$BALD $30M Rug & DeFi Near Implosion

Was This Crypto's Most Insane Week?

GM DOers! 😎

It's been a long year in these last couple of days. 😴

To put it lightly, this week has been a hard rollercoaster.

Initially, we had our sights set on dissecting the $30M $BALD rug pull, a saga with ties to SBF (FTX Founder) that had us all on the edge of our seats. 🧑🦲

But then, the crypto world decided to throw us a curveball.

News started pouring in from every corner, each headline more eye-catching than the last. It felt like we were trying to catch a waterfall in a cup. 😅

So, we decided to switch gears. Instead of focusing on just one topic, we're going to serve up a buffet of the most impactful news in web3.

So buckle up, because we've got a lot to break down.

Let's get started! 👇

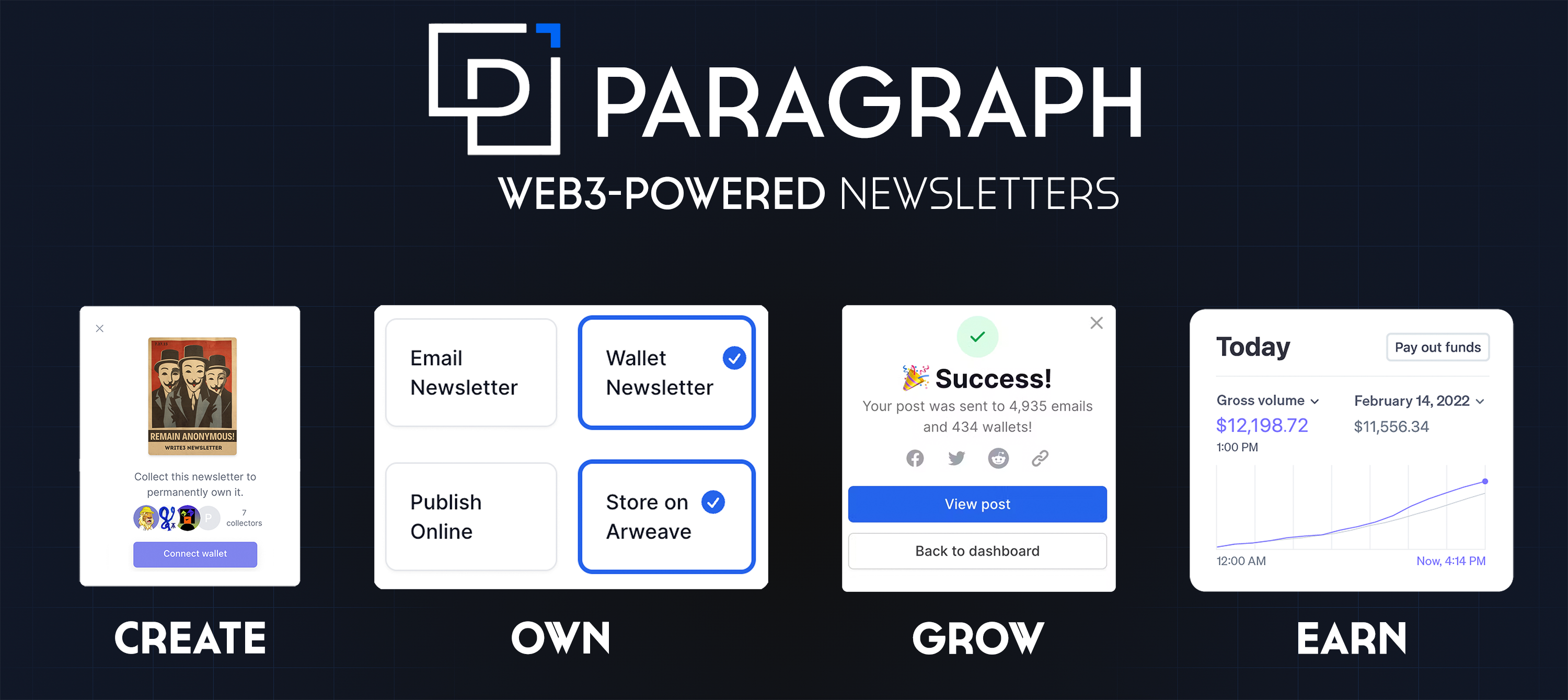

Paragraph powers modern newsletters, enabling readers to own their content and creators to share revenue with fans.

Web3 Academy has already transitioned to Paragraph because it’s the future of newsletters.

If you're a creator, writer, or keen reader, explore Paragraph's early opportunities!

A $BALD Story of a Base Rug Pull

As we talked about on Monday, BASE, Coinbase’s brand new Layer 2 blockchain has been buzzing with activity.

Despite lacking a bridging interface, users funneled over $50M of ETH into Base within a 24-hour period.

The main attraction? Meme coins. 🤦

Leading the charge was $BALD, a playful jab at Coinbase CEO Brian Armstrong's lack of hair.

