Can we program economies to reshape markets?

An intro to the thinking behind Daylight.

In the face of global challenges like climate change and the need for sustainable energy, we find ourselves at a critical juncture. The world desperately needs innovative solutions to accelerate the transition to clean, distributed energy systems. But how do we incentivize rapid innovation and deployment in a field as messy as economics?

Advanced market commitments are an economic tool used to shepherd economic development in markets in positive directions. However, they require massive war chests of available capital, and are typically top down, run by (hopefully) benevolent dictators.

Can startups compete here? Is it possible to program economies to solve these challenges?

Shaping Markets with Advanced Market Commitments

Advanced Market Commitments (AMCs) are powerful economic tools designed to address market failures and incentivize innovation in areas where natural market forces are insufficient. AMCs are promises to buy or subsidize a product or service in the future, provided it meets certain predefined specifications. This mechanism creates a guaranteed market for products that might otherwise be too risky or unprofitable for companies to develop.

The concept of AMCs gained prominence in the global health sector, particularly with the pneumococcal vaccine AMC launched in 2007. This initiative, backed by five countries and the Bill & Melinda Gates Foundation, committed $1.5 billion to accelerate the development and production of pneumococcal vaccines for developing countries. The results were remarkable: the AMC accelerated vaccine development by 5-7 years and has since helped prevent hundreds of thousands of childhood deaths.

AMCs work by addressing a fundamental challenge in innovation: the uncertainty of future demand. For many critical global challenges, such as neglected diseases or climate change solutions, the societal benefits far outweigh the potential commercial returns. This misalignment of incentives leads to underinvestment in research and development. AMCs bridge this gap by providing a clear, credible signal that there will be a market for the product if it can be successfully developed.

The power of AMCs lies in their ability to shape future markets without picking winners at the outset. Unlike traditional grants or subsidies that fund specific research projects, AMCs reward outputs. This approach allows for a diversity of potential solutions and encourages efficiency and innovation. Companies compete to develop the best product that meets the specified criteria, knowing that there's a guaranteed market awaiting success.

AMCs can be applied to a wide range of global challenges beyond vaccines. For instance, they could be used to accelerate the development of carbon removal technologies, incentivize the creation of drought-resistant crops, or spur innovation in renewable energy storage. By providing a clear demand signal and reducing market uncertainty, AMCs can mobilize private sector resources and expertise towards solving pressing global issues.

However, implementing an effective AMC is not without challenges. It requires careful design to balance the needs of potential suppliers, buyers, and the overall goals of the initiative. Key considerations include defining the target product profile, determining the appropriate size of the commitment, and structuring the payment mechanism to incentivize both innovation and cost reduction over time.

Despite these challenges, the potential of AMCs to catalyze innovation and shape markets makes them a powerful tool in addressing complex global challenges. As we face increasingly urgent issues like climate change and emerging health threats, the ability of AMCs to align market forces with societal needs becomes ever more valuable.

Onchain Economies Democratize Market Shaping Mechanisms

Onchain economies represent a paradigm shift in how we can create and implement Advanced Market Commitments (AMCs). These digital, programmable economies offer a new frontier for market-shaping mechanisms, democratizing the ability to create AMCs and compete on economic policy design with both large corporations and governments.

Traditionally, AMCs have been the domain of well-funded entities like major foundations, philanthropies, or large corporations. The pneumococcal vaccine AMC, for instance, required the combined resources of several countries and the Bill & Melinda Gates Foundation. More recently, Stripe's Frontier initiative for carbon removal demonstrates how large tech companies can leverage their resources to create AMCs. However, these examples also highlight the significant capital and organizational requirements that have historically limited AMC creation to a select few. You need billions of dollars to even think about launching an AMC.

Cryptonetworks change this dynamic fundamentally. They provide a framework for creating programmable economies with built-in incentive structures, governance mechanisms, and value distribution systems. This programmability allows for the design of complex economic systems that can mimic and even improve upon traditional AMCs, but with several key advantages:

Lower Capital Requirements: Crypto networks can bootstrap liquidity and create value through token economics, allowing startups or smaller organizations to create AMC-like structures without the need for massive upfront capital.

Decentralized Participation: Unlike traditional AMCs which often have a limited number of buyers or funders, crypto networks can enable global, permissionless participation. This can lead to more diverse funding sources and a broader base of potential innovators.

Flexible and Adaptive Designs: Smart contracts and onchain governance allow for AMC designs that can adapt in real-time to changing conditions, market feedback, or new information. This flexibility can make AMCs more resilient and effective over time.

Transparent and Verifiable: Blockchains provides unprecedented transparency in the operation of these economic systems. All transactions and rule changes are publicly verifiable, which can increase trust and participation.

Token Incentives: Onchain economies can create unique incentive structures using tokens, potentially aligning the interests of all participants (innovators, funders, and users) more effectively than traditional AMCs.

These characteristics enable startups and smaller organizations to compete on economic policy design with both large corporations and governments. A small team with a innovative idea for an AMC can now potentially create an onchain economy that rivals or surpasses the market-shaping power of initiatives backed by major institutions.

