W3A PRO | $LOOKS vs. $BLUR vs. $X2Y2 Tokenomics

The Sustainability of NFT Marketplace Tokens

GM PRO DOers!

Token 👏 Incentivized 👏 NFT 👏 Marketplaces 👏

That was the theme in last week's PRO report (and in the recent NFT marketplace war).

Launch a token and pay users to use your platform. That seems to be the best way to dethrone Opensea’s dominance in the NFT marketplace war so far.

While its effectiveness is up for debate, considering the amount of wash trading and airdrop farming it creates, the next questions are…

Are these tokens sustainable? Do they accrue value from the marketplace?

…Or are they just a short term tool used to vampire attack the NFT market? 🧛🏻♂️

These questions and more are what we will uncover in today's report.

We’re exploring the tokenomics of the 3 largest NFT marketplaces with tokens: LooksRare, Blur and X2Y2.

If you need a refresher on tokenomics, check out our past PRO report titled “The Greatest Tokenomic Design in Web3”

Also, if you’re a new PRO member, make sure to read last week's report for a backstory on the NFT marketplace wars.

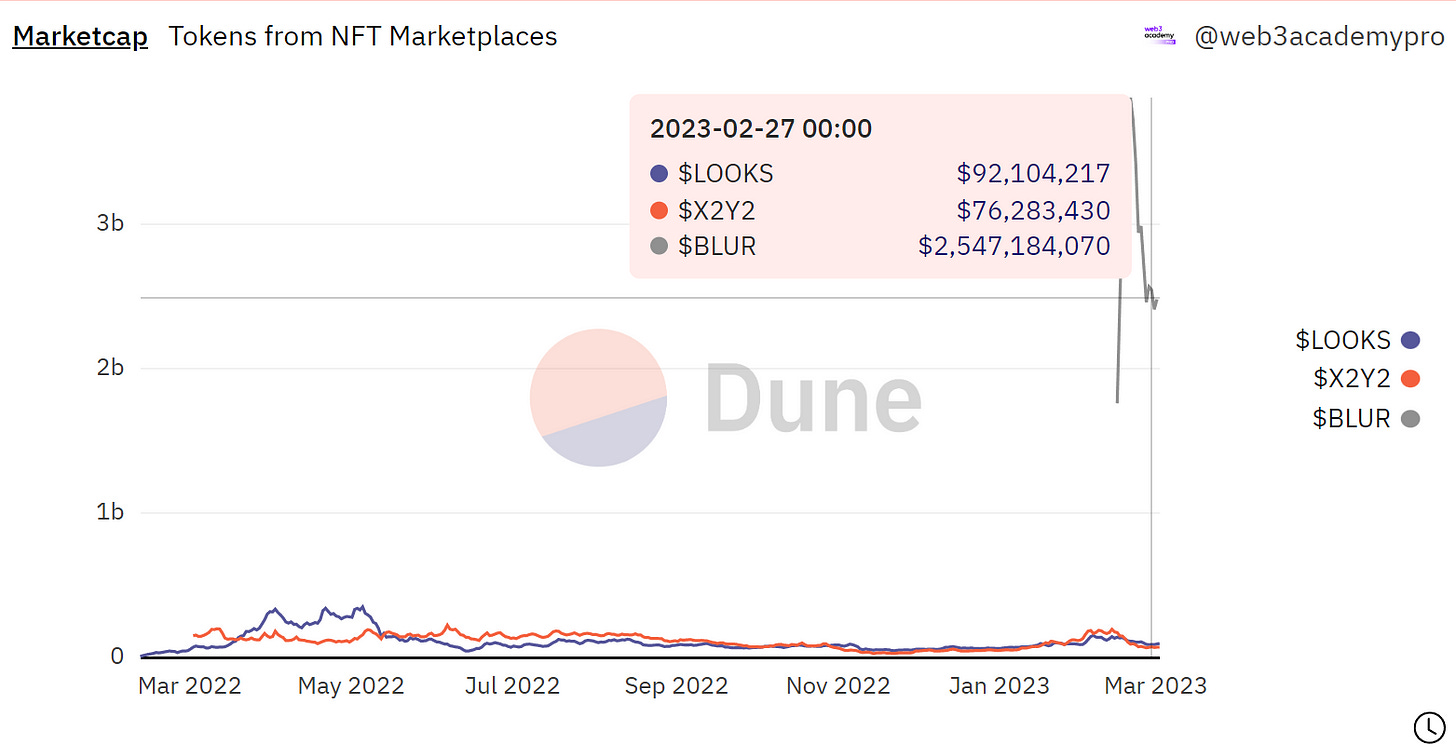

Let’s start off with a bit of context around each token's performance since launch, just to get our feet wet.

