Why the Real Ethereum Killer is ... Ethereum

And Polygon is the future of Web3 monetization

If you haven't seen the announcement yet, on May 22, I'll be launching Paragraph's first NFT token-gated book launch using a Mirror NFT as the token. In fact, it will be the first NFT book launch on Paragraph. You can get the book poster for free, but there are only 2 mints left.

Only 9 days left to claim your mint.

For about the last half decade or so, we've heard a lot about the so-called Ethereum killers. These are often smart contracts blockchains that serve as Ethereum alternatives. And I understand why. For most people, Ethereum gas fees are way too high—just like the rent.

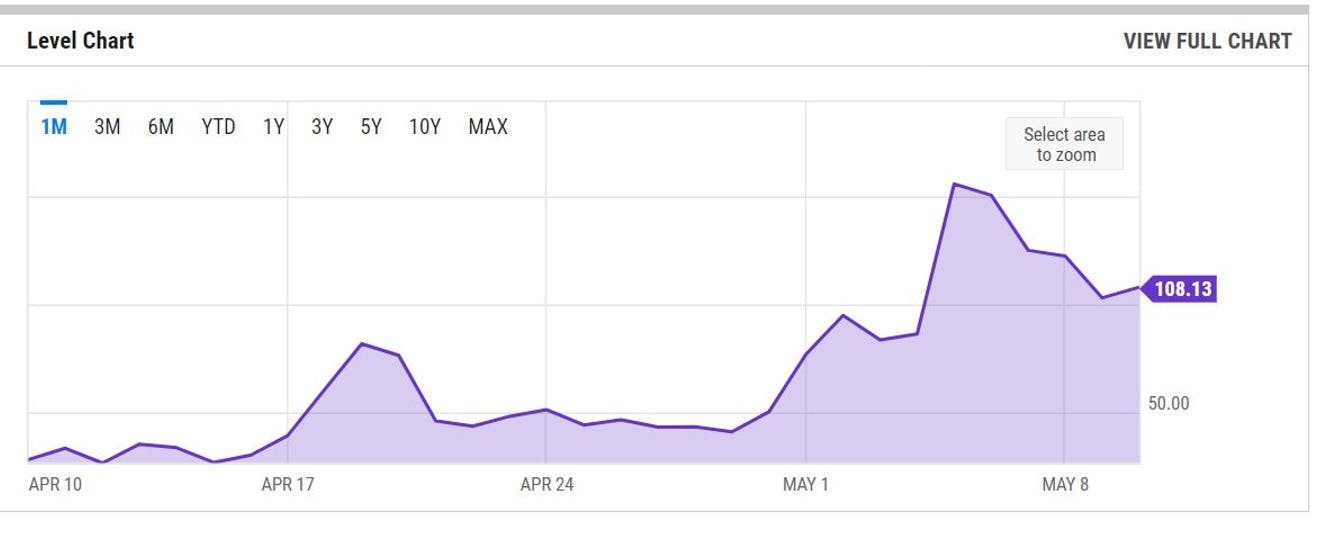

Case in point: Just recently we've seen Ethereum's gas fees move from 41.25 GWEI on April 29 to 108.13 GWEI on May 10, peaking at 155.84 GWEI on May 5. What happened?

Never mind what happened. It's not the first time it has happened, and it likely won't be the last.

Ethereum has become the blockchain for the crypto wealthy. There's no sense pretending otherwise. And it was that way before the Merge. The migration from proof-of-work to proof-of-stake will only ensure that Ethereum remains the blockchain protocol for the crypto wealthy, and it will likely widen the gap between them and everyone else. That means anyone who can't afford the gas fees will have to use a blockchain alternative for most of their transactions.

But which ones?

We've all heard about those Ethereum killers, the alternative blockchains that will overtake Ethereum and become bitcoin's date to the crypto ball. The usual suspects are generally Solana, Avalanche, and Polkadot. Before the cataclysmic earthquake last year that catapulted the market into chaos, people were calling Terra Luna the next Ethereum killer. Well, Terra Luna jumped off a bridge.

It didn't even bounce.

Solana has managed to remain in the top 10 cryptocurrencies for an extended period of time. Cardano, for some reason, has done even better. Polkadot moves in and out of the heavy cream like a paper Tab A trying to mate with Slot B. And Avalanche can't seem to get enough mojo to stay in the saddle. Other blockchains often mentioned include Fantom and Tezos.

Tezos isn't a bad blockchain, but it's fallen below the top 50. Fantom is below the top 40, like a second-rate pop singer trying to keep up with Taylor Swift.

