Opinion: SVB and The Adaptive Dilemma

An opinion, and only that

I do not typically write opinion pieces like this, but it's worth taking the time, methinks

The largest banking collapse since 2008 happened last week. Obviously, the damage is great and the fallout is still unknown. We will be talking about it from a fundamental perspective next week on "(Un)Exploitable" but here are some initial thoughts.

First, my feed is full of crypto Twitter, so this is top of mind: this is not a crypto thing. This is a bank going under; fortunate 500's and publicly traded companies are likely losing tens or even hundreds of billions of dollars. Many companies and start-ups with no exposure to crypto at all are going to go under if they haven't already. A friend of ours is the CEO of a publicly traded company, they lost 500 million (presumably, we won't know until the whole thing is sorted).

Circle had about 3.3b of its 40 billion reserves in SVB at the time. It's not nothing, but they didn't get the worst of it. The response, in my opinion, highlights the immaturity of the crypto market in general. The ACTUAL impact on crypto was minor compared to other industries. The nature of crypto, the behavior of investors, and the lack of understanding compound into a lot of poor decisions stacked on top of one another.

This is not a "crypto" thing.

Just like it wasn't an internet thing or a real estate thing during their respective bubbles.

It's a human thing.

It appears that what is considered poor policy (which I agree with) led to a credit-mania, hysteria-induced bank run. That is not a crypto thing, or a tech thing, or anything other than humans reacting to humans that are reacting to policy. From what I have seen it seems a few VCs pulled about 42 billion from SVB. SVB basically went from solvent to insolvent overnight. A few irresponsible people created a self-fulfilling prophecy.

“This is going to go down as one of the ultimate cases of an industry cutting its nose off to spite its face.” - Ryan Falvey

Side Issue: this raises the question, should they have been able to withdraw $42 billion? On one hand, there is a strong argument to protect all your clients, on the other, there is a strong argument that everyone should be able to access their money. I don't know the answer, but we can't say "Protect me, but if I want my money, don't protect others".

Anyway, that happened. As stated above, publicly traded and privately held companies were devastated overnight. Obliterated. Zoom out and Circle took a relatively small hit.

Just for perspective:

USDC temporarily is seeing a 7-8% drop in value (at the time of writing this). Entire companies have lost 100% in value overnight. Both are unfortunate and unexpected, but perspective is helpful sometimes.

USDC is expected to lose its peg on weekends (although not this extreme) because it's kept stable through arbitrage. For arbitrage to work with an asset backed by the US dollar, the bank has to be open, so banking hours are important.*

*Many people feel very strongly in support of or against USDC without understanding the above point. That is also a human thing. If you want your asset backed by something, the properties and/or risks of that something will bleed into the asset.The fallout will impact crypto because it will impact EVERYTHING. If you are being impacted by it, take some time to zoom out and get a feel for the environment. Experiencing pain, depending on your industry, may be inevitable. Making a bunch of poor decisions to compound the pain is not necessary.

What am I doing?

Building. Solving problems. Collecting data. I'm not sitting around letting the minute-to-minute sentiment of the market dictate what I focus on.

As far as USDC:

Circle is a very strong company with a good relationship with regulators, in theory, they will be fine. The wildcard is the immaturity of the market. More than likely, SVB will get acquired by another bank or group of VCs and everything will hum right along.

**The following is my experience and my experience only, not prescriptive or suggestive.

When the market first started turning red I watched a lot of people I know and care about panic and move everything into Anchor, anchor crashed a few days later.

When the news about BUSD broke, I watched a lot of people rush into USDC and they are now dealing with this.

I did not move my BUSD because the information available suggested that Paxos was reserved and providing service for another year, giving me at least a year to wait for more clarity.

Similarly, what I have in USDC I am leaving USDC for three reasons:

Panic is never a good reason to make a move. If I move out of USDC it will be with more complete information and I will not panic move into something with a similar risk profile. I don't expect that to happen, but it could.

Even though there is a wildcard (humans), I am of the mind that Circle is more likely to figure it out than not figure it out. new information could be revealed that changes my mind.

Given the above two points and my general belief system, I do not want to contribute to the problem.

Everyone should make their own decisions. If you find yourself reacting all the time I suggest that you rethink your strategies, it will be a lot less stressful for you, and that has to be worth something.

One more side note

Tether has the highest risk profile and is the least transparent of stables, yet it has remained the most stable during all of this. I interpret this as proof that the market wants transparency, but due to their impulsivity, giving them what they want results in them doing more damage to themselves (in the short term). That does not mean Tether will stay stable or stay around, but it's worth noting that the evidence suggests their black box of reserves (or lackthereof?) is far more palatable for the average investor.

Conclusion

Zoom out. Miscatageorizing the problem will lead to an illusion of learning something that isn't. Crypto has been impacted by a credit-fueled mania that obliterated a large bank. So have many other industries.

If you invested in a candle company and they go bankrupt on Monday because their cash was sitting in SVB would you really think that there is a candle industry problem?

When a big bank crashes, there is pain coming to a lot of people. The more irrational and impulsive we are the more pain we are inflicting on ourselves and others.

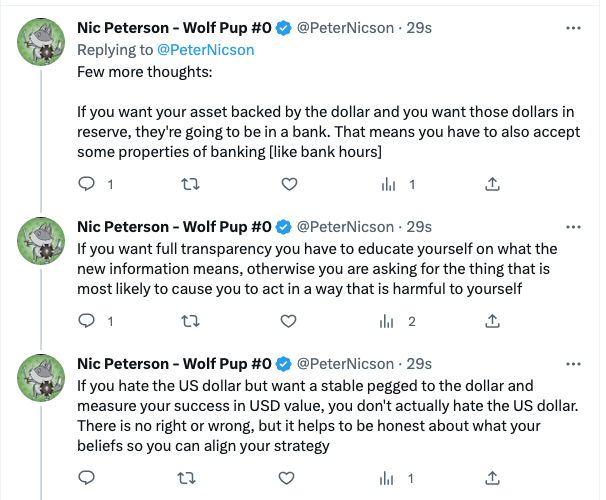

Will discuss this more in-depth Monday on the Guardian call and Thursday on (Un)Exploitable since Dan will have some insights as to how to protect yourself from this kind of stuff. In fact, here are some thoughts he just tweeted:

Nic

PS. Final thoughts:

1

1