NFT Marketplace Token Performance

$LOOKS launched first back in January 2022 and went as high as $6, as low as $0.11 and at the time of this writing sits at $0.19.

$X2Y2 was next, launching in February 2022 and went as high as $4.14, as low as $0.028 and at the time of this writing sits at $0.074

And finally $BLUR, which launched just recently on February 14th, 2023. We don’t have much to go from here but it started as high as $5.02 and quickly fell to a low of $0.48 and currently is sitting at $0.78.

LOL. Doesn’t look too good for these tokens, does it? Maybe we should end the report here… 🤷

I’m kidding, this type of volatility is common in crypto, but even more so in tokens that start with an airdrop.

Why?

How Do You Value a Young Crypto Project?

First of all, these are businesses that are 1 year old or less, built on top of technology which is only a few years old, which are attempting to be priced based on an open and global market, mainly by young retail NFT trader degens from their parent’s basement.

Of course it's volatile!

So stop trying to value this shit in the short-term, it's impossible. Instead, look at its mechanics to see if in the long-term the token can accrue value or generate more buyers than sellers. That’s the goal of a sustainable token. 🌱

Furthermore, when it comes to airdropped tokens, you should expect that a large % of people are going to sell the tokens for something more stable that can be used as money elsewhere (ETH, BTC or Fiat Currency).

That is, unless the token provides other forms of value (aka utility) to the holders that would give them a reason to hold or buy more of the token.

This breakdown, however, is not meant to be used as financial advice. It is only meant to illustrate the dynamics of a token to see if it can be a useful tool for the business and its users.

Before we move forward, I just want to share one quick piece of information for those that are new here. When looking at a token's value, it’s more useful to look at its market cap, rather than its price.

This can give you a much better idea of its overall value and a relative comparison amongst other tokens and businesses. ⚖️

Below are the fully diluted market caps of the 3 tokens (aka the value of all of their tokens combined). Notice anything odd here? I’ll explain more below.

Tokenomics Of $LOOKS

Here’s how we’re going to do this. I’m going to outline the supply, issuance and demand (utility) dynamics of each token and then provide my thoughts on its sustainability.

For those new to tokenomics, I will do my best to define and explain in simple terms as I go.

Supply of tokens:

✅ Max Supply = 1,000,000,000

This is the max supply of tokens that can ever be minted.

✅ Total Supply = 846,206,640

This is the total supply of tokens that are minted.

✅ Circulating Supply = 544,846,570

This is the amount of tokens which are available on markets to be bought or sold.

Looking at circulating versus max or total supply is very important in understanding the sustainability of a token’s price.

Generally speaking, the fewer tokens currently on the market, the more sell pressure is coming when the locked tokens are released (via airdrops, released to investors, issuance, etc.).

Again, the key to a sustainable token is balance between supply and demand. If more tokens are being put on the market, there needs to be a reason for those people to hold the token, or more demand for others to buy the token.

Otherwise, its price is likely going down (see price charts above for real examples of this).

Market Cap:

✅ Market Cap = $105,224,037

This is the value of all the tokens in circulation (Current Token Price x Circulating Supply)

✅ Fully Diluted Market Cap = $193,125,998

This is the value of all the tokens that can be minted (Current Token Price x Max Supply)

Keep in mind that these numbers are volatile and constantly change. If you read this report a few hours after release, it’s likely the numbers are different.

$LOOKS Utility

A token can have various forms of utility. If we remember from the ETH tokenomic design, it is used as gas to pay for transactions on Ethereum, as a currency across the ecosystem, collateral in DeFi (since it has the lowest risk of any token) as well as used to stake and run a validator to secure the blockchain.

The key to understanding a token's utility is to determine all of the reasons someone might want to buy and/or hold the token. Let’s look at what the $LOOKS token offers. 🔍

Like most tokens in crypto, $LOOKS provides 0 ownership or shares in the LooksRare protocol or business. Here is what is explained on the LooksRare website:

This is something I think most crypto investors, especially those who are new to the space, don’t quite understand. Generally, these tokens aren’t giving you much!

