This Onchain Casino Burned $5 Million 🤯

WTF Is Rollbit?

GM DOers! 😎

The casino and gambling industry is one of the biggest worldwide, and it’s now coming onchain. 🎰

If you’ve ever gambled, you’ll know that the house always wins. Even if you sometimes get lucky, if you keep playing, you’ll end up losing.

But now, onchain casinos promise to share parts of their revenues with their users, and it has become one of the hottest web3 narratives. 🥵

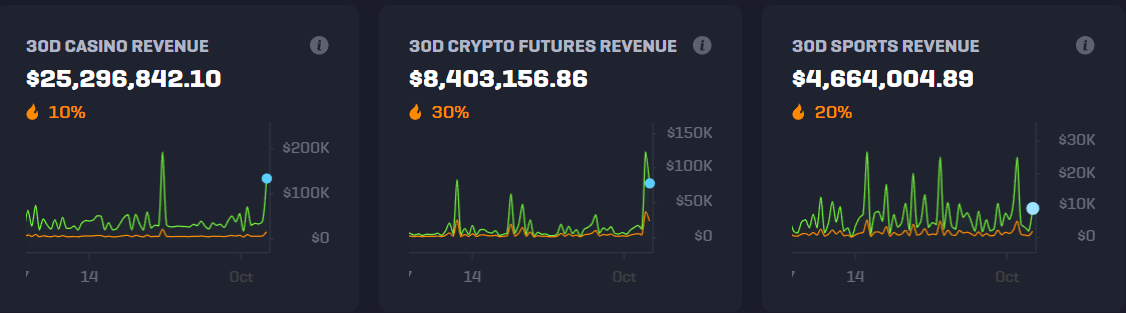

Today, we’ll talk about Rollbit, the biggest onchain casino right now, which generated a whopping $37.7 million in revenue in the last 30 days. 🤯

Furthermore, they’ve also burned $5 million to create scarcity for Rollbit Coin holders.

WTF is all of this about & should you buy the Rollbit Coin ($RLB)?

Let’s see. ⏬

Btw.. Tomorrow, we're launching one of our biggest initiatives yet - an ongoing series that will incentivize people to take weekly action onchain. Stay tuned. 👀

Paragraph powers modern newsletters, enabling readers to own their content and creators to share revenue with fans.

Web3 Academy has already transitioned to Paragraph because it’s the future of newsletters.

If you're a creator, writer, or keen reader, explore Paragraph's early opportunities!

What is Rollbit? 🎰

This is your typical casino/sports betting platform. You can play blackjack or bet on football. 🏈

However, it doesn’t require KYC. Users can simply log in with their web3 wallet or email, deposit $RLB and start gambling.

There’s no name, no address and no taxes involved.

Note: Once you deposit $RLB to Rollbit, they custody it for you, which means everything that occurs on their platform happens off-chain.

On top of the typical offerings, Rollbit also allows users to trade crypto with up to 1000x leverage. 😳

Last month, Rollbit made almost $40 million. What’s this hype all about? 🤔

Why Do People Care About Rollbit? Utility & Burning 🔥

The reason people care about Rollbit is because of the $RLB token.

$RLB Utility ⚙️

Firstly, you need $RLB in order to start gambling on their platform. You can’t deposit FIAT.

Secondly, by holding $RLB, you can get up to 60% reduced fees on the platform.

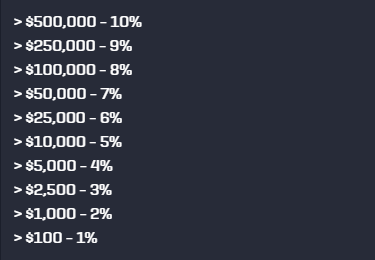

Thirdly, depending on how much $RLB you hold, you can receive a % of the house edge from every bet you place.

This is a way for Rollbit to share revenues with its users & $RLB holders.

But the main thing that gets people excited about $RLB is their burning mechanism. 👇

$RLB Burning 🔥

Rollbit uses a portion of its daily revenue to purchase and burn $RLB.