For example, KlimaDAO emerged in late 2021 as effectively an AMC for carbon emissions. By creating a carbon-backed currency with innovative yield mechanisms, KlimaDAO aimed to aggressively acquire carbon offsets at scale. The protocol's explicit goal was to drive up the market price of carbon, thereby strengthening the economic case for investing in carbon emission abatement technologies.

This approach stands in stark contrast to traditional AMCs like Frontier Climate, backed by corporate giants Stripe and Alphabet. Frontier committed a staggering $925 million over 8 years to fund carbon offsetting projects.

KlimaDAO, as an on-chain protocol, essentially launched a competitor to this active AMC with virtually zero pre-commitments. The results were remarkable.

Within mere months of its launch, KlimaDAO had purchased nearly $100 million in carbon offsets - more than 10% of Frontier's total commitment! As of 2023, Klima's treasury holds over 24 million tonnes of CO2 in offsets. While the token price has experienced volatility, the protocol's impact on the carbon market has been undeniable. The protocol's design was clearly effective in rapidly mobilizing resources to shape a market.

This example illustrates the power of onchain economies as a capital-light business model for shaping markets and infrastructure outcomes. In contrast to traditional AMCs which are asset heavy and bureaucratic, crypto networks like KlimaDAO can achieve similar or even greater market impact with minimal upfront capital. They leverage the power of tokenomics, community incentives, and programmable money to create self-sustaining ecosystems that can rapidly scale.

The implications of this model extend far beyond carbon markets. We're witnessing the emergence of a new paradigm for organizing economic activity and addressing global challenges. By harnessing the power of cryptonetworks, we can create AMC-like structures that are more efficient, adaptable, and inclusive than their traditional counterparts. With the democratization of market-shaping mechanisms, we may find that these programmable economies offer solutions to problems that have long seemed intractable.

Shaping Energy Markets with Daylight

I've spent a lot of time thinking about AMCs. Economic development is a passion of mine, and I even spent a summer working for the best economic development agency in the U.S. Much of my interest lies in designing incentive games that create positive economic outcomes. It's one of the reasons why, despite all of its flaws, ponzis, and scams, I believe crypto is incredibly exciting and worth exploring. It's also why I started Daylight.