Governance is another common utility of a token. However, $LOOKS does not yet have any governance with their token, but it could potentially have in the future

That’s the other key thing to consider with sustainability of a token. It’s not just about what the token offers now, it’s also about what potential features it could have. Of course, this is speculative, but it’s a protocol that’s still only 1 year old.

Therefore, we need to give these things time to get built out.

For example, ETH only just recently launched the burning of its token and significantly reduced its inflation with the PoS merge. It took 7 years to build out a favorable tokenomic design!

So does $LOOKS have any utility at all? Why would anyone buy or hold this token right now?

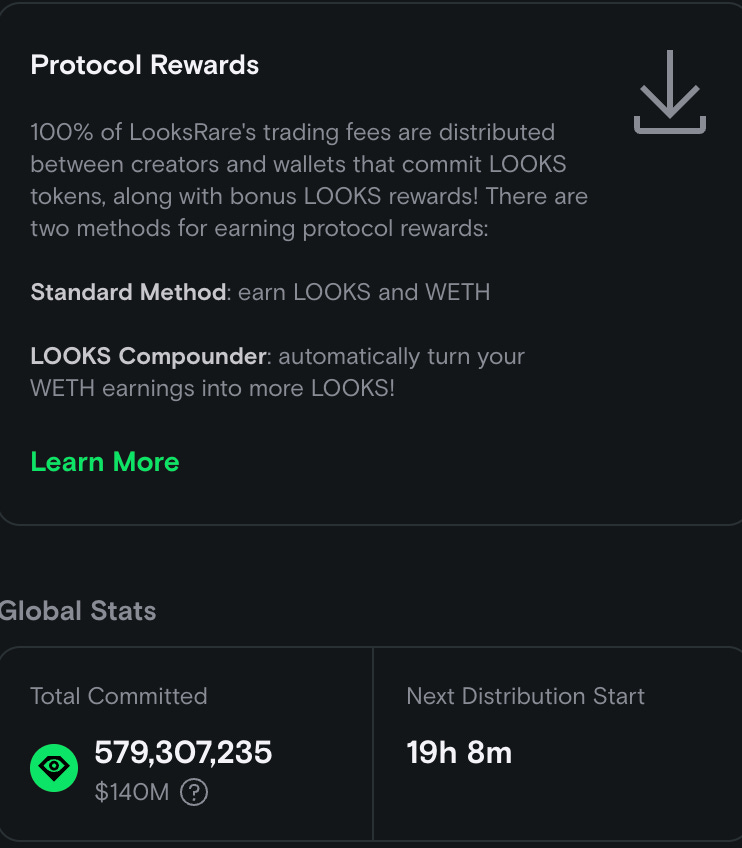

Currently, $LOOKS’s only utility is that you can stake $LOOKS to earn more $LOOKS tokens. The $LOOKS rewards come from 2 different places:

100% of trading fees on LooksRare are distributed between creators who receive 25% and then the remaining 75% to those who “commit” (aka stake) $LOOKS tokens.

Stakers also receive $LOOKS from new issuance of $LOOKS tokens. To be clear, this isn’t creating net new tokens like ETH issuance for example, it is instead moving locked tokens (max supply) into unlocked tokens (circulating supply).

There is no other utility to the $LOOKS token currently other than staking. More on all of this in a second.

$LOOKS Issuance

Issuance is essentially the schedule of tokens being put into the circulating supply to be bought or sold. More tokens moving into circulating supply without an increase in demand for the token generally means bad things for its price and overall sustainability.

It’s important to find a balance between buyers and sellers over time. ⚖️

I mentioned above about the issuance of tokens for stakers and, of course, the big issuance from the airdrop at launch, but you also need to think about the investors, team, treasury and others that may be receiving tokens over time.

