The DeFi Den Weekly Ride #003

Building on mSOL, Pendle Finance token listing and Velodrome V2

GM! Today we will be covering 2 large defi protocols and a recent development in Solana that can attract users back to the ecosystem with high yields! Lets dive in!

Spotlights

Pendle Finance: Listing on Binance

Pendle Finance is a relatively up and coming defi protocol in the LSDFi space which I included in the first newsletter, link here. As of yesterday, Binance announced that they will be listing their token $PENDLE in their Innovation Zone.

More Information: https://www.binance.com/en/support/announcement/binance-will-list-pendle-pendle-in-the-innovation-zone-56c9c5899f3747b2b9a0452450f5eb24

In light of that, lets take a look into Pendle Finance and their upcoming V2 which is launching in Q4.

Pendle AMM V2 Upgrades

The new model incorporates the Principal Tokens (PT) and Yield Tokens (YT) on a single pool of PT liquidity. This results in deeper liquidity and increased protocol revenue.

Pendle AMM V2 introduces two significant improvements: Concentrated Liquidity and Dynamic Curve.

Concentrated Liquidity: enables capital efficiency up to 70 times by providing a predictable yield range.

The Dynamic Curve: automatically adjusts PT and YT prices as they approach maturity, allowing traders to focus on interest rate changes rather than individual asset prices.

In terms of IL, it's minimized as Liquidity Providers (LPs) supply PT and its closely correlated yield-bearing asset. Moreover, the maximum IL is deterministic, further protecting LPs.

💰More revenue sources for LPs

LPs have four revenue streams: fixed yield from PT, yields from yield-bearing assets, swap fees from PT and YT trades, and PENDLE incentives.

EIP5115: Standardized Yield (SY)

The updated model brings EIP5115: Standardized Yield (SY), which wraps all yield-bearing tokens with SY, providing a single standardized yield interface. This encourages composability and allows developers to instantly access a yield-bearing token’s yield. Furthermore, Pendle V2 expands to multi-chain capability, integrating both LayerZero and Kyber Network.

📈$PENDLE Upgrades

The updated tokenomics includes vePENDLE which is designed to distribute swap fees to the pools voted by vePENDLE lockers. A fee of 3% from all yield accrued via YT is distributed pro-rata to all vePENDLE holders. vePENDLE holders can also vote for the allocation of liquidity incentives to different pools, collectively earning 80% of that pool’s swap fees.

Research summary by Binance: https://research.binance.com/en/projects/pendle?ref=AZTKZ9XS

What does this mean?

With an upcoming major listing and v2 to look forward to towards the end of the year, we can really expect $PENDLE to continue to perform. Do watch out for a dip on the news and when it is listed due to "sell the news" effect.

