Centring Lived Experience in Token Engineering

Designing without assumptions

Written by Madhuri Rahman - March 2024

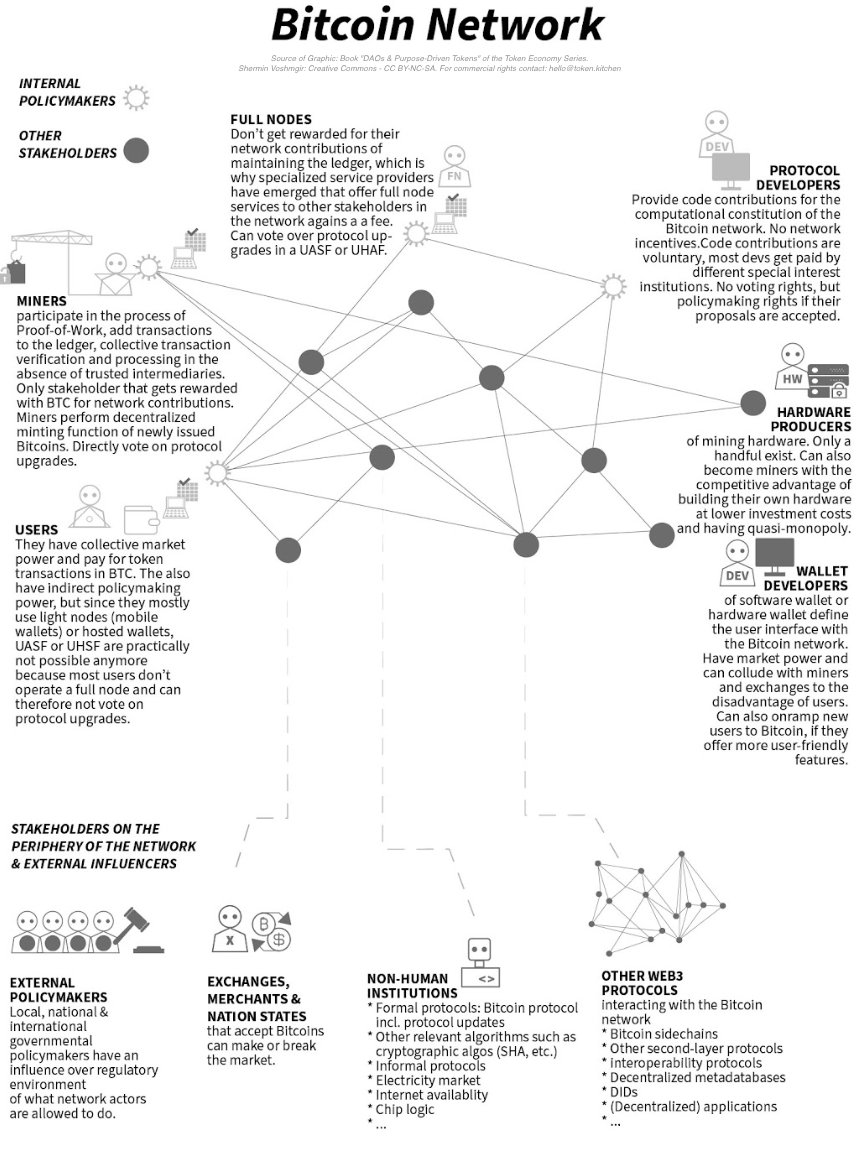

In Shermin Voshmgir's article, "Bitcoin Network Analysis," she dives into the multifaceted dynamics of the Bitcoin ecosystem, exploring its technical architecture, stakeholder engagement, and the economic and political implications that have emerged since its inception. This analysis provides a foundational understanding of how Bitcoin operates and interacts with various user groups, highlighting the complex interplay between technology and its real-world applications.

