The DeFi Den Weekly Ride #001

Polygon and BNB Upgrades, LSDFi booming, DEXes launching and more!

GM GM! Welcome to the first edition of DeFi Den! We are currently experimenting with the format but we will focus on a few key sectors:

Blockchains

Liquid Staking Derivatives Finance (LSDFi)

Real World Assets (RWA)

Decentralized Exchanges (DEXes)

Polygon 2.0 introduces a network of ZK-powered Layer 2 (L2) chains unified by a cross-chain coordination protocol.

The network will provide the experience of using a single chain while supporting an unlimited number of chains.

Cross-chain interactions will be safe, instant, and without additional security or trust assumptions.

The aim is to achieve unlimited scalability and unified liquidity within the Value Layer.

Over the coming weeks, Polygon will provide more details will be provided:

Key Feature: Over 4000 transactions per second with the average cost of below 0.005 USD per transaction

EVM-compatible layer 2 chain based on Optimism OP Stack, enhancing BSC scalability while maintaining affordability and security.

Optimistic Rollups reduce computational load by executing transactions off-chain and posting data on-chain as calldata, improving scalability.

Testnet Launch: June 19, 2023

Validators and dApp Builders are invited to participate in the Testnet and provide feedback. (Airdrop maybe?)

Aim: Smart contract platform with a focus on decentralized finance (DeFi)

It will utilise a Layer 2 rollup model and publish state roots to the Ethereum mainnet for network security.

Key Feature: Decentralized Sequencers

Decentralized sequencers are responsible for ordering transactions in batches.

The selection of sequencers will be determined by a governance vote, creating a decentralized sequencer base.

In case of a sequencer shutdown, the next elected sequencer will continue from where the previous one left off.

Governance of Fraxchain: Frax Shares (FXS) token holders

Transaction Fees: Frax stablecoin and Frax Ether (liquid staking derivative)

Fees Distribution: May be burned or redirected to the Ethereum mainnet for distribution among FXS stakers.

Expected Launch: End of 2023

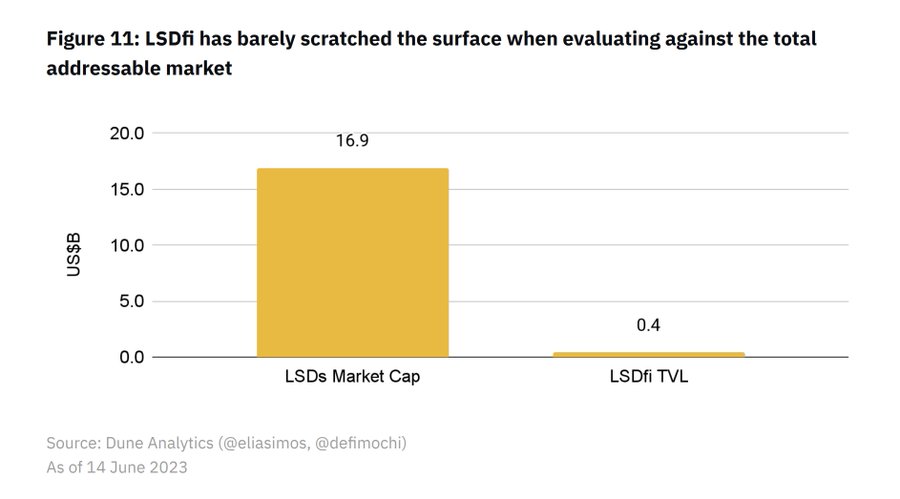

Binance recently released a report on liquid staking derivatives finance, where they cover the massive untapped potential of LSDFis and the few DeFi protocols currently building on the various staked ETH.

We are just scratching the surface of the TAM of staking ETH. Currently, only 17.9% of ETH is staked, leaving around $17 billion of ETH idle. With liquid staking adoption expected to increase with greater staking participation, this will only grow. On top of that, LSDFi's TVL is a mere 2% of the total LSD market cap, there is plenty of room for growth and for DeFi protocols capitalize on this space.

https://research.binance.com/en/analysis/lsdfi-when-liquid-staking-meets-defi

Here's a list of the current LSDFi projects:

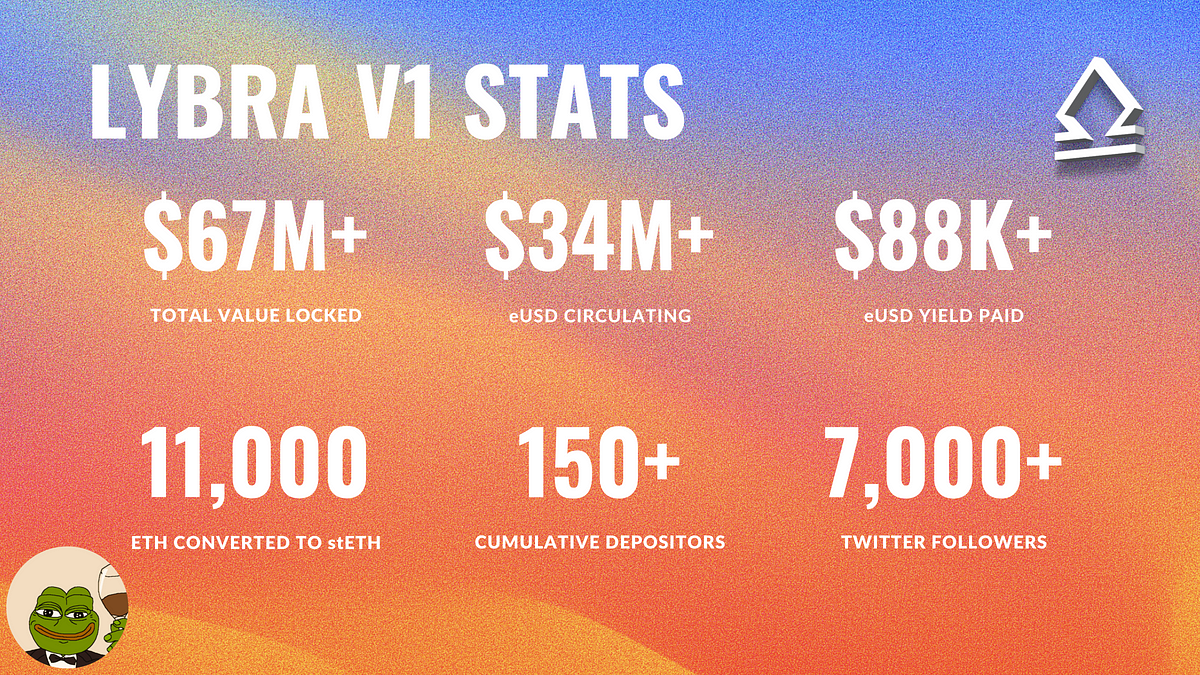

Market leader: @LybraFinanceLSD

Lybra offers collateralized borrowing, where users can deposit ETH or stETH and borrow eUSD, repaying the debt at a later date. Additionally, by using stETH as collateral, which is an LSD/LST asset that generates interest, Lybra Protocol can provide interest back to eUSD holders. This means that holding eUSD alone generates a stable income with an approximate APY of 8%.

With V2, users can deposit a wide range of LSD/LST assets as collateral, including rETH, stETH2, wBETH, swETH, and tapETH. Additionally, integration with LayerZero to enable bridging to Arbitrum. Lastly, the introduction of weUSD to enhance DeFi compatibility and pave the way for potential partnerships in perpetual trading platforms and increasing eUSD adoption.

What does this mean?

LSD holders can look forward to more use cases and further defi composability for their tokens. LBR can be reconsidered as a hold when V2 is nearing live as they will be focusing on making the token deflationary.

Warbler Labs, a contributor to Goldfinch, and Cerchia, a decentralized risk transfer provider, are collaborating to reduce the widening protection gap and connect investor capital to attractive investment opportunities. A key aspect of their partnership involves the potential launch of a lending pool that is fully collateralized with reinsurance instruments, a first-of-its-kind offering.

What does this mean?

Asset tokenisation is expanding beyond its initial stages of just providing loans to crypto market makers and now deeper into more traditional assets. As we continue to blur the lines, this is one of the key ways which we see the crypto markets mature and grow beyond speculative trading.

Along with the official launch of their DEX, Vela is giving away the Official Launch Vela NFT (4th edition) with 2 requirements to claim:

1. Attend their upcoming launch AMA [Details soon!]

2. ??? (we will stay alert and update you if we see anything!)

On top of this, they are partnering with @Vaultkaofficial for their users to access 3x Leverage vault on their VLP token.

Twitter Spaces [20th Jun - 4:30 pm (UTC)]: https://twitter.com/i/spaces/1yNGaNBMkRQJj?s=20

Aevo has officially launched on mainnet and is allowing BTC and ETH trading on their platform, including both options and perpetual futures with various expiry periods (daily, weekly, monthly and quarterly).

Snapshot: They will be conducting a snapshot of new users over the next two weeks. Trade during this period for a potential reward.

What does this mean?

For these DEXes, you can consider trading on them and keeping a lookout for any new tweets regarding potential airdrops with regards to their NFT and snapshot dates.

The DeFi Den Weekly Ride #001 was brought to you by YPSONO.

.png)