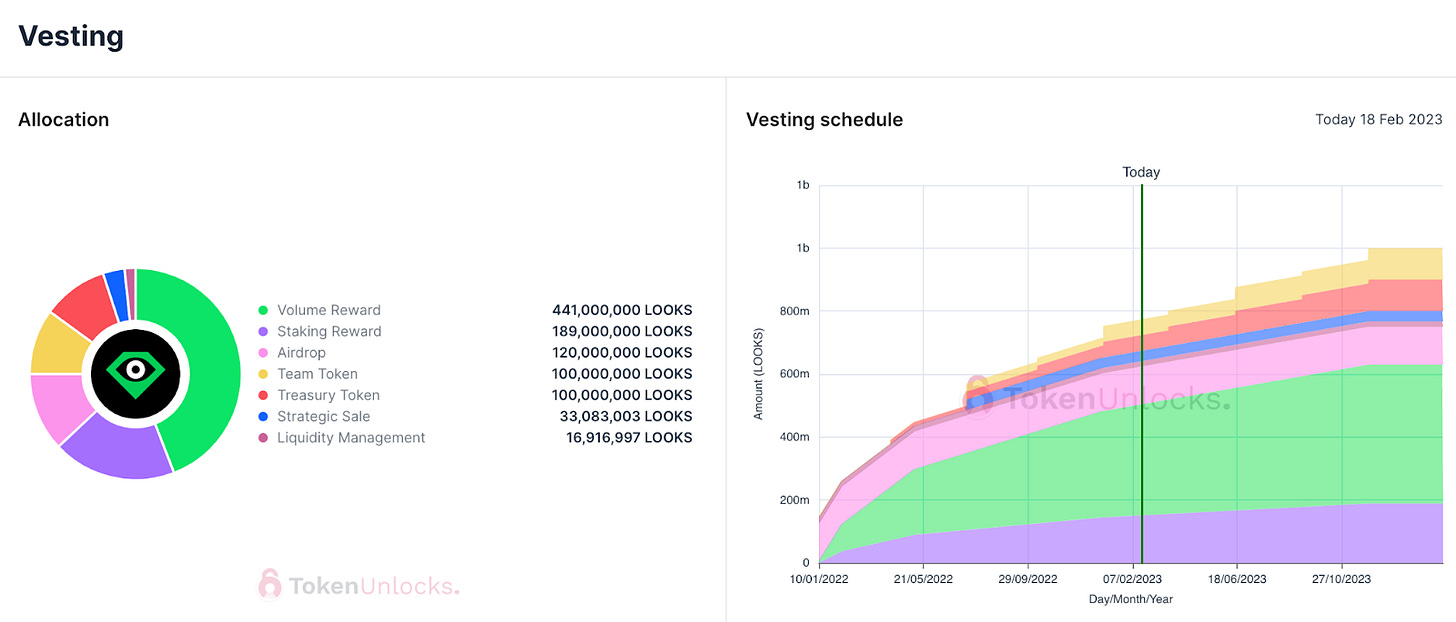

You can see the timeline and allocation of the $LOOKS token below.

We’re about half way through the timeline for all $LOOKS to be put into circulation.

$LOOKS Sustainability Thoughts:

It’s never a good thing when the only form of utility of a token is to create more tokens.

This is the epitome of what creates an inflationary death spiral of a token’s price.

To be fair, there are two forms of earning $LOOKS from staking.

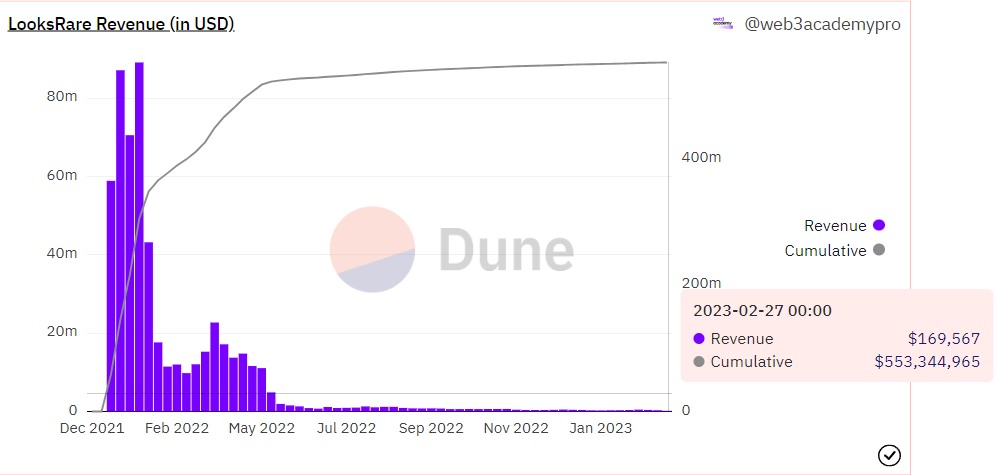

The first form would be sustainable, as it comes from revenues (trading fees) of the protocol itself. This is a very smart business model. However, as we saw from last week's report, NFT marketplace fees are likely going to 0. So will this model even continue in the future?

We can already see LooksRare’s revenues from trading fees diminishing significantly.