$BALD skyrocketed to a market cap of almost $100M before the deployer of the coin pulled liquidity, rug-pulling and crashing the price 99%. 💸

But the drama didn't stop there.

LeetSwap, the biggest DEX on Base, was exploited, so the $BALD developer then announced they were waiting for a safer DEX to deploy more liquidity.

And so they found SushiSwap!

The dev deployed more liquidity, got everyone excited and then rugged again, just after saying “if you still decide to trade this token you will probably lose all your money (if you somehow haven’t already)”

He then said all profits will be going to charity… Ya right buddy. You’re not fooling us.

An evil masterpiece. 👺

Then, in a twist that could rival any soap opera, onchain analysts noticed that the dev’s wallet address was linked to one of Alameda’s many wallets.

Reminder Alameda operated as a primary market maker on FTX.com, with the King Fraudster himself, Sam Bankman-Fried (SBF) as defacto leader of both.

Some speculated that SBF could be behind the rug pull, others suggested that it was Sam Trabucco, Alameda’s co-CEO.

Others think Sam may have a decent alibi with his house arrest and lack of access to internet or sufficiently advanced technology to rug pull.

Whoever it was, there are too many links between the FTX cartel and $BALD. Judge for yourself:

A complete shit-show. Were there any winners? 🤔

There were reports of individuals turning $500 into $1.5M in a matter of days, just to see all of it vanished for not taking profits.

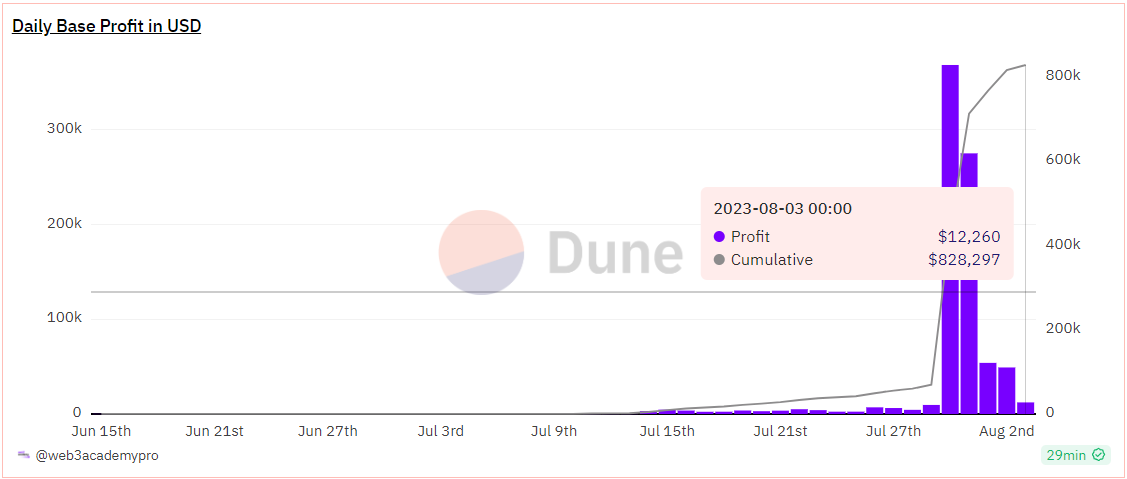

So no, no winners… Apart from the dev who rugged. And BASE (the blockchain), which generated almost $1M in profit in a few days. Annualized, that would be a profit of $85M for BASE.

Bullish for the Coinbase stock, which makes $COIN a good investment still. Just like we wrote about here, before $COIN doubled in price in 2 months.

Oh, and Ethereum. Because all these transactions are settled on Ethereum. And lastly, Optimism. Because BASE is using the OP stack, aka it is copying the Optimism blockchain code, for which Optimism charges 10% from all revenue.

In short, no retail investors won here. But there are still some real winners that could help you benefit as an investor.

A good reminder to never touch meme coins and not FOMO into the new shiny thing. You’ll get caught up in the hype cycle! 🚨

Instead, look for which protocols/businesses profit from the hype. Stay safe out there, DOers! 🛡️

The SEC is Busy

Our friends at the SEC have been on a roll 🎢

1. Questioning the XRP ruling

They're not too thrilled about the recent XRP ruling that cheered up the whole Altcoin market, and are hinting at an appeal.

The SEC believes all XRP sales, not just those to institutions, should be considered securities offerings under the Howey Test. 📜

But crypto lawyer John Deaton argues that the ruling is a significant win and will remain the law for at least two years while the appeal process plays out. 🏆

2. Going after Hex founder and number 1 douchebag, Richard Heart

They're also targeting Richard Schueler, aka Richard Heart, and his projects Hex, PulseChain, and PulseX, charging him with fraud and securities registration violation

Heart allegedly raised over $1 billion through unregistered securities offerings and is accused of using investor funds for personal luxuries. 🛍️💎

His projects (PulseX and PulseChain) faced turbulence after launch, leading to a drop in token prices, after Heart said that ‘ Hex was built to be the highest appreciating asset that has ever existed in the history of man’. 🚩🚩🚩

Instead, he used user funds to buy himself luxury goods, which he flexed on social media.

