🟣 Wall Street Doesn’t Understand Coinbase (or Crypto…)

Coinbase Crushed Its 2023 Earnings

GM DOers!

Coinbase recently released their 2023 yearly report and it absolutely smashed all of Wall Street’s expectations.

Revenue for Q4 2023 hit $953.8 million, beating the estimate of $826.1 million.

On this news, Coinbase hit a new yearly high, currently sitting at $180 (just before market open).

Back in May 2023, when $COIN was <$60, we mentioned that Coinbase was ready to rip, and it didn’t disappoint.

The stock has performed well and so has the company. Coinbase is becoming an absolute darling on Wall Street, yet they still don’t understand this company (or the industry).

That’s why $COIN continues to be such a great opportunity!

Here's the full yearly breakdown of Coinbase’s earnings – it looks incredible.

If some of these numbers on this infographic don’t make much sense to you right now, don’t worry, I’ll simplify & highlight the key things below.

TL;DR: Coinbase is slowly but surely creating immense FOMO among Wall Street investors & nobody is bullish enough on $COIN.

Not to mention, understanding Coinbase and its numbers is a great way to understand the health of the industry, as well as where we are in the current crypto cycle…

So take note & let’s dive into the details. ⏬

The 2024-25 Bull Market is going to make millionaires.

Learn the best practices to allocate capital and successfully invest in crypto and web3 with our Web3 Investing Masterclass.

P.S. PRO members get a 50% discount, while Founding members get the Masterclass for FREE.

Coinbase’s revenues for 2023 ($3.1 billion) were similar to 2022 ($3.2 billion).

However, in 2023, Coinbase managed to come out with a $95 million profit versus the $2.6 billion loss in 2022.

Their EBITDA – which shows a company's earnings before certain costs like interest and taxes are subtracted – jumped from a $371 million loss in 2022 to nearly $1 billion in profit in 2023.

The main contributor? Subscription and service revenue soared by 78% to $1.4 billion 🚀 – this revenue came from custodial fees, staking, analytics, and interest from crypto holdings.

At the same time, Coinbase managed to reduce its operating expenses by 45%, the main driver being decreasing their staff count by 25% to 3,416.

Another huge factor contributing to Coinbase’s revenue was $USDC, which generated 22% of their total revenue for 2023.

Context: $USDC makes money through interest from its reserves and transaction fees on platforms and exchanges. Since 2023 had high interest rates, it turned out to be a great year for $USDC issuers (Coinbase & Circle).

In 2023, Coinbase launched Base, their L2 network on Ethereum aimed at reducing fees and speeding up transactions, making blockchain more accessible for users and developers.

Their incredible launch with Onchain Summer led to ~$600 million being locked on Base today.

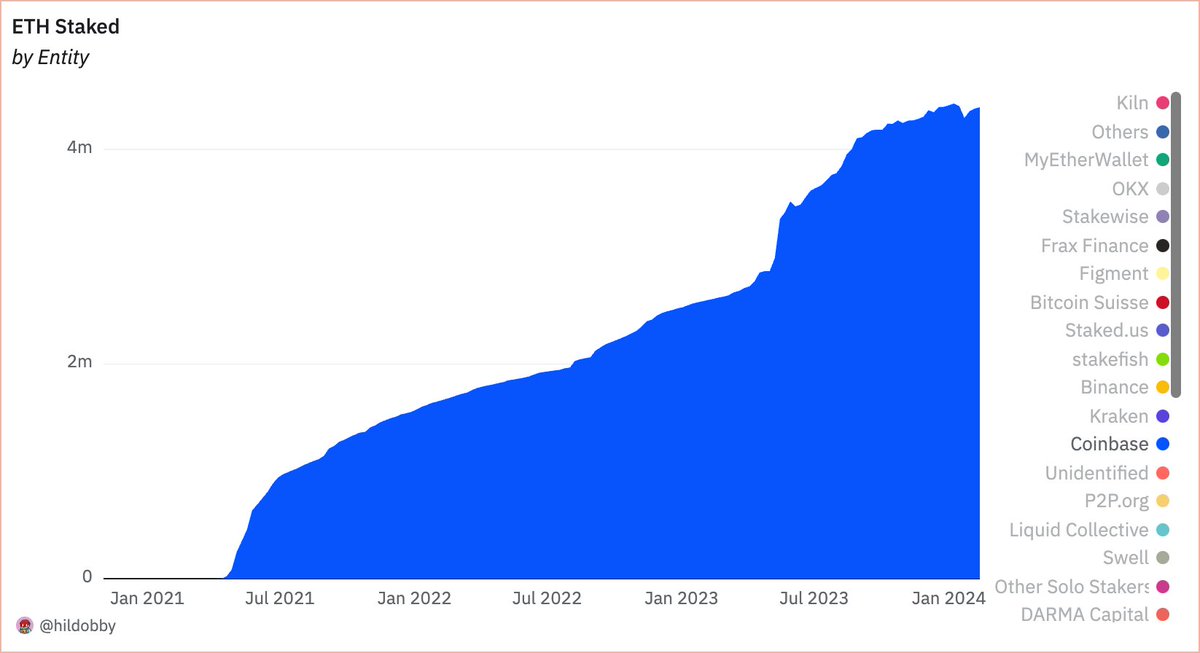

Speaking of onchain stuff, Coinbase stakes about 4.4 million $ETH on behalf of their customers, equating to 14% of all staked ETH.