They burn:

🔥 10% of the Casino revenues

🔥 20% of the Sports Betting revenues

🔥 30% of the Crypto Futures revenues

In total, they’ve burned 1.8 billion $RLB so far – 37% of the original supply of 5 billion $RLB.

The goal of the burn is to make $RLB more scarce, so that holders benefit & new $RLB buyers are attracted.

In the past 2 weeks, the amount of $RLB holders has increased by over 1000, which clearly shows that the burning mechanism works.

So what does Rollbit gain? 💸

They burned over $5 million in the last 30 days just to make their holders happy. Wouldn’t they’ve been better off keeping that money? What do they gain from this?

Rollbit actually owns 69% of the $RLB tokens – so it’s in their interest to drive the $RLB token price up.

And using a burning mechanism is a perfect way to get people to take action. Here are some other examples…

The Importance of Burning in Web3

The concept of burning is powerful because it creates urgency. Knowing that tokens will be burned forever makes people participate.

Here are two examples.

1. NounsDAO Burning Proposal

A Nouns DAO member recently suggested burning excess ETH in the treasury, calculated using the auction price and Nouns count.

For instance, if Nouns' median auction price was 30 ETH with a total 300 Nouns in existence, and the treasury had over 9000 ETH, they'd burn all the ETH they own over 9000.

If this method, called The Burn, was adopted today, Nouns DAO would burn about $2.5 million.

This adjustment encourages the DAO to spend funds on improving their brand, instead of holding it in the treasury – it creates urgency within the organization.

Hear Jay and Jeff from Jump discuss this on our latest podcast. 👇

2. VeeFriends’ Burn Island

The Burn Island allows the VeeFriends community to burn their NFTs to get the chance to unlock other (more valuable) collectibles, access to events and more.

Since Burn Island was introduced, a whopping 6400 tokens were burned, worth almost $1 million. 🤯

This mechanism encourages people to interact and participate, and it clearly works wonders.

Is this the future of engagement? Is this how we’ll engage communities onchain?

We have an entire PRO Report where we dive deep into this. Check it out. 👇

On top of creating urgency (Nouns DAO) and excitement (VeeFriends), burning makes a token more scarce (if implemented correctly).

Just look at $RLB – 37% of their supply is gone and that number is only going up.

That creates scarcity. Is it a good thing? Long-term, no idea, but short-term, it clearly attracts a lot of new token holders.

So, should you buy $RLB? 👀 Keep reading. 👇

🚨 Update: What’s up with Ethereum ETFs? 🤔

On Monday, we announced that 9 Ethereum Futures ETFs were approved.

In total, all of them witnessed less than $2 million worth of trading volume in their first day – very, very low.

This shows that nobody cares about Futures ETFs, aka paper contracts.

However, the approval of Futures ETFs opened the gates for Spot ETF filings. We now have at least 4 Spot ETF filings for Ethereum, with Grayscale being the latest one.

A Spot ETF is coming for both Bitcoin and Ethereum. It’s a matter of when, not if.

Wrapping Up 🧵 Should you Buy $RLB?

The GambleFi industry is on the rise and it’s showing no signs of slowing down. Rollbit is at the forefront of this industry.

Furthermore, they’ve also established partnerships with many crypto influencers to spread awareness about the platform.

Lastly, $RLB is up almost 10x since June, and because they’re burning so many tokens, they’re only attracting more $RLB holders every day.

But all of that doesn’t mean that $RLB is a good investment, because there are concerns to be raised.

Firstly, regulation. It appears that Rollbit is a regulated casino. However, their license doesn’t cover their crypto trading products. Huge concern.

Secondly, unclear tokenomics. While Rollbit does burn a lot of tokens, the $RLB tokenomics still raise some eyebrows.

Mainly because of the huge amount of tokens held by the team, which they declared as ‘tokens in circulation’.

For the moment, it looks like the strategy of attracting new holders by burning tokens is working for Rollbit & $RLB.

But how long will this persist? Are their tokenomics sustainable long-term?

Right now, we’re unsure. But if you’d like us to dive deeper into this in a PRO report, let us know by replying to this email with YES.

Thanks for reading. And remember, you're strong, you’re powerful, you’re alpha! ❤️

See you soon. ✌️

Join us on Discord | Follow us on Twitter

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.

409

409