the last cycle. Ethereum went from 195 daily active devs down to 100, a drop of 49%. Albeit, that low came almost 2 years after the all-time high.

Daily Active Developers

Solana 2022 = 61% 📉

Ethereum 2022 = 48% 📉

Ethereum 2018 = 49% 📉

This is the first metric so far where Solana isn’t mimicking 2018 Ethereum. My assumption as to why this is true goes back to competition.

In 2018 there was nowhere else for developers to go if they wanted to work on a live smart contract platform. Today developers have a choice of 20+ layer 1s and another 20+ layer 2s.

As mentioned in the beginning, we have already seen some high-profile projects migrate to Ethereum and Polygon in the last few weeks.

So it will be interesting to see if that trend continues throughout 2023.

For the last couple of comparisons, we will look at the trends of newly minted fungible and non-fungible tokens across both ecosystems.

I would have liked to compare total smart contract deployments across both ecosystems as developers are building more than just tokens on blockchains. However, we could not find this data for Solana (if you know where to find this, please feel free to share in the comments below).

Below we can see that Solana was ranging between 1,000 and 1,500 daily deployments of new fungible tokens at its high in Q3 of 2022 and has since fallen into a range of around 300 - 800.

Ethereum on the other hand has held fairly strong the last few months ranging between 500 and 1,000, aside from a few spikes in October.

Looking at NFTs, Solana has taken a pretty clear hit since October. There were around 100k NFTs minted daily, but now the average sits closer to 25k/day, ranging much lower than its pre “spike levels” in September/October.

The comparison here on Ethereum is a bit different, as this chart is looking at smart contracts of NFTs, rather than the total number of NFTs. That said, again Ethereum has essentially maintained its pre-September/October spike levels.

An important factor to keep in mind here too is that if we were to include fungible and non-fungible token mints across Ethereum's Layer 2 ecosystem, you would see continued growth across the entire Ethereum ecosystem during this bear market.

If we simply look at the on-chain metrics, there is nothing that would suggest Solana is dead.

You could argue that the numbers suggest Solana is “dying”, however, its numbers are very similar to that of Ethereum in its first cycle, which managed to survive and thrive through a 2-year bear market. 🤔

I don’t see why Solana couldn’t do the same. They seem to have a strong community (though that could be falling) in addition to having an unbelievably talented leadership team.

However, the big difference between Solana today and Ethereum from 2018 is the clear competition that Solana faces during this cycle.

Solana is trying to become the king “consumer” blockchain—a fast, cheap, and mobile-friendly blockchain for the masses.

Ethereum does not compete here, as that is not its goal. Instead, Ethereum is aiming to become the ultimate decentralized and secure consensus layer for the internet.

That said, the Ethereum ecosystem has launched some serious competitors to Solana with the likes of Polygon, multiple Optimistic layer 2s (Arbitrum and Optimism), and ZK-proof layer 2s, like Immutable, with various other layer 2 ZK technologies coming live in 2023. 😬

Each of these has the ability to provide fast and cheap transactions, while also remaining decentralized and secure, thanks to Ethereum.

While Solana’s tech has the potential to be superior in terms of scalability, we have yet to see that play out without issue.

Now, the debate about a multi-chain future, what that looks like, and what properties are required for a blockchain are beyond scope of this article.

But what I will say is that there is plenty of demand for block space and that will only grow over time. While competition between blockchains is heating up, in the short to medium term we still don’t have close to enough supply of viable block space for what's coming.

There’s plenty of room for Solana, the Ethereum ecosystem, and other blockchains to grow the overall pie together, rather than fight for market share

In the long term, I have a very different opinion, however, I will save that for another day! 😉

To wrap up, I don’t think Solana is going anywhere anytime soon.

However, I do think we need to keep a close eye on a lot of the metrics above throughout 2023 to see if they bounce back and continue Solana’s long-term trend of up only. 📈

Soon I will publish a PRO report about Polygon and the Ethereum layer 2 ecosystems and I think many will be surprised at its performance throughout this bear market, especially versus the Ethereum and Solana numbers shared above.

But you’ll only get it if you go PRO because this is the last free report we’ll be creating!

So, if truly understanding web3, cutting out the noise on crypto Twitter, and staying on the forefront of the space is important to you, PRO is a must-have resource—just ask the 100+ DOers who are already leveling up in web3. 👀

Not only will we do the heavy lifting (aka on-chain analysis) for you, but you’ll also get to lean on industry experience and insights from myself and the Web3 Academy team.

So don’t miss your chance to go PRO with a whopping 50% lifetime discount for the next two days only!

You’ll likely never see a price this low (or even a discount) for a long, long time. 🤷

Note: If you’re not logged in, Substack might need your email before you can sign up!

By the way, as a PRO member, you can comment on the post below to share feedback, ask questions, or ask the PRO team to do an on-chain analysis on your favorite business or web3 project.

Thanks to Saska and the Phaver team for pointing out a mistake in the Lens comments last week, we are all learning together. Please continue to criticize and provide feedback on our work, that is how we all learn!

See you in the next one, frens! ✌️

Kyle Reidhead

Founder of Web3 Academy and Impact3

Find him: Twitter

Kyle Reidhead