Some of the conclusions around unexpected emergent ecosystem outcomes in the article led me to reflect on the concept of "lived experience". The idea of centring lived experience is central to the diversity and inclusion space. The term refers to the personal knowledge gained by individuals through direct, daily encounters with a social or cultural dynamic. Recently, I have designed learning programmes for social purpose organisations, and I realised this concept can extend beyond traditional social purpose organisations into the realm of token engineering and broader technology design and development. In sectors that often claim goals of societal good and economic change, the role of lived experience becomes even more critical. The inclusion of individuals with lived experience is crucial in designing solutions that are not only effective but also empathetic and responsive to the needs of the community they aim to serve. The underlying theory here is straightforward but powerful: an organisation cannot fully address the challenges of a particular community without involving representatives who have firsthand experience of these challenges.

Technologies like Bitcoin, which purport to offer decentralisation and financial empowerment, must be scrutinised through the lens of inclusivity and equity. By integrating individuals who have lived through financial exclusion and instability into the design and development teams, token ecosystems can be engineered to meet the nuanced needs of a broader demographic, potentially leading to more just and effective outcomes. This reflection on Voshmgir's article serves not only as an exploration of Bitcoin's technical and social infrastructure but also as a call to action for incorporating lived experience into the fabric of technology that shapes our futures.

Including individuals with lived experiences of financial exclusion in the development team of Bitcoin could have significantly altered its evolution, creating a system that is more attuned to the needs of marginalised communities and less prone to exploitation.

Bitcoin, conceived during the 2008 financial crisis, emerged as a technological solution to bypass traditional financial intermediaries, reducing the costs and complexities associated with transactions. Its design focused on solving technical issues like the double-spending problem and ensuring a decentralised, secure, and transparent transaction environment. However, the team that developed Bitcoin primarily consisted of individuals with strong backgrounds in cryptography and software engineering, which influenced its technical orientation and priorities.

Had the development team included members who had experienced financial exclusion firsthand, the priorities in the design and implementation of Bitcoin could have been different. Such team members would bring perspectives that highlight barriers that prevent marginalised and underserved populations from accessing financial services. This could include issues such as technological accessibility, usability, and educational barriers.

For example, people from less privileged backgrounds might have emphasised the need for Bitcoin to work on low-cost mobile devices commonly used in developing countries, rather than high-end hardware. They might also have highlighted the importance of creating user interfaces that are intuitive and accessible for individuals without technical expertise or advanced literacy skills. These features could make Bitcoin more inclusive, allowing it to serve not just as a store of value but as a practical medium for daily transactions for those currently underserved by traditional banks.

Moreover, individuals from economically marginalised communities could have advocated for economic models within Bitcoin that discourage speculative hoarding and encourage the circulation of coins, which would support its use as a currency rather than just an investment asset. They might have proposed mechanisms to stabilise transaction fees or to adjust the difficulty of mining activities to ensure that the network remains accessible to individuals with less computational power, promoting a more equitable distribution of new Bitcoins.

These contributions could have extended to the governance of Bitcoin, advocating for policies that prioritise transparency, community involvement, and equitable access. For instance, they might have pushed for more democratic processes in protocol upgrades or for the inclusion of more stakeholders in decision-making processes. This could help prevent the centralisation of control and ensure that Bitcoin remains a tool for economic empowerment rather than becoming dominated by those with significant computational resources or technical expertise.

In essence, the inclusion of voices from financially excluded backgrounds in the development of Bitcoin could have shifted its trajectory from being primarily a technological experiment to a more socially-driven project. This shift could potentially have created a version of Bitcoin that is not only a pioneering digital currency but also a transformative tool for financial inclusion, directly addressing the needs and challenges of those who are typically left out of the financial system.

Ultimately, integrating diverse experiences and backgrounds into the development of technologies like Bitcoin is crucial. It ensures that these technologies serve a broader spectrum of human needs and do not inadvertently reinforce existing social and economic inequalities. By fostering inclusivity in its developmental phase, Bitcoin could have more effectively aligned with its vision of decentralising financial power and becoming a truly universal and accessible financial system.