With recent news, why would someone trade on LooksRare and pay a 2.5% fee when they can do it for free on OpenSea or Blur? When we look into the potential utility of tokens, we need to look at what utility can/will be removed, too.

The second form of earning tokens is NOT sustainable. It’s a short term gimmick to move tokens off the market (via staking) and in return put more tokens on the market (via rewards issuance).

I’m not saying this is a bad thing, as it helps incentivize users and distributes tokens to the community for decentralization purposes down the road. I’m just saying it’s not sustainable.

At some point there will be no more tokens left to release, unless they inflate their supply.

If fees go to 0 and all $LOOKS rewards are released, which will occur in about 1 year from now, what’s the point in staking? The only reason to buy $LOOKS currently is going to be extinct within the next year.

So what creates demand for $LOOKS tokens moving forward? Before we discuss this further, let’s first review the rest of the tokens.

Tokenomics of $X2Y2

Supply:

✅ Max Supply = 1,000,000,000

✅ Total Supply = 595,049,996

✅ Circulating Supply = 207,382,539

Market Cap:

✅ Market Cap = $15,442,733

✅ Fully Diluted Market Cap = $74,464,964

$X2Y2 Utility

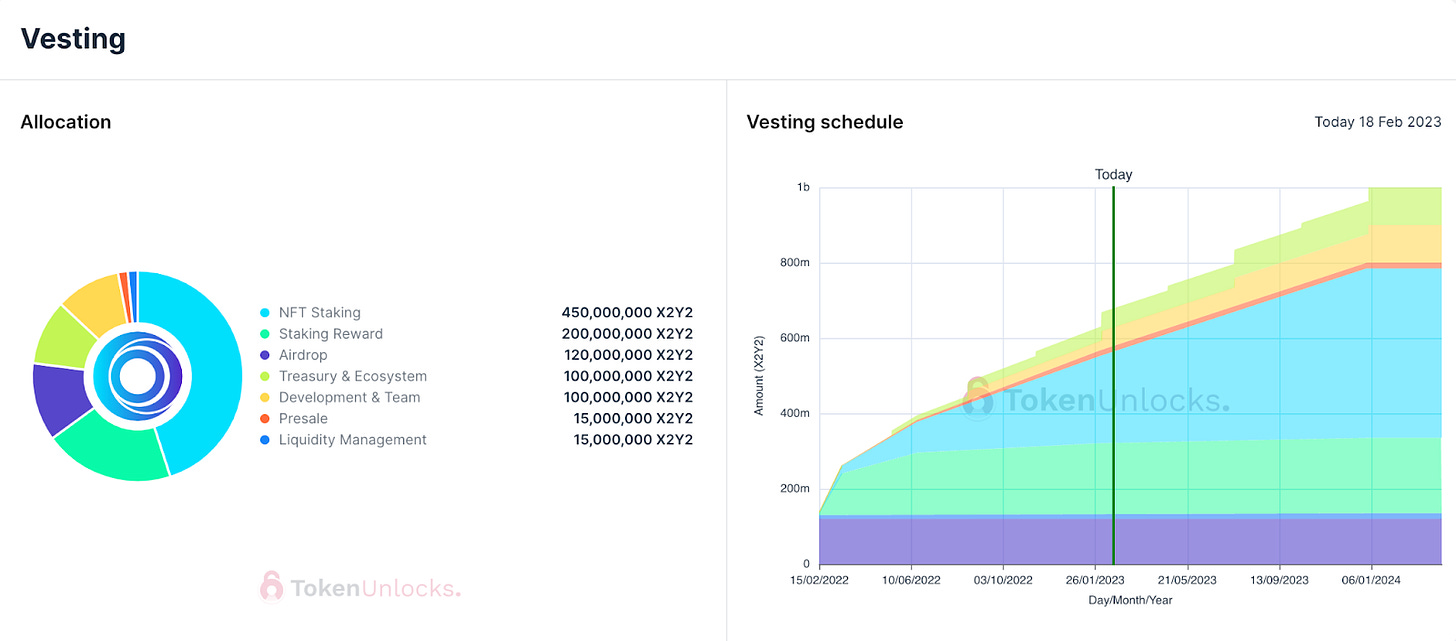

$X2Y2 is essentially a fork (copy) of $LOOKS, with some changes to the allocation amounts, rewards, etc. Ultimately, the utility is the same as $LOOKS in terms of no ownership, no governance (yet) and the ability to earn $X2Y2 tokens if you stake.