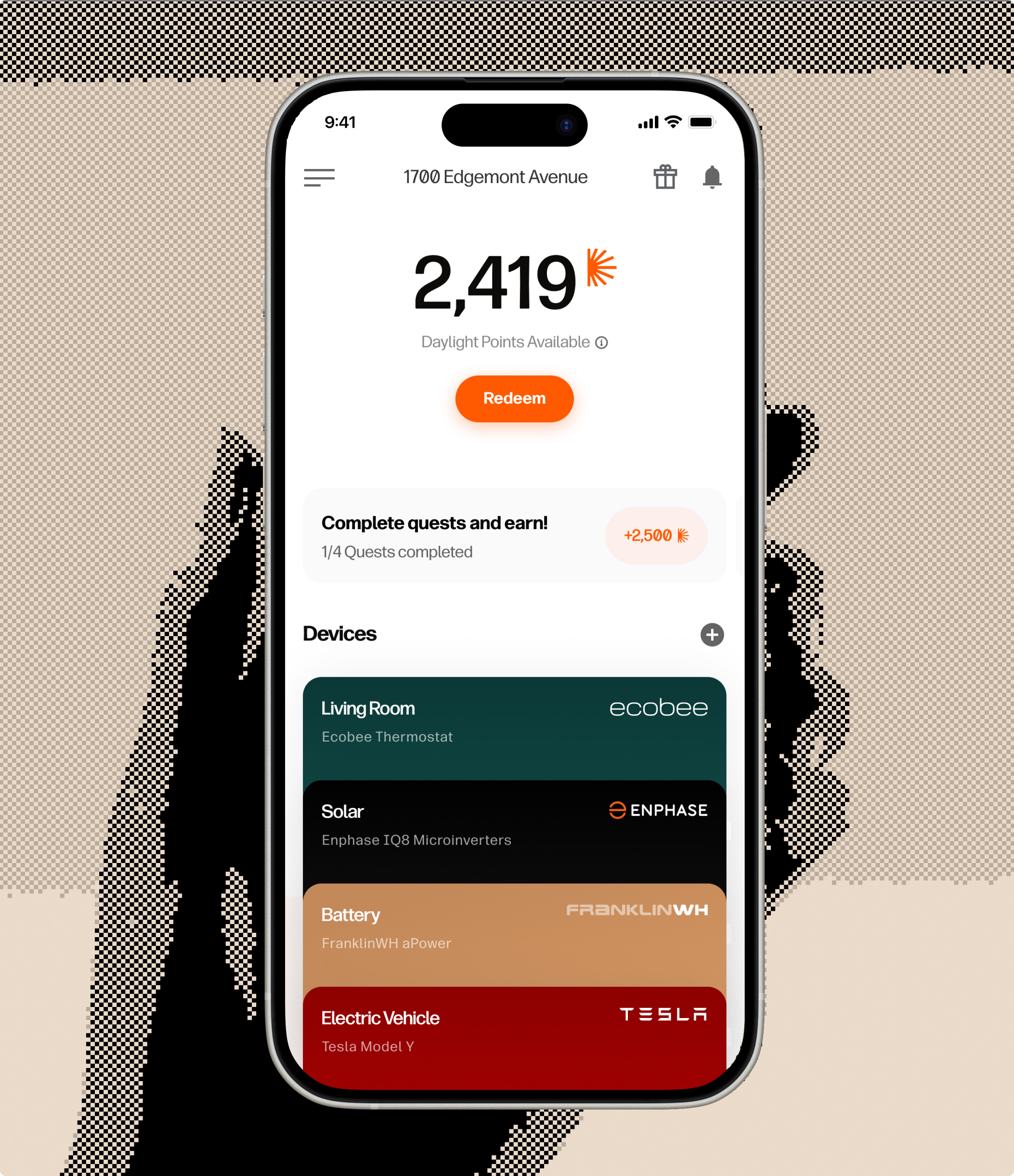

Daylight, at its core, is a network economy for distributed energy resources and electrification. Daylight is a protocol for an energy currency - a digital asset backed by commitments to deliver future electricity capacity. By leveraging the programmable nature of onchain economies, Daylight aims to reshape the energy landscape, incentivizing the growth of decentralized energy production and smart energy technologies while simultaneously creating a new, energy-backed currency system.

Daylight is designed to solve a critical market failure in the energy sector. Despite the clear societal benefits of transitioning to a more distributed, flexible, and resilient energy system, there's currently insufficient market incentive for rapid adoption and scaling of these technologies. Market-based solutions have been integral to modifying outcomes in the energy sector for decades. For example, tradable credit systems such as renewable energy credits (RECs) and energy efficiency credits have encouraged significant investment in renewable energy and energy efficiency projects. However, these solutions are typically top-down, relying on governments for implementation. What if we could create new market solutions from the bottom up, merging economics with startup intensity to drive societal outcomes?

Daylight addresses this by creating a programmatic buyer of flexible energy capacity, establishing reliable price signals for distributed energy and electrification resources.

The protocol's native token serves as the backbone of this AMC. The protocol mints new currency when contributors provide energy flexibility to the network through an "energy sharing agreement" - effectively creating a currency backed by commitments to deliver future electricity. The protocol prices these agreements through the Daylight Value of Distributed Energy Resource (DVDER) mechanism, a formula that ingests publicly available data on regional energy dynamics to evaluate the value of a distributed energy upgrade. This mechanism aligns with traditional AMC principles by guaranteeing future demand for a product - in this case, flexible energy. It uniquely also enables the world's first energy currency, collateralized by the protocol's "energy sharing agreements" - essentially a PPA.

By subsidizing the growth of distributed energy resources in its early stages, Daylight aims to kickstart a virtuous cycle. As more users join the network and connect their energy devices, the aggregate energy flexibility of the system grows. As the protocol aggregates proprietary energy data, flexibility, and customer load, it becomes increasingly valuable for energy retailers, utilities, electrification installers, and others to work with the network. Additionally, it's standardized real-time data opens up novel data applications like fire risk monitoring and preventative property warranty plans.

As the network grows and matures, it can transition from primarily subsidizing growth to capturing value from the network effects it has generated. This could position Daylight as a crucial piece of infrastructure for coordinating distributed energy resources at a global scale. It also creates a new paradigm for thinking about energy as a form of currency.

Our approach of using a programmable, onchain economy allows us to launch a novel AMC with far less upfront capital than traditionally required. Market shaping activities that were once reserved for the Gates Foundations, Stripes, and governments of the world can now be speed run by highly motivated development teams and communities.

I hope you'll explore our ecosystem!

economic development was once the domain of governments, NGOs, and big corporations but today, startups can compete directly in shaping markets and accelerating new economies this is what we're doing @daylightenergy; read my thoughts here! https://paragraph.xyz/@badeaux/programming-economies-to-reshape-markets

🔆 🔆 🔆

Thanks! Capital always tends to find high ROI, moving into new layers of the “cloud”(l2, l3, gaming economies) is the only option to drastically reshape markets for now until space related businesses becomes more available as industry grows. 200 $degen

GMenergy everyone 🔆 Our founder Jason Badeaux just posted a brilliant article to his Paragraph blog diving deep into why we believe Daylight is a major step forward in programmatic economics. This is probably the best thesis yet on HOW and WHY Daylight is going to transform the energy industry. Go big up his tweet here by liking, commenting, and retweeting: https://x.com/jasonbadeaux/status/1831077546764448098?s=46 And read (and mint) the whole piece here: https://paragraph.xyz/@badeaux/programming-economies-to-reshape-markets The future is so bright you’re going to need shades. 🔆