We like the SEC for coming after this guy. 👍

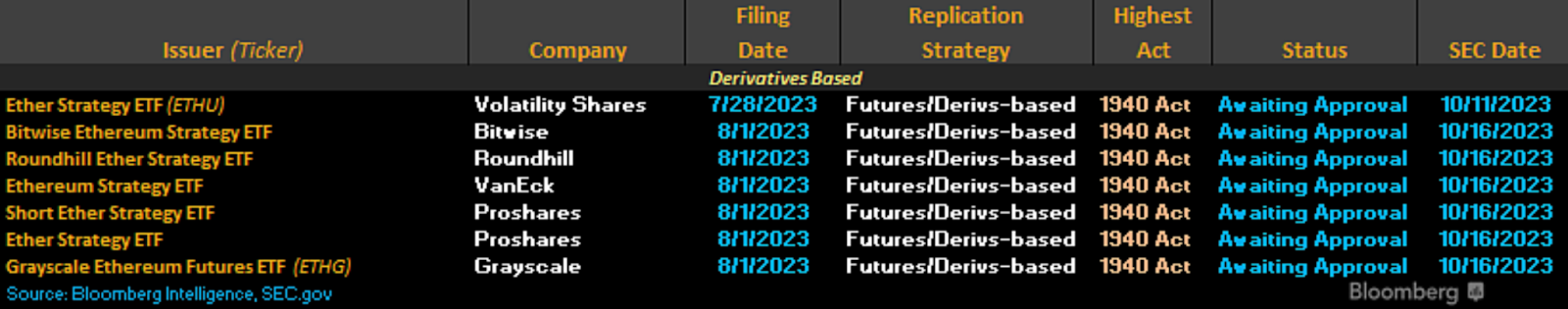

3. Warming up to Ethereum futures ETFs

There are 7 Ethereum ETF filings (from 6 issuers), all coming through this week.

All issuers are backed by the same firm that managed to get a 2X Bitcoin Futures ETF ($BITX) through.

This means that we could get an Ethereum ETF soon. But keep in mind that this won’t be a spot ETF. It’ll be a futures one, aka paper garbage, which won’t have an effect on ETH’s price.

It's a wait-and-watch game now but we still think we need a Spot Bitcoin ETF approved first for the SEC to approve an ETH one.

The Curve Finance Hack

In case you missed it, DeFi almost had a Black Swan event this week when Curve got hacked for (somewhere between $30-$100M).

$CRV almost collapsed because founder Michael Egorov had staked locked 300M CRV on AAVE for a 60M USDT loan, with a liquidation price of 0.3767 CRV/USDT.

Thankfully some major DeFi players bought $18M of CRV from Michael in order to help him cover the loan and stabilize $CRV which honestly could have caused a ripple effect across all of DeFi had it collapsed.

We wrote all about this in our latest newsletter from Wednesday! To dive deeper into the story, give it a read.

P.S.- This was our first newsletter on Paragraph and you can now collect & own it.

Beyond the Main Headlines…

Worldcoin drama continues…

The Kenyan government has suspended all Worldcoin activities due to concerns about public safety and the integrity of financial transactions. 🚧

Those found supporting or aiding Worldcoin could face serious consequences.

Meanwhile, Worldcoin is working on an onboarding program with better crowd control measures. 🚦

This comes amidst investigations by other countries into the project's handling of sensitive biometric data.

To get the lowdown on Worldcoin, read our comprehensive article here.

Tether has banked +$1B this Quarter

Tether's Q2/2023 results are in, and they're impressive!

Remember Tether’s USDT is the largest stablecoin in the market, with a circulating supply of more than $82.8 billion.

With operational profits exceeding $1B, largely due to interest on T-Bills, Tether is now one of the biggest holders of US debt and holds $3.3B in excess reserves.

More attacks on Binance. ¿FUD? 🤔

The U.S. Department of Justice (DOJ) is considering fraud charges against Binance.

However, they're concerned this could trigger a run on the exchange, similar to the FTX situation, causing consumer losses and market panic.

To avoid this and minimize harm to consumers, the DOJ is exploring other options like fines and deferred or non-prosecution agreements.

Binance and its founder, Changpeng Zhao, are already facing SEC charges for operating an unregistered exchange in the U.S. and alleged trade manipulation. 📉🔍

We wrote extensively about Binance & their SEC feud here.

Get the lowdown on the latest in crypto & web3

What we talked about in this newsletter is only scratching the surface of the insane week that crypto experienced.

If you want the full lowdown, head to our latest Weekly Rollup episode.

Share Your Feedback

We've never written a newsletter in this format before, so we need your opinion!

Did you like us breaking down the latest news in crypto? Was this helpful?

To share your feedback, please reply to this email with either a Yes or a No!

Your feedback is always crucial to us. 🙏

Thanks for reading. And remember, you're strong, you’re powerful, you’re alpha! ❤️

See you soon. ✌️

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.

201

201