There really isn’t much to add here in terms of utility so let’s move on.

$X2Y2 Issuance

Again, not much to uncover as it’s very similar to $LOOKS. Below is the allocation and timeline chart for $X2Y2.

$X2Y2 Sustainability

See above in the $LOOKS sustainability section.

Tokenomics of $BLUR

Supply:

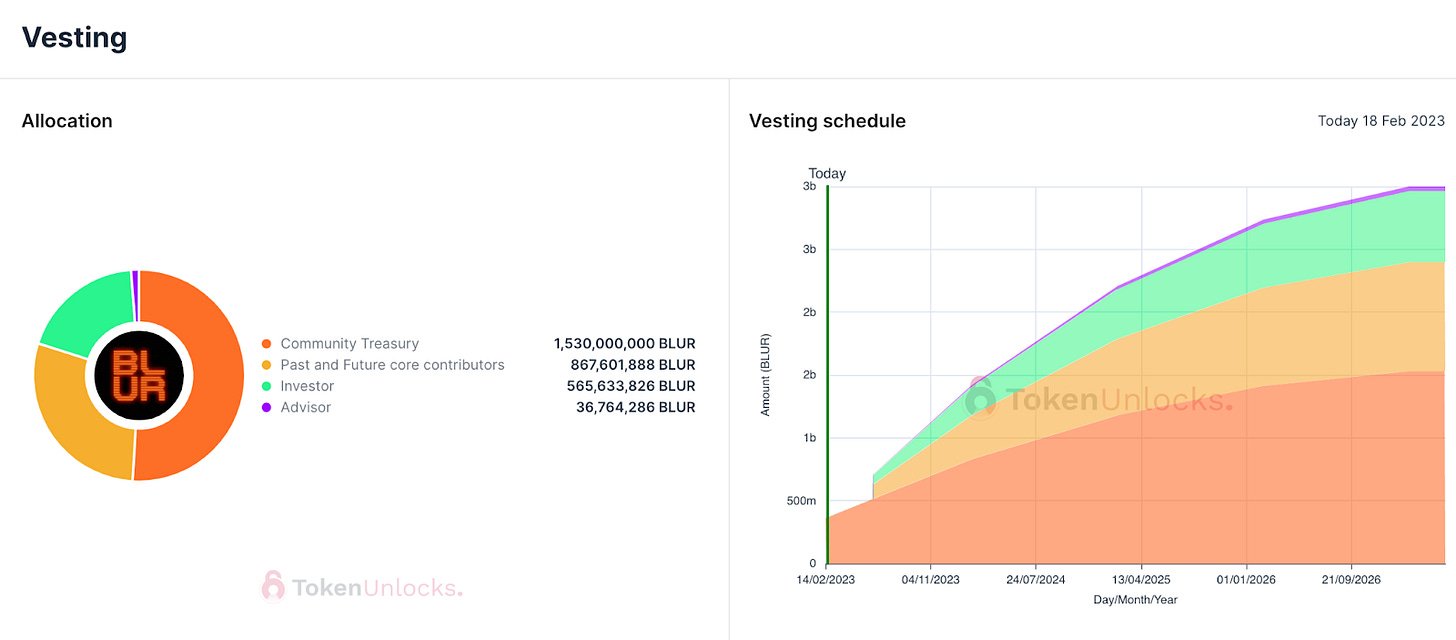

✅ Max Supply = 3,000,000,000

✅ Total Supply = 3,000,000,000

✅ Circulating Supply = 396,973,334

Market Cap:

✅ Market Cap = $312,060,913

✅ Fully Diluted Market Cap = $2,358,301,320

$BLUR Utility

$BLUR is only a couple weeks old at this point, so expectations on utility should be limited. That said, what Blur did differently to the others is it provided governance and formed a DAO (Blur DAO) immediately.

The DAO will have a say in key decisions related to the protocol's value accrual and distribution.

The team also states that $BLUR could eventually be used to reward users for paying creator royalties, but none of this is a guarantee. Also, in terms of rewarding users, that’s great for creators, but again, it’s just creating sell pressure to the $BLUR token.

It does not add a reason for anyone to buy or hold the token (though governance does).

$BLUR Issuance

At the moment, there is very little of total $BLUR tokens on the market. This means that with any increase in demand (whether that be for speculation or otherwise), the token is prone to extremely volatile price changes.

At the same time, this also means that over the coming years there will be plenty of new tokens released into circulation.

