#4 Things That Move

The Classroom vs Reality

I pick on marketers a lot.

That’s just because they make themselves easy targets. I am not actually saying “look out for marketers”, I am saying “look out for people that make dynamic issues seem like static issues”. These are the people that can make sense of something on paper or "in theory" and mistake it for reality. Most of the time, it’s because they have little experience or lack contact with reality.

Things don’t move in the classroom.

They do in real life.

My observation has been this:

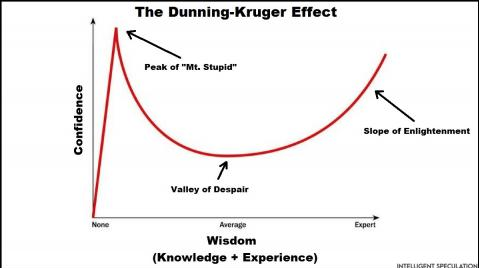

Those that sit atop Mt. Stupid are CERTAIN of what they know to be true. They believe it is not only the best truth but the only truth and what is relevant and accurate from their point of perception is relevant and accurate to everyone else.

Some never truly engage with or accept reality, leaving them to sit atop Mt. Stupid forever. Those that do engage with reality starts to slide into the “valley of despair” because they learn through experience how much they did not know (because a classroom can't teach it) and what a book cannot teach you:

Things Move.

Everyone I’ve ever met that sits atop Mt. Stupid believes there is a single answer for everything or a single best answer for everyone.

The few that I would consider already on the “slope of enlightenment” have a few commonalities:

They have battle scars. (Nobody told them that things move, they had to learn the hard way).

The answer to almost everything is: “It depends”.

Why does it depend?

Because things move.

Not just concrete, tangible things (another thing people, including myself, struggle with) but things like personal preferences and priorities are also always in motion.

Because these individuals sit in a classroom (or masterclass, mastermind, or overpriced course) and surround themselves with their like-minded friends on Mt Stupid, they tend to miss two critical points of reality:

Static X and Dynamic X are very different things and, if we intend to be useful, should be treated differently.

Group Indexing and Individual Indexing are very different things and, if we intend to be useful, should be treated differently.

These two realities bleed together, they do not live in isolation (yet another thing many intellectuals struggle with).

Before we go any further, let me remind you that I am coming from the following base assumptions:

First, you intend to be useful. If you do not intend to be useful to yourself or others, you can stop reading.

Second, the point of data/research/effort is to modify your behavior to have a higher probability of getting favorable outcomes. If you are uninterested in modifying your own behavior and prefer to just sit around and “be right” about stuff or point fingers at others, you can stop reading now. This will not be helpful or interesting to you.

Okay. Had to get that out of the way.

Onward:

Static X and Dynamic X are very different things

We can look at something like the income gap as an example. This is not an argument for or against either side of the issue, it’s to illustrate the differences in the data, narrative, and potential consequences on our belief and, subsequently, our behavior.

Static Inequality:

The top 1% owns 27% of the total income in America.

Nearly every year the headlines show a greater gap between the top 1%, 10%, etc, and everyone else.

Static inequality is a snapshot view of inequality, it does not reflect what has happened, what will happen, or what you can do about it.

Consider this: Ten percent of Americans will spend at least a year in the top 1% and over half of all Americans will spend at least one year in the top 10%.

Static inequality, to those that are unaware of the fact that in reality, things move, appears to tell the story: "the rich and only the rich get richer." But that is not the reality. The rich certainly can and do get richer, but with 50% of the population spending time in the top 10%, that means that only can the poor become rich, but the rich can also become poor.

In fact, they do.

Because things move, a snapshot or series of group-indexed (more on that shortly) snapshots do not tell us what is really going on. Life is a motion picture, treating it as a snapshot is never a good practice. We must turn to:

Dynamic Inequality

"Dynamic Inequality" takes into account the entire future and past life, accounting for the individuals that make up the data set and their movement.

This tells us an entirely different story: half of us will end up in the top 10% in our lifetime. Again, that means some people will fall and others will rise. What static data fails to reveal is that there is mobility; it’s not the same 10% day to day, month to month, or year to year.

To be clear, I’m not making an argument about whether it’s better or worse, but instead that recognizing that things move creates an entirely different reality than the one created under the presupposition that they do not.

Another thing missed by the static data sets:

Groups are not individuals. Your grandma might be a Catholic member of the Republican party. She also, 30 years ago, could have been a Protestant member of the Democratic party. Data sets of groups, just like the income groups above, may be made up of different individuals.

Groups can change or stay the same, individuals within the groups can change or stay the same because…

Things Move.

Russian Roulette, Group Indexing, and Individual Indexing

Imagine for a moment that there is a worldwide game of Russian Roullete being played. All winners get ten million dollars. There is one bullet for 17 guns; that's 16 guns with no bullets and a gun with a single bullet.

That’s 1 bullet for every 102 times the trigger is pulled (assuming 6 chambers per firearm); over a 99% chance of "winning".

Over a 99% probability of winning. Winners get ten million big ones.

Is that a good bet?

Let’s imagine two extreme scenarios:

Scenario 1:

Thousands of people decide this is a good bet and fight to get on the list to play the game. There is a limit of 1 turn per person, so the competition ends up being 102 people, each with one pull of the trigger.

Scenario 2:

Thousands of people decide this is a good bet and fight to get on the list to play the game. There is no limit to the number of turns per person so a single person buys all 102 turns for himself.

Scenario 1 is a group indexing problem: if we all play this, we all have 1 in 102 odds of dying. The risk is evenly distributed and there is no repeat exposure.

It’s an ensemble probability.

Scenario 2 is an individual indexing problem: if I play 102 times in a row, I am certain to die.

It’s a time probability.

102 people distributing a risk that is below 1% is very different than one person taking on a 1% chance to ruin 102 times in a row.

When you mistake a time probability (repeat exposure, over time, in the real world) for an ensemble probability (the static type taught in the classroom) a good bet on paper and "in theory" can quickly turn into a ticking time bomb. It's helpful to remember:

Things move.

Because things move, what we’ve learned to be true in a nice, comfortable environment can turn us into really poor decision-makers. Even if it looks good on paper. The right answer is not always the best answer for survival.

There is more to this, of course. Russian Roulette, for example, has an outcome of complete ruin or death which changes the implication of repeat exposure. But that is what the classroom, the intellectual and even YOU don’t want yourself to know.

There is always more to it.

Because things move.

Onward

Nic

PS. I don't have comments enabled because I don't want another thing to manage. Questions, comments, 6WUs, and Observations about Things That Move can be posted here.

12

12