Staking 4.4 million $ETH earns a total of about $615 million a year at today’s 5% staking APY. From that, Coinbase takes a 25% cut, making around $154 million a year from, based on today's $ETH prices.

That’s just insane… And it’s not all!

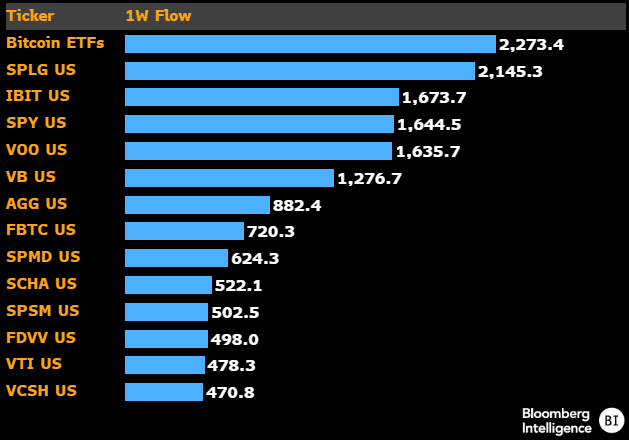

Coinbase’s massive achievement lately is that it became the custodian for 8 out of the 11 Bitcoin ETF providers.

This shows that Coinbase is probably the most reliable custodian around, capable of safely holding billions of dollars worth of $BTC for their institutional customers.

Because of that, more and more institutions are trusting Coinbase, and that’s reflected in Coinbase’s volume:

Lastly, Coinbase has also launched their long awaited international derivatives exchange, where people can trade crypto with leverage.

I think that this could be massive, because 75% of the yearly volume in crypto comes from derivatives trading, not spot trading (where you actually hold your coins).

By capturing even a small percentage of this market, Coinbase could literally double their revenues by 2025, which we wrote about earlier this year.

However, the most underrated highlight from Coinbase’s report is their Coinbase Ventures holdings.

Coinbase Ventures is the investment arm of Coinbase, focusing on investing in early-stage crypto companies.

Some notable investments over the years include Celestia, Arbitrum and dYdX.

In their report, Coinbase stated that their investment portfolio was $1 billion.

However, in previous earnings calls, Coinbase noted its assets are listed at cost price, not current value, on their balance sheet.

Thus, the reported $1 billion shows how much Coinbase Ventures’ assets are worth at original cost.

Their real portfolio value could far exceed reported figures, potentially even 100X, since the tokens they invested in have gone up a lot in value. 🚀

This indicates a large amount of unrealized profit not yet reflected in Coinbase's financials, and that’s a huge opportunity.

Source? Michael Ippolito, Blockworks Co-Founder. 👇

Coinbase's earnings significantly surpassed Wall Street's forecasts. Most analysts, including JP Morgan have been terribly wrong in their predictions, and have already updated their price targets for $COIN. 😂

Everyone's much more bullish after Coinbase's annual report, and savvy investors should be awakened & crypto FOMO will most likely start to creep in.

Here’s what Wall Street sees every day:

Bitcoin ETFs are the most popular products of all

Bitcoin ETF flows >>> Gold ETF flows

Coinbase beating all estimates

The best part? This is just the beginning.

$COIN is still not at ATHs

Ethereum ETFs are coming

Circle is planning to go public soon

This is going to be a fun year for crypto and with Coinbase playing a role in crypto (similar to Apple's role in personal computing and the internet) I think that $COIN will turn out to be a great investment.

I’ve got a full PRO report that highlights exactly why that is. Give it a read & stop fading $COIN!!

Thanks for reading. And remember, you're strong, you’re powerful, you’re alpha! ❤️

Let us help you wrap your head around this industry that’s constantly transforming.

Take our Free 1-hour Web3 Rabbit Hole Course to learn the foundational components you need to start building and investing successfully.

Secure Your Crypto w/ a Hardware Wallet – Get a Ledger Today

Get the #1 Crypto Tax Software - Get Started with CoinLedger

The Best Charting Software on the Internet - Join Trading View

Join us on Discord | Follow us on Twitter

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.

1,060

1,060