eth can have a little etf for its birthday as a treat

a critically acclaimed weekly consumer crypto roundup

cheerio,

i send this newsletter to you from an unrendered part of the English countryside where I woke up to rain and grey skies indistinguishable from the gestalt evoked in the dream world. Good news! My screen time is down to an average of 22 hours and 15 minutes per day. What a year this last 2 days has been. catch a week in consumooor below.

xx c

The SEC has issued final approval for spot ETH ETFs to commence trading and it reached 50% of BTC ETF volume, in first 90 minutes of trading! Uniswap Extension is now available. S2 $enjoy claims are open thru Aug 5th !!! Privy announced a strategic investment from Coinbase Ventures. The Shape L2 “chain for creators” just launched. Optimism announced Retro Funding 5: OP Stack. Blackbird, the crypto-powered restaurant loyalty product, released Pay with Fly this week. $FLY is their native rewards token that you earn when you check-in at participating restaurants. With this release though $FLY is now liquid (albeit at a fixed rate), purchasable, and usable as currency at participating restaurants.

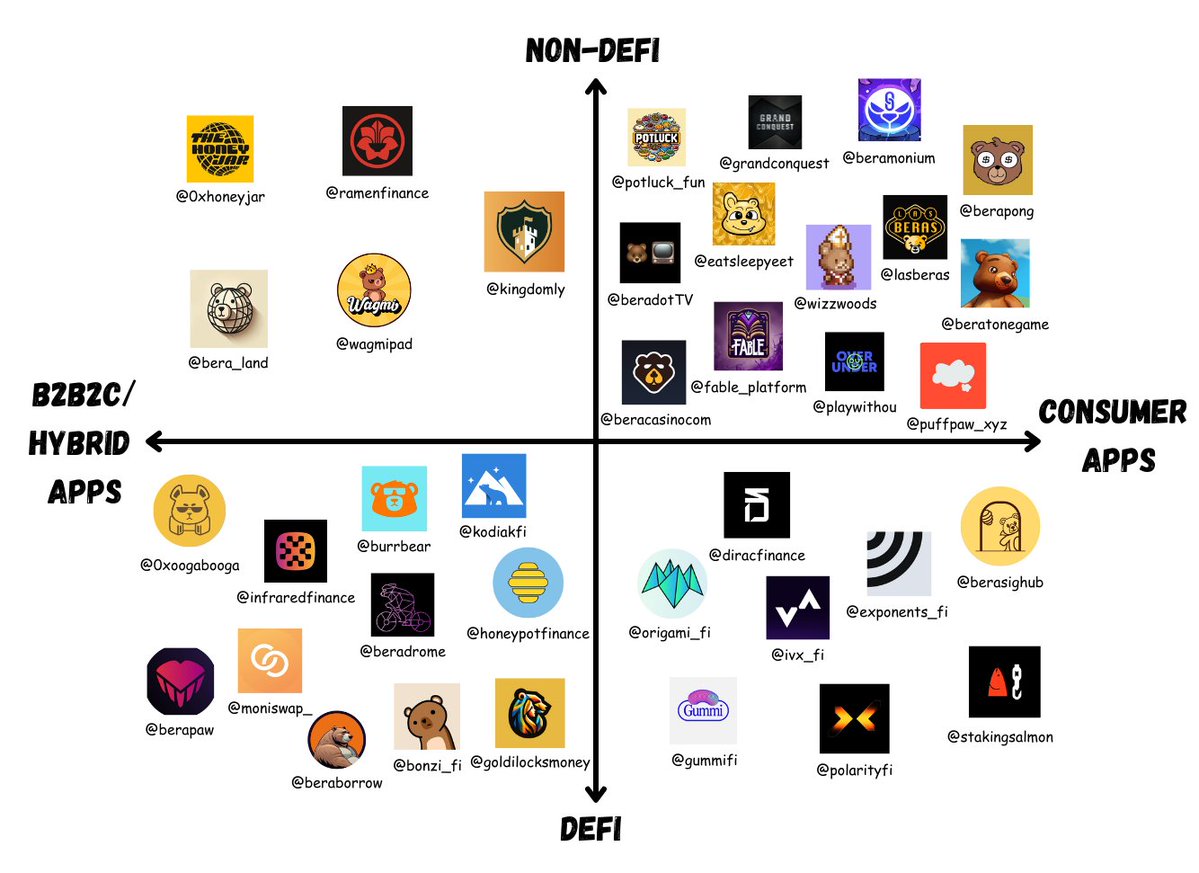

Polymarket is in a great position to continue being the “professional” prediction market platform (another ATH this week), but there's a lot of opportunity for more consumer friendly, vertical-specific, and social implementations of the idea: think social sign-in, higher liquidity (SOL, Base, Blast, etc), mobile first. We love a new BoysClub newsletter: get on the list for Athleisure, their new newsletter on the future of sports. The Berachain consumer ecosystem is ever-growing. Weekly USDC transfers on Base have grown to ~$20B. We've got a Seed Club Alpha TG Chat now.

