Exchange Traded Funds

Bitcoin's IPO moment

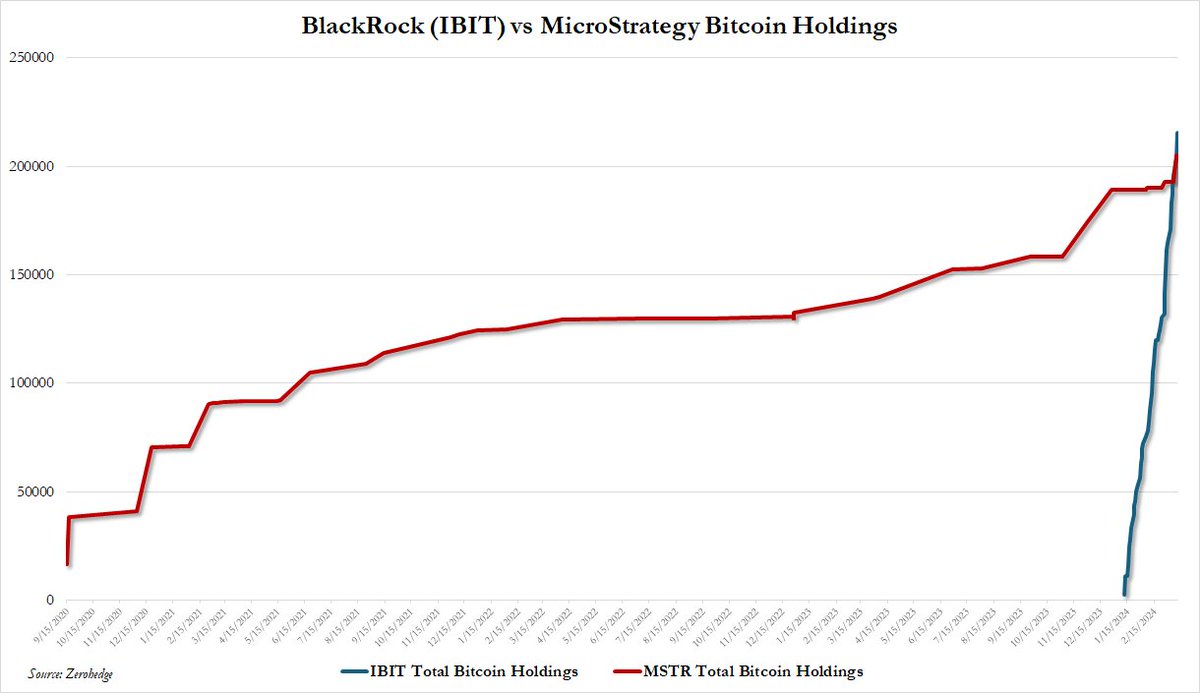

By every measure of success, the Bitcoin ETFs have crushed it. $55B in AUM as of early March.

Look at those flows. Beautiful. Back in 2021, my friend, his dad, and I had dinner in Miami and his dad had a great quote, "The more the price goes up, the more it makes sense." This was at $20K Bitcoin. Turns out he was right. Bitcoin is a Veblen good.

This chart shows the scale that Crypto is now exposed to. I mentioned in a previous article that Bitcoin ETF was a trojan horse. The Greeks are inside the gates. I think most people underestimate the amount of wealth in the world and how little of it is exposed to crypto right now. The Bitcoin ETF has been a spotlight on the industry and like eli manning in super bowls, Bitcoin is coming through in the clutch. Where does this leave us?

Luckily this is a two part show. The first act is over as of this writing (Eth is at $3650 down from $4100) and it is intermission. The curator of the the show, Larry Fink, has extensive experience putting on these shows. Some might say he is the best to ever do it with a crazy record of 500+ complete shows to 1 incomplete show. Following up the greatest launch ever, Mr. Fink must have something good. Maybe something so good, it could be considered the best venture investment of all time. 30 cents to $3,650 or 12,166x in about a decade. I bet this would be enticing as a second act to this crypto show. Can he get it done?

His record says yes.

Since the ETF approval in January, ETH/BTC ratio has increase. But Bitcoin is the coin with the ETF! Why is this? Market is forward looking.

End of May folks. That is the date that matter. All else is noise. Similar to BTC ETF game theory, same situation will begin to play out with Ether. It's a risk not to be exposed and every day is less time. They're not increasing the supply anymore. More buyers, no increased sellers.

Beautiful chart. Ethereum exchange supply has been done only since ether is an extremely useful asset to own. Use cases include but are not limited to store of value, yield, collateral, L2s, Art, interacting with the blockchain, medium of exchange, networking, social. I read an LP letter that up to 40K developers are now working on the Ethereum virtual machine "EVM". Everyday they create value to make the EVM more useful (and thereby pumping my bags).

A simple way to look at this is 14M people own ether. A lot more will buy it over the next 2 -5 years (5x in holders). They have to buy it from existing holders who were crazy enough to buy it before the ETF. The venues where these ETFs can purchase ether has downward only liquidity. This can cause some volatility. Look at WTI in 2020, oil was trading for negative dollars. Doesn't make sense logically but damn ain't that financial markets though. Too simple?

How about...

When comparing the real yield generated from Ether (yield - inflation), it should be an extremely attractive asset for institutions. Not only does it give exposure to technology built in the EVM, but between staking yield + deflation of the network the real yield is about 4-4.5%. That is super attractive and looking forward, if it continues to be an extremely liquid asset you can hedge ether yield rates (similar to interest rate swaps in traditional finance) to create new exotic structured products. Sounds enticing.

Leverage, swaps, all sorts of alchemy on a bearer asset. What could go wrong? Seen theories that next black swan could be staked ether getting hacked that causes a lot of derivatives or loans on top to blow up and that has a cascading effect.

As always, Make your own decisions ANON. Crypto is the Wild West. Opportunity comes with risk. I'm a believer but the most important thing is to understand your own situation and make choices that you're comfortable with. No one on the internet has the answer for you but hopefully reading posts like this can help light the way.

Cheers,

Whitetail

8,695

8,695

Hard to fade a permanant twap. This months post is on the success of the BTC ETFs. Alfa: they can also use those ETFs to short the shit out of crypto when the time comes. Until then... https://paragraph.xyz/@whitetail/exchange-traded-funds

sweet frame 1000 $degen