For the price to remain, Blur will need to create some additional form of demand for the token or it will end up in the same place $LOOKS and $X2Y2 are 📉 (see the market cap comparison above).

The only somewhat interesting difference between Blur’s token allocation versus the others is that they are not providing ongoing rewards from staking, outside of the airdrop rewards.

Instead, the bulk of their tokens are going to two things:

A community treasury, which my assumption is that it will be governed via $BLUR token holders in the future. 🤝

Community distribution, which seems to be aimed at incentivizing liquidity on the platform. This is Blur’s main strategy, rather than incentivizing transactions like LooksRare and X2Y2 have done.

Technically, LooksRare and X2Y2 also have a treasury of their tokens, albeit much smaller. The caveat to all of this is that the token must retain value for that community treasury to be worth anything.

The LooksRare and X2Y2 treasuries have depreciated in value big time in the last year as they consistently released tokens without creating any new demand (again, see price or market cap charts above).

$BLUR Sustainability

Launching a token and immediately giving governance to the holders is a great way to encourage their users to hold onto the $BLUR token. The question remaining is, how many people really care about governing a protocol which has no revenue?

Even if it did have revenue, there is no guarantee it would share that revenue with token holders.

In the last few months Blur has grown in market share across all NFT metrics and is becoming a strong competitor to Opensea. The question is how much of that activity has come as a result of airdrop farming?

Likely lots, albeit much less than LooksRare or X2Y2, so I think Blur’s success as a platform is here to stay, at least for the short to mid term.

In terms of governance tokens holding in value, we have plenty of examples to pick from across crypto. The most prominent being $UNI, the governance token for Uniswap, the largest decentralized exchange in the space.

The $UNI token does not accrue value from the fees that the protocol earns and is used exclusively for governance purposes, the same as $BLUR, currently.

$UNI has a market cap of ~$5 Billion at the time of this writing, and is the 19th most valuable token in crypto, so it’s done a great job at retaining value over time (in crypto terms). That said, Uniswap as a protocol generates $2.67 Million per day in fees on average, making it the second highest earning protocol in crypto.

At any moment, Uniswap could turn on the switch to share this revenue with $UNI token holders, which is likely why Uniswap’s market cap is so large.

While $UNI is holding its value due to governance, in addition to speculation on a potential rev share, $BLUR may be the same. However, we need to speculate that Blur remains relevant, that Blur can generate revenue and then that Blur will share that revenue with token holders.

For now, that’s a bit of a stretch.

In the short-medium term, I see no reason for this token to gain or even retain its value… However, that doesn’t mean it won’t.

Again, it has a fairly small circulating supply, so anything can happen in a speculative market. My reasoning is based purely on the dynamics of its token.

So What’s the Point in These Tokens?

You might be wondering, if these tokens don’t represent any ownership and don’t have any utility (in terms of $RARE and $X2Y2), what’s the point in having a token?

It’s a great question. Are we just creating speculative ponzi schemes for no reason? If that’s the case, tokenizing businesses is probably not here to stay.

However, there are short and long-term reasons why tokenizing a business makes sense.

Below I will break down the reasons for using a token as well as what the NFT marketplaces might do next to create demand for their token.

Why Token?

👉 Tokens are used to print money out of thin air to reward investors, core contributors, and early adopters

By the way, this is not a bad thing. This is how equity works in the traditional world as well, however, it’s just not available on public markets from day 1 like tokens are.

👉 If the token becomes successful, the token provides a large treasury for the protocol or business.

Remember, just because $BLUR’ market cap is over $3 Billion, it doesn't mean the treasury actually has access to all of that capital. There needs to be someone on the other side of the trade to buy that much $BLUR.

In other words, to access that capital they need to create demand for the token.

👉 Tokens are used to decentralize a protocol or provide governance to the community. The idea is to get the tokens into the hands of those who actually use the protocol and benefit from it.

That way, they may choose to hold the tokens to vote on the direction of the platform they are building on or use to make $$ on (ie. creators, traders, etc.)

Imagine all creators and users of Instagram held the $GRAM token and we could all vote on changes, updates and other parts of the technology. That would undoubtedly be a valuable use of a token.

This is what Blur is hoping occurs with their latest airdrop.

👉 At any point, the protocol is able to share revenue with the token holders. Just because they aren’t now doesn't mean they won’t. To be honest, they shouldn’t share revenue in the beginning until they have solid cash flows.

This is the same in traditional markets when companies begin to provide dividends to shareholders once they have an established business. It makes no sense to do it early on when you have little revenue or are operating at a deficit.