I'm not convinced there is an Ethereum killer, but if there is, it's likely Ethereum itself. The second largest cryptocurrency by market cap, it seems to be doing just fine despite its outrageous gas fees. And why shouldn't it be? It has a strong community and is reputable technology. The problem is, it's a Lexus and most of us can't afford to drive a Lexus. We're stock in the Honda and Toyota lanes. The game we play is fuel efficiency. Give me a vehicle that may or may not be attractive but gets me from Point A to Point B without draining my pocket book in fuel costs and maintenance. It's a game called Eat the Rich.

Is there a blockchain that can manage to help the rest of us gain the freedom that Web3 offers? I think there is at least one.

Polygon has come a long way in a couple of years. In November 2021, MATIC's market cap was $12.5 billion, enough to rank it 21st among cryptocurrencies in the field. Today, its market cap is $7.7 billion, but that's enough to keep it at No. 10.

Dappradar lists nearly 2,000 dapps operating on Polygon. Top categories include gaming and DeFi dapps. With more than 270 games built on Polygon, gamers have something to look forward to in growth and quality of networking. DeFi dapps number over 500. Additionally, there are close to 200 collectibles marketplaces, and almost 50 social applications. Among these is the Lens Protocol, an up-and-coming Web3 social platform that is building an open social graph and seems to have attracted a growing community of loyal supporters.

MATIC is also tradeable on more than 300 crypto exchanges, including the largest in the space. Among these include Binance, Coinbase, Kraken, and KuCoin.

CoinGecko lists almost 1,000 coins and tokens tradeable on the Polygon network. And MATIC isn't even the biggest of these. USDT, BNB, and USDC all outrank it in terms of market capitalization.

NFT Price Floor ranks Polygon No. 2 in the NFT brand rankings (right behind Ethereum). This is largely due to Polygon's lower gas fees and higher transaction speeds. On Ethereum two days ago, I spent over an hour and $10 to bridge $30 in ETH to Optimism. That was just so I could offer a Subscribe-to-Mint opportunity for my audience and collect future Mirror NFTs that I might want. I don't have those kinds of headaches with Polygon, though if I wanted to bridge ETH to the Polygon blockchain, I could do that with ease.

The only reason Ethereum outranks Polygon in NFT Price Floor's rankings is due to its age. It certainly isn't winning on quality driving experience and fuel efficiency.

Polygon also has several token-gating tools that give creators the ability to manage their part of the creator economy. Some of the most popular among these include:

Collab.Land - Used for Telegram and Discord communities.

Submarine - A no-code solution for unlockable content.

Novel - A merchant tool for creating token-gated ecommerce stores.

Sentr3 - A tool for managing token-gated memberships and events.

Highlight - A Web3 toolbox for creators that facilitates allow lists, token gating, and NFT distribution.

The latest entrant to the Polygon ecosystem, Paragraph, has come to the table with a Substack alternative that allows creators to monetize their content with NFTs on the Polygon blockchain and offer token-gated content on Polygon. This newsletter is published with Paragraph.

Of the Ethereum alternatives with the most potential to becoming the Web3 paradise creators are hoping for, Polygon has the most potential. I rank it above all the Layer-2 solutions and every Layer-1 alternative that has been dubbed an "Ethereum killer." And that includes Cardano.

What do you say? Want to change my mind?

If you like this post, show me some love. There are three ways to show me that you enjoyed reading this issue of Web3 Writings.

Share this post with your friends

Subscribe to the channel

Collect this post (only 3 mints available)

This article does a great job of explaining why Ethereum remains a leader despite its challenges and why Polygon is emerging as a key player in Web3 innovation. With its lower gas fees and creator-focused tools, Polygon offers exciting possibilities for blockchain gaming and NFTs. By the way, have you tried using platforms like playtoearn.com to discover projects and opportunities in this space?

Thanks for the comment. I've moved the newsletter back to Substack. Feel free to follow me there. https://thetaylorkarass.substack.com/

I’m very much enjoying your posts here on Paragraph. Polygon is fantastic and I’ve started to invest in it somewhat, alongside Hive where I am also active. Even on OpenSea where I’ve been promoting some of my photography in NFT form, I opt for the Polygon chain. Same goes for Highlight, I love the whole user experience there and how easy it is to inject those into Paragraph content. Exciting times we live in! Substack is great but I would like to think Paragraph will overtake it at some point in time!

Thank you Nick! I love Polygon/MATIC. I think I'll buy some more just to have around. I've used Highlight once, so I'm still trying to figure it out. I do like the ability to integrate those into Paragraph. And, like you, I'm hopeful that Paragraph will overtake Substack. These are exciting times indeed!