Internet Explorers is a weekly rundown live stream where extremely online individuals broadly explore (romanticize, even) new consumer internet experiences.

Live & online Fridays at 10am PT / 1pm ET.

Product Spotlights: Moshi, Uniswap Extension, Moonshot

Internet Explorers kicked off last week with Mikey, founder of Gallery and now Moshi. Gallery, known for its clean design and solid discovery experience, has been a top choice for showcasing digital art, but its market didn’t materialize as expected. They pivoted to explore more scalable products built on onchain media primitives, with Moshi being their first experiment. Moshi is a polaroid-inspired app that lets users take photos, mint them with artist-designed borders, and share them, all using the Coinbase smart wallet for an clean user experience.

We also welcomed Medha, who leads product at Uniswap for their wallets, and discussed the new Uniswap browser extension featuring a unique sidebar UX. This release rounds out Uniswap's stack, giving them full control over swapping and transaction experiences. Medha told us that 80% of new wallets use Uniswap on their first day in crypto, which is significant leverage for serving their users in new ways. Watch the show recording below to hear Medha delve into product details, their mintable Uniswap usernames, and more.

Moonshot, a newly launched “robinhood for memecoins” lets you buy and sell memecoins with Apple Pay, sign up with email + FaceID, and send your friends tokens via username all within a nice clean app. Logically it makes a ton of sense. Memecoins are clearly these new internet attention assets that are seeing huge demand and aren’t going away, yet the trading experiences around them remains janky and kind of cringe. If you can be the first to break into mainstream audiences by making it as easy and accessible as Robinhood, while maintaining the social and raw internet lore of these things, there's a lot of value to be unlocked.

L3 Economics

Syndicate dropped a report outlining the current economics of L3s. They show how L3s face significant economic sustainability challenges, unlike L2s such as Base and Arbitrum, which generate substantial sequencer revenue. While L3s reduce fees dramatically, making onchain apps more accessible, this also means they can't rely on sequencer fees unless they achieve impractically high tx volumes. Their analysis shows that L3s struggle to breakeven unless they achieve L2-like tx volumes (50M+ per month) or keep fees within 3x of L2s. Future models, including priority fees and native gas and/or staking tokens (ex: $DEGEN), offer alternate pathways to sustainability.

Yet, the primary economic benefit of L3s is not in revenue generation but in the value they provide to the apps built on top of them. By dramatically reducing tx costs, L3s enable new apps and enable that might not be economically viable on more expensive L1 or L2s, and they allow apps to retain more value in the form of lower costs for themselves. So focusing solely on fees and scalability misses the true point of L3s, which are uniquely designed to provide a home for social token networks and distinct community ecosystems. L3s make scenecoins and social token networks (Sanko, Enjoy, etc.) much more accessible and engaging, allowing for fluid participation, speculation, and a more focused space for collective contributions towards growth of a native scene. So it’s great if we can get to a point where L3s / appchains are easy to run sustainably if not profitably, but it’s not really the main point.

Fat Bera Thesis

Competing with the network effects of Ethereum and Solana today it very difficult- without strong culture and a cult of builders and users, technical innovation can only get you so far. This is why we're interested in a lot of activity happening within the Berachain ecosystem as they integrate years of social and cultural infrastructure with their new L1 infra. Their uniquely mimetic brand, which its cult following, is attracting a ton of builders. Projects like Puff Paw’s vape2earn and other strange DeFi experiments fit perfectly within their ecosystem. Knower dropped a great post on the fat bera thesis and how Berachain mechanistically incentivizes value capture at the application layer. This thesis emphasizes the importance of apps over protocols, asserting that apps built with Proof-of-Liquidity (PoL) will capture most of the value. This shift aims to reward important activities like liquidity provision and governance. Monegro said that “The market cap of the protocol always grows faster than the combined value of the applications built on top, since the success of the application layer drives further speculation at the protocol layer.” In other words, historically, protocols have commanded greater premiums than apps, but the fat bera thesis seeks to balance this by enabling inter-protocol alliances and competition. By aligning incentives among users, dApps, and validators, Berachain aims to foster an ecosystem where both protocols and applications can thrive and be valued appropriately.

Excited to see the Berachain eco continue to proliferate.

Watch the full episode:

we think you know her..... join us with meltem this friday!

1,050

1,050

What a year this last two days has been https://paragraph.xyz/@seedclubhq/seedclub-network-news-july-23-2024

What a year this last 2 days has been https://paragraph.xyz/@seedclubhq/seedclub-network-news-july-23-2024

have been but yeah 🙃