Again, imagine that Instagram shared a % of its ad revenue to $GRAM token holders. Creators who are building their business on the back of Instagram (which is in the millions right now) would have a say in the direction of the platform and earn a cut of the revenues.

Of course, this would create a strong reason to buy and hold the $GRAM token.

👉 Tokens can be used as rewards for loyalty within the ecosystem. Those with a certain amount of tokens could access certain features, events, or content. You can use this to gamify use of the platform (a growth tool) as well as a means to create community and a “stickiness factor” (a moat) for your business.

Think about how Elon is using Twitter Blue to provide additional features for paying subs. You could use your token in a similar way or use it to provide a discount.

What’s Next for NFT Marketplaces and Their Tokens?

At the moment, it’s clear that all 3 of these tokens don’t have enough reasons to generate demand to sustain long-term (especially $LOOKS and $X2Y2). Price movements in these tokens currently are purely speculative, with gravity pushing it to the downside.

Why?

Because unlike a strong token like ETH, which has demand and a burning mechanism of tokens to accompany speculation, these tokens only have a selling pressure, with people eager to sell their airdropped goods.

Again, this does not mean they won’t go up, as most people do not understand these dynamics and will simply speculate. In crypto, and especially in smaller cap tokens like these, narrative is everything!

But in terms of a sustainable tool for a business, they are not that (yet).

That said, there is some real potential that these tokens can be extremely valuable in the long-term. It’s obvious that the adoption of NFTs and the ability for them to be traded on a marketplace is trending upwards.

This technology is going nowhere but up for many years ahead. 🚀

The big elephant in the room, however, is the question of: “How do these marketplaces generate revenue from their users?”

It’s unclear if trading fees ever become a thing again. My assumption is they will not. This means that NFT marketplaces will need to find new revenue streams.

They could launch ads, however, at the moment we are nowhere near enough users for this to make sense.

They could also launch a premium tier whereby paying subscribers gain access to certain features (seems to me the most likely option).

Regardless, other than fighting for market share, this is the next big hurdle for marketplaces to figure out. Token holders will need to hope that the protocols are interested in sharing those revenues with them, because even if they do figure out a path to generate revenue, the token holders are not owed any of it!

I think the other obvious next steps for NFT marketplaces is to turn their tokens into a governance token, like Blur, while using the token to create a loyalty program.

There is absolutely no user loyalty in the NFT marketplace wars currently, so these tokens could be used as a tool to solve this problem. Though again, they need to find reasons for people to buy these tokens outside of speculation.

Otherwise, using a token with nothing but downwards pressure could be fatal for a loyalty program.

It’s going to be extremely interesting to see how this all plays out. My assumption is that things happen very quickly, and of course, Web3 Academy will be here to keep you on your toes every step of the way!

As a final note and as a bit of a disclaimer, I do not hold any of these tokens currently. I was airdropped the LooksRare token in 2022 and sold it immediately (thankfully).

I have no interest in buying any of these tokens at the moment as there are too many unknowns for all of them.

There is a lot of excitement around Blur and its token right now. Don’t get caught up in the FOMO. While Blur looks to be a very innovative marketplace, and its activity is booming, we’re unsure how much of this is just airdrop farming (my assumption is that a lot of it is).

Understand that all movements in prices in these tokens are completely speculative and have no fundamental component to it (for now).

Thanks, friends.

I hope this breakdown helped you understand tokenomics and how to break down the viability of a token.

See you in the next one!

ABOUT THE AUTHOR

Kyle Reidhead

Founder of Web3 Academy and Impact3

Find him: Twitter

🟣ACTION STEPS

CLAIM

All PRO members who submitted the Kazm Form before Monday, have been whitelisted for Lens Protocol.

Simply click here to claim your profile. You need to connect your wallet first.

COMPLETE

As a PRO, you’re entitled to your PRO/FOUNDERS Pass, which unlocks different perks & benefits across the web3 ecosystem.

We airdrop these passes each Monday & Thursday. To get yours, make sure to fill out this Kazm Form!

If you already hold your Pass, make sure you head to Discord to unlock access to the exclusive PRO channels!

ATTEND

If you’re in or around Cleveland, USA at the beginning of May (1st-3rd), we recommend you attend the Creator Economy Expo!

Kyle will speak at the event and we secured a $100 discount for all of our PRO members!

To grab your discount, head here and apply 'W3A100' at checkout.