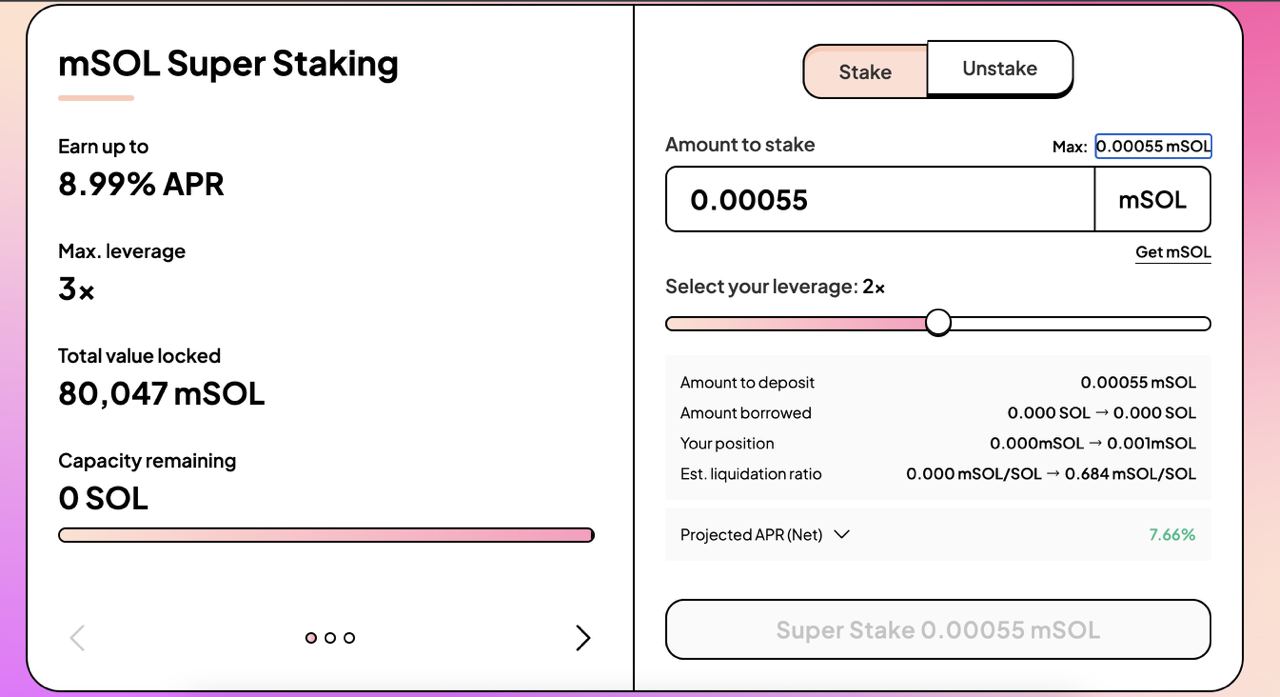

Super Stake: mSOL Leverage Vaults

💰 Super Staking SOL up to 15% APY!

We have all heard liquid staking of ETH and the insane adoption that has taken. I covered it briefly in the first DeFi Den newsletter and focused on Lybra Finance $LBR which has since listed on Kucoin and the token went up from $1.40 to currently $2.06 (📈~47%)

For today, we are looking at Super Stake SOL by Drift, the allow users to significantly amplify their staking returns, automating the "restaking" of one's SOL stake to enjoy yields of up to 15%.

🔑 Key Features

Super Stake SOL employs a sophisticated strategy of recursive borrowing and lending of mSOL and SOL via Drift, aiming to supercharge your mSOL staking rewards. By depositing mSOL, you can unlock a staking rewards yield of up to 15%, dwarfing the base staking APY of approximately 6.5%. Super Stake SOL utilizes the deposited mSOL to borrow SOL against mSOL up to the user's intended leverage ratio, fully automating the process of "leverage staking". One of the key benefits is that users can conveniently withdraw their mSOL from the Super Stake vault at any time without any extra fees.

⚠️ Key Risks

While Super Stake SOL brings potential rewards, it is crucial to be aware of the associated risks.

Depreciation risk: A significant decrease in mSOL price or an increase in SOL price could allow liquidators to partially close out SOL borrow positions.

Liquidation risk: A fall in staked mSOL value could lead to a liquidation event, potentially resulting in collateral being sold off.

🔮 Future Developments

Looking ahead, Super Stake SOL is focusing on further enhancing user flexibility by introducing a feature that would allow users to adjust their leverage while they are staked.

🎁 Promotional Period with Super Stake SOL

Marinade and Drift have joined forces to co-sponsor an exclusive promotional campaign. For a limited period of two weeks, initial depositors on Super Stake SOL stand a chance to be awarded up to a whopping 125,000 MNDE.

What does this mean?

If you ever considered to own $SOL and gain any exposure to their ecosystem, this is a good way to further leverage your exposure. Just be careful of potential liquidation and you will be fine.

Velodrome V2: Key improvements and what's next

🔑 Key Features

A significant improvement is the ability to customize pool fees (up to 1%) and names, providing greater flexibility to users. Creating a position in a liquidity pool is now more accessible, with the ability to deposit just one of the pool's tokens.

The new veNFTs come with a unique feature of on-chain dynamically generated artwork and metadata. Velodrome V2 allows veNFTs to be set in a maximum 4-year lock state and offers Managed veNFTs that operate like a vault, serving as a foundation for reward-compounding products. Transferability of V2 veNFTs is improved as well, with the ability to reset, transfer, and use them for voting in the same epoch.

The Velo FED feature comes into play when VELO emissions drop below 6m per epoch, allowing veVELO voters to control Velodrome’s monetary policy. Velodrome V2 also streamlined voting rewards by rewriting and simplifying the V2 gauges and rewards contracts, significantly reducing gas costs for claiming rewards. A new VELO token and veNFTs replace the current governance and utility tokens of Velodrome. The existing V1 VELO and veNFTs can be converted to V2 at a 1-to-1 rate.

🚀 What's next?

Beyond V2, Velodrome has sets its sights on the Superchain, aiming to cater to the next billion on-chain users' complex liquidity and infrastructure needs.

What does this mean?

With the latest update solidifying its position as the main dex on Optimism, their next development will be to build towards a Superchain, I liken it to DyDx and their move towards building their own chain on Cosmos. There is significant upside for $VELO holders and with more fees generated and going towards $veVELO voting incentives, there is more reason to hold $VELO and lock it up to earn fees on the largest DEX on Optimism.

Velodrome Fees Accrued: https://dune.com/msilb7/velodrome-fees

Quick Fire News

The DeFi Den Weekly Ride #003 was brought to you